Region:Global

Author(s):Shubham

Product Code:KRAC0887

Pages:99

Published On:August 2025

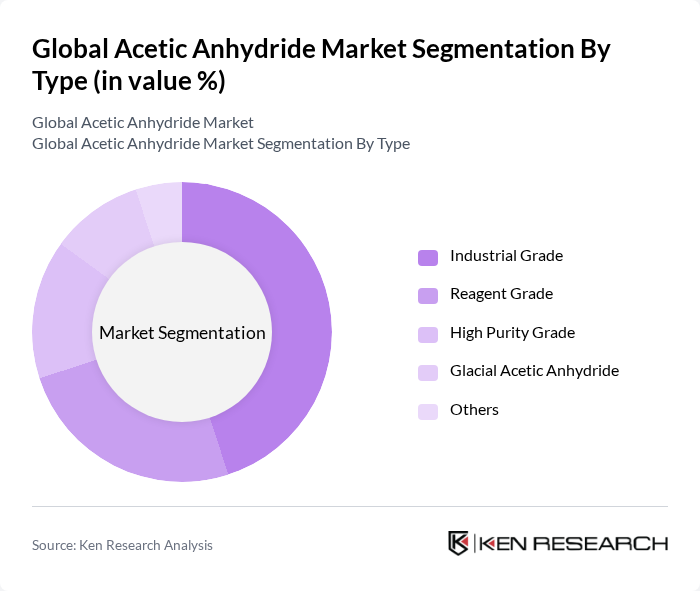

By Type:The acetic anhydride market is segmented into Industrial Grade, Reagent Grade, High Purity Grade, Glacial Acetic Anhydride, and Others. Industrial Grade acetic anhydride holds the largest share, attributed to its extensive use in chemical manufacturing, particularly for producing cellulose acetate, pharmaceuticals, and intermediates. The cost-effectiveness and versatility of Industrial Grade make it the preferred choice for large-scale applications in textiles, plastics, and pharmaceuticals .

By End-User:The end-user segmentation includes Chemical Manufacturing, Pharmaceuticals, Agrochemicals, Textiles, Automotive, Construction, Electronics, Consumer Goods, and Others. The Chemical Manufacturing sector is the leading end-user, driven by high demand for acetic anhydride in producing intermediates for plastics, coatings, and cellulose acetate. Pharmaceuticals form the next largest segment, supported by the use of acetic anhydride in drug synthesis. The growth in these sectors is reinforced by increasing industrialization and the need for specialty chemicals across diverse industries .

The Global Acetic Anhydride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eastman Chemical Company, Celanese Corporation, BASF SE, DuPont de Nemours, Inc., Mitsubishi Chemical Corporation, OXEA GmbH, Perstorp Holding AB, LyondellBasell Industries N.V., INEOS Group Limited, SABIC, Wacker Chemie AG, Jiangshan Chemical Co., Ltd., Shandong Huachang Chemical Co., Ltd., Jiangsu Sopo (Group) Co., Ltd., Hubei Shunhui Chemical Co., Ltd., Daicel Corporation, Lonza Group AG, Uflex Ltd., Chang Chun Group, Yip's Chemical Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acetic anhydride market appears promising, driven by the ongoing expansion of end-user industries and technological advancements. As the global economy recovers, demand for acetic anhydride is expected to rise, particularly in emerging markets where industrialization is accelerating. Companies are likely to invest in sustainable production methods and innovative applications, positioning themselves to capitalize on the growing need for high-purity acetic anhydride in pharmaceuticals and agrochemicals.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Reagent Grade High Purity Grade Glacial Acetic Anhydride Others |

| By End-User | Chemical Manufacturing Pharmaceuticals Agrochemicals Textiles Automotive Construction Electronics Consumer Goods Others |

| By Application | Solvent Production Acetate Esters Production Cellulose Acetate Production Plasticizers Synthetic Fibers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America United States Canada Mexico Europe United Kingdom Germany France Italy Spain Russia Benelux Nordics Rest of Europe Asia-Pacific China India Japan South Korea ASEAN Oceania Rest of Asia-Pacific Latin America Brazil Argentina Rest of Latin America Middle East & Africa Turkey Israel GCC North Africa South Africa Rest of Middle East & Africa |

| By Packaging Type | Drums IBC Totes Bulk Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Product Development Scientists |

| Plastics Manufacturing | 80 | Production Supervisors, Quality Control Managers |

| Textile Industry Usage | 70 | Textile Engineers, Procurement Managers |

| Agrochemical Sector | 90 | Formulation Chemists, Regulatory Affairs Specialists |

| Research Institutions | 40 | Academic Researchers, Industry Analysts |

The Global Acetic Anhydride Market is valued at approximately USD 3.9 billion, driven by increasing demand in pharmaceuticals, textiles, and automotive industries, as well as the expansion of the chemical manufacturing sector, particularly in regions like Asia Pacific and North America.