Region:Global

Author(s):Geetanshi

Product Code:KRAC0101

Pages:95

Published On:August 2025

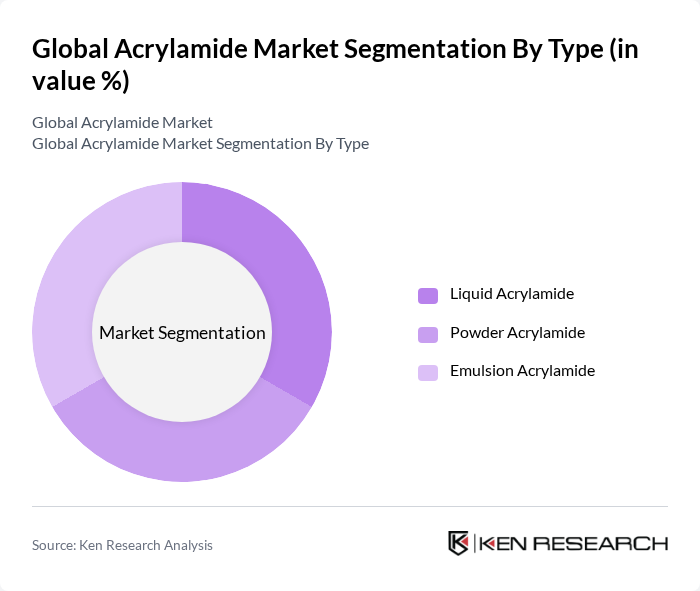

By Type:

The acrylamide market is segmented into three main types: Liquid Acrylamide, Powder Acrylamide, and Emulsion Acrylamide. Among these, Liquid Acrylamide is the dominant sub-segment, primarily due to its extensive use in water treatment applications. The liquid form is preferred for its ease of handling and effective dissolution in water, making it ideal for various industrial processes. Powder Acrylamide is also significant, particularly in applications requiring solid formulations, while Emulsion Acrylamide is gaining traction in specialized applications such as oil recovery .

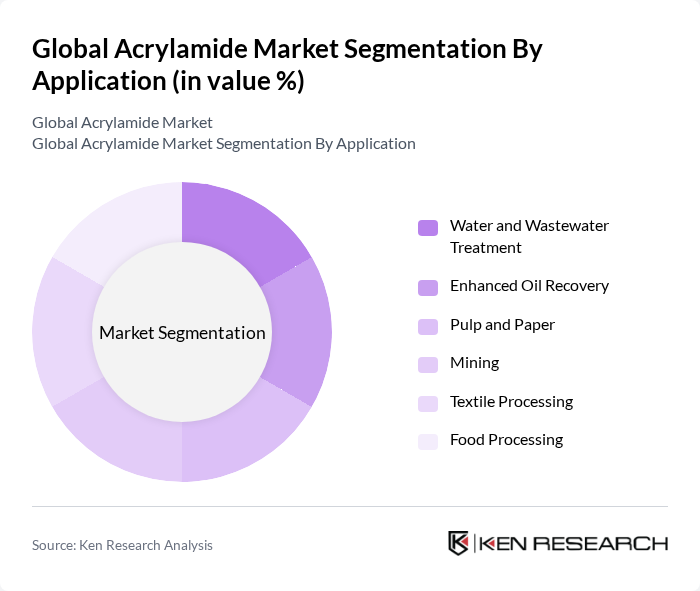

By Application:

The applications of acrylamide are diverse, including Water and Wastewater Treatment, Enhanced Oil Recovery, Pulp and Paper, Mining, Textile Processing, and Food Processing. Water and Wastewater Treatment is the leading application segment, driven by the increasing need for clean water and effective wastewater management solutions. Enhanced Oil Recovery follows, as acrylamide is used to improve oil extraction efficiency. The Pulp and Paper industry also utilizes acrylamide for its binding and retention properties, while Mining, Textile Processing, and Food Processing are emerging applications that contribute to market growth .

The Global Acrylamide Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, Nouryon (formerly AkzoNobel Specialty Chemicals), Solvay S.A., Evonik Industries AG, Mitsubishi Chemical Corporation, SNF Floerger, Kemira Oyj, Ashland Global Holdings Inc., Jiangsu Jiangnan Chemical Co., Ltd., Beijing Hengju Chemical Group Corporation, Hexion Inc., Chemtrade Logistics Inc., Taminco Corporation (now part of Eastman Chemical Company), Shandong Yulong Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the acrylamide market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly production methods, the demand for bio-based acrylamide is expected to rise. Additionally, emerging markets in Asia and Africa present significant growth opportunities, with rising industrialization and urbanization. Companies that innovate and adapt to these trends will likely capture a larger market share, ensuring resilience against regulatory and health-related challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Acrylamide Powder Acrylamide Emulsion Acrylamide |

| By Application | Water and Wastewater Treatment Enhanced Oil Recovery Pulp and Paper Mining Textile Processing Food Processing |

| By End-User | Municipal & Industrial Utilities Oil & Gas Companies Pulp & Paper Manufacturers Mining Companies Food & Beverage Industry Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 100 | Quality Assurance Managers, Production Supervisors |

| Chemical Manufacturing | 80 | Plant Managers, Process Engineers |

| Regulatory Bodies | 40 | Policy Makers, Health Inspectors |

| Research Institutions | 50 | Research Scientists, Environmental Analysts |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Health Educators |

The Global Acrylamide Market is valued at approximately USD 3.7 billion, reflecting a significant growth trajectory driven by increasing demand across various applications such as water treatment, food processing, and oil recovery.