Region:Global

Author(s):Rebecca

Product Code:KRAC0252

Pages:94

Published On:August 2025

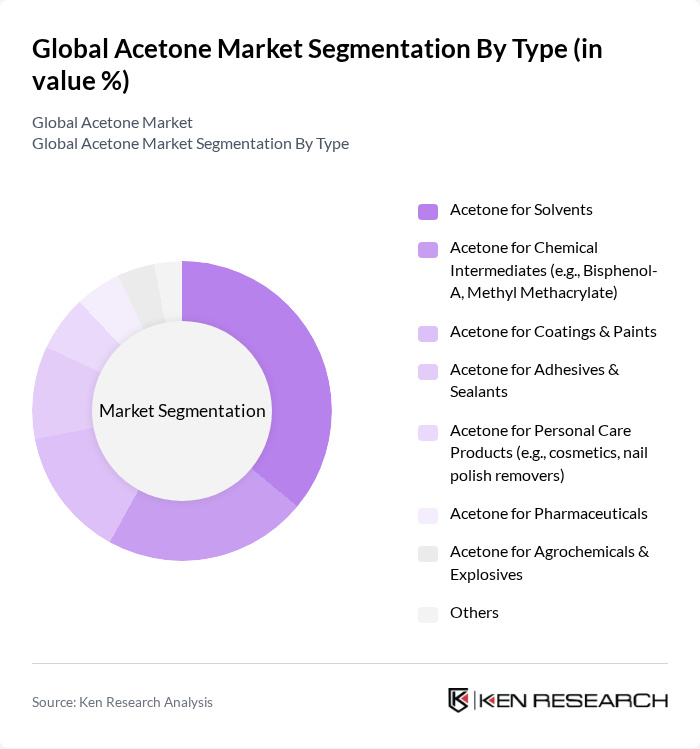

By Type:The acetone market can be segmented into various types, including acetone for solvents, chemical intermediates, coatings & paints, adhesives & sealants, personal care products, pharmaceuticals, agrochemicals & explosives, and others. Among these,acetone for solvents is the most dominant segmentdue to its extensive use in industrial applications and consumer products. Solvents accounted for approximately 34%–36% of the market share in recent years, confirming its leading position ; .

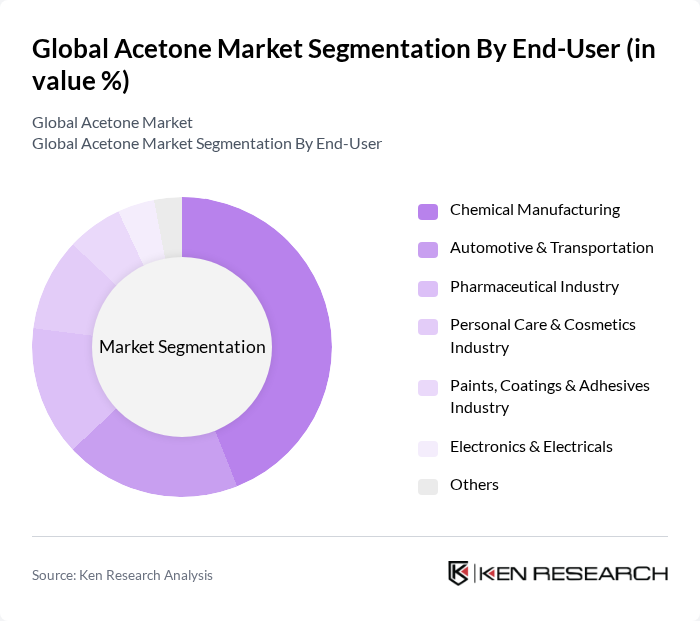

By End-User:The end-user segmentation of the acetone market includes chemical manufacturing, automotive & transportation, pharmaceutical industry, personal care & cosmetics industry, paints, coatings & adhesives industry, electronics & electricals, and others. Thechemical manufacturing sector remains the leading end-user, driven by the high demand for acetone in producing various chemicals and materials, particularly bisphenol-A and methyl methacrylate ; .

The Global Acetone Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., INEOS Phenol, Mitsubishi Chemical Corporation, LG Chem Ltd., Shell Chemicals (Royal Dutch Shell plc), Formosa Plastics Corporation, Cepsa Química, Repsol S.A., ALTIVIA Petrochemicals LLC, Hexion Inc., LyondellBasell Industries N.V., Eastman Chemical Company, OXEA GmbH, Solvay S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acetone market appears promising, driven by increasing demand across various sectors, particularly chemicals and solvents. Innovations in production technologies are expected to enhance efficiency and reduce costs, while the shift towards sustainable practices will likely reshape the industry landscape. Additionally, the growing focus on bio-based acetone production could open new avenues for market expansion, aligning with global sustainability goals and consumer preferences for eco-friendly products.

| Segment | Sub-Segments |

|---|---|

| By Type | Acetone for Solvents Acetone for Chemical Intermediates (e.g., Bisphenol-A, Methyl Methacrylate) Acetone for Coatings & Paints Acetone for Adhesives & Sealants Acetone for Personal Care Products (e.g., cosmetics, nail polish removers) Acetone for Pharmaceuticals Acetone for Agrochemicals & Explosives Others |

| By End-User | Chemical Manufacturing Automotive & Transportation Pharmaceutical Industry Personal Care & Cosmetics Industry Paints, Coatings & Adhesives Industry Electronics & Electricals Others |

| By Application | Solvent Applications Chemical Synthesis (e.g., BPA, MMA) Cleaning Agents & Degreasers Paints, Coatings & Thinners Pharmaceuticals & Laboratory Use Others |

| By Distribution Channel | Direct Sales (Manufacturers to End-users) Distributors & Wholesalers Online Sales Platforms Retail Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, UK, Italy, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Southeast Asia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Range Medium Price Range High Price Range |

| By Packaging Type | Bulk Packaging (Tankers, ISO Containers) Drum Packaging (Steel/Plastic Drums) Bottle Packaging (Consumer/Industrial Bottles) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 60 | R&D Managers, Quality Control Analysts |

| Plastics Manufacturing | 50 | Production Supervisors, Procurement Managers |

| Cosmetics and Personal Care | 40 | Product Development Managers, Marketing Directors |

| Industrial Solvents | 55 | Operations Managers, Supply Chain Coordinators |

| Chemical Intermediates | 45 | Process Engineers, Business Development Managers |

The Global Acetone Market is valued at approximately USD 6.1 billion, driven by increasing demand in various applications such as solvents, chemical intermediates, and personal care products, particularly in the Asia Pacific region.