Region:Global

Author(s):Geetanshi

Product Code:KRAB0148

Pages:95

Published On:August 2025

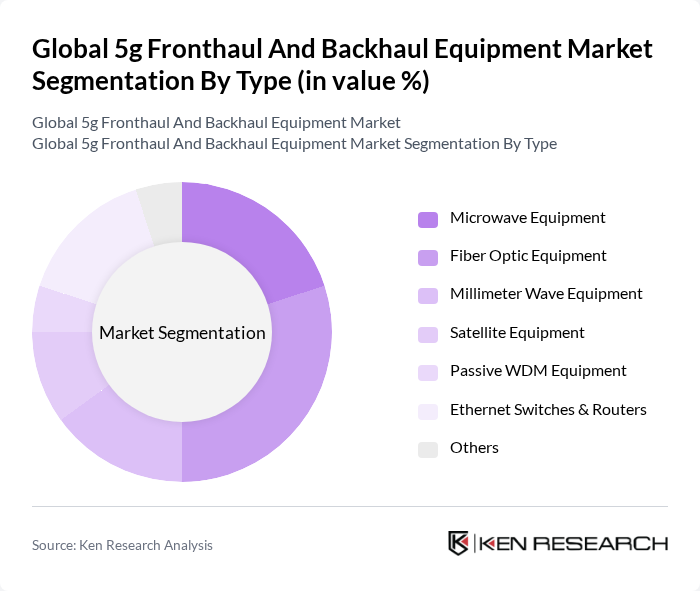

By Type:The market is segmented into various types of equipment that are essential for the effective functioning of 5G networks. The primary subsegments include Microwave Equipment, Fiber Optic Equipment, Millimeter Wave Equipment, Satellite Equipment, Passive WDM Equipment, Ethernet Switches & Routers, and Others. Each of these types plays a crucial role in ensuring seamless data transmission and connectivity .

The Fiber Optic Equipment subsegment is currently dominating the market due to its ability to provide high bandwidth and low latency, which are essential for 5G applications. The increasing demand for data-intensive applications, such as video streaming and online gaming, has led to a surge in the adoption of fiber optic solutions. Additionally, advancements in fiber optic technology, such as the development of dense wavelength division multiplexing (DWDM), have further enhanced its appeal in the fronthaul and backhaul landscape .

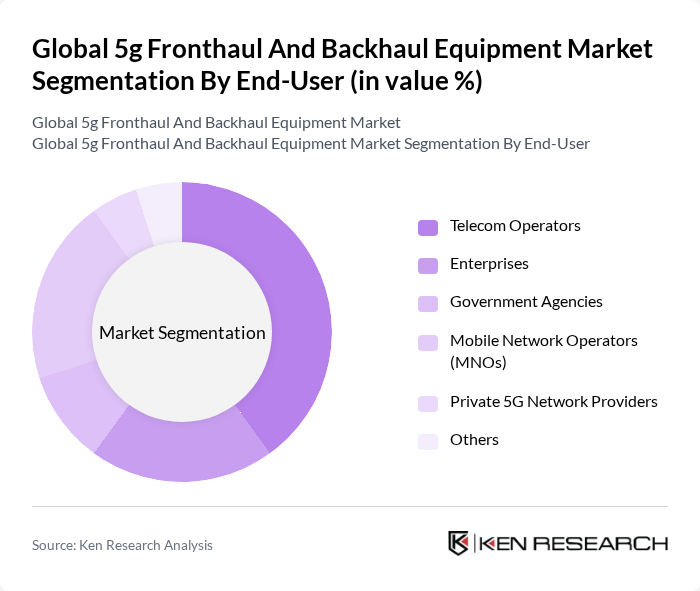

By End-User:The market is segmented based on end-users, which include Telecom Operators, Enterprises, Government Agencies, Mobile Network Operators (MNOs), Private 5G Network Providers, and Others. Each end-user category has distinct requirements and applications for fronthaul and backhaul equipment .

Telecom Operators are the leading end-users in the market, primarily due to their extensive infrastructure and the need for robust fronthaul and backhaul solutions to support the growing demand for mobile data. These operators are investing heavily in upgrading their networks to 5G, which requires advanced equipment to handle increased traffic and provide reliable services. The competitive landscape among telecom operators further drives innovation and investment in fronthaul and backhaul technologies .

The Global 5G Fronthaul and Backhaul Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ericsson, Nokia, Huawei Technologies Co., Ltd., Cisco Systems, Inc., ZTE Corporation, Samsung Electronics Co., Ltd., Ciena Corporation, Juniper Networks, Inc., Fujitsu Limited, NEC Corporation, CommScope Holding Company, Inc., Infinera Corporation, ADVA Optical Networking SE, Ribbon Communications Inc., FiberHome Telecommunication Technologies Co., Ltd., Sterlite Technologies Limited, Corning Incorporated, II-VI Incorporated (now Coherent Corp.), ECI Telecom Ltd. (now Ribbon Communications), Tellabs, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 5G fronthaul and backhaul equipment market appears promising, driven by technological advancements and increasing connectivity demands. As telecom operators continue to invest in network upgrades, the adoption of virtualized network functions and Open RAN architecture will enhance operational efficiency. Furthermore, the rise of edge computing solutions will facilitate lower latency and improved data processing capabilities, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Microwave Equipment Fiber Optic Equipment Millimeter Wave Equipment Satellite Equipment Passive WDM Equipment Ethernet Switches & Routers Others |

| By End-User | Telecom Operators Enterprises Government Agencies Mobile Network Operators (MNOs) Private 5G Network Providers Others |

| By Component | Hardware (Optical Transceivers, Switches, Routers, Antennas) Software (Network Management, Orchestration, SDN Controllers) Services (Deployment, Maintenance, Consulting) |

| By Application | Urban Areas Rural Areas Industrial Applications Mobile Backhaul Private 5G Networks Others |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Pricing Model | Subscription-Based One-Time Purchase Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators' Fronthaul Strategies | 100 | Network Architects, Operations Managers |

| Backhaul Equipment Suppliers | 80 | Product Managers, Sales Directors |

| 5G Infrastructure Deployment Projects | 75 | Project Managers, Technical Leads |

| Regulatory Impact on 5G Rollout | 60 | Policy Analysts, Regulatory Affairs Managers |

| Market Trends in 5G Equipment | 90 | Market Analysts, Industry Consultants |

The Global 5G Fronthaul and Backhaul Equipment Market is valued at approximately USD 6.3 billion, driven by the increasing demand for high-speed internet, IoT proliferation, and the transition from 4G to 5G networks.