Region:Global

Author(s):Dev

Product Code:KRAB0483

Pages:81

Published On:August 2025

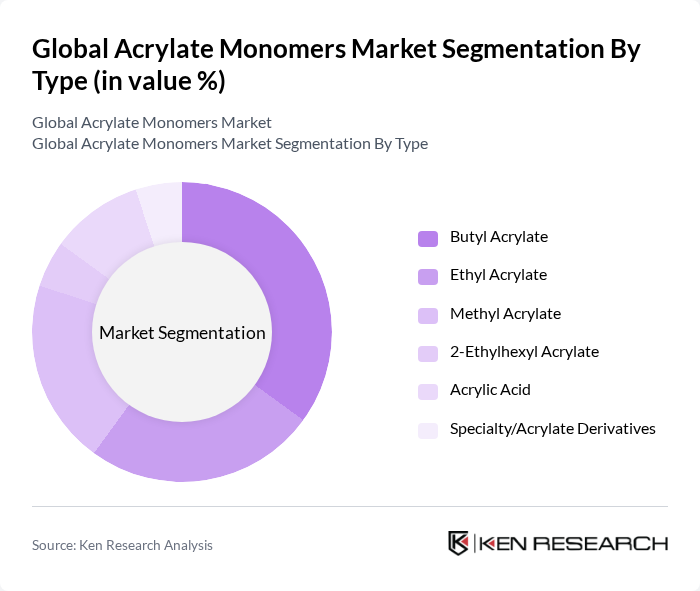

By Type:The acrylate monomers market commonly includes Butyl Acrylate, Ethyl Acrylate, Methyl Acrylate, 2?Ethylhexyl Acrylate, Acrylic Acid and derivatives, and specialty acrylates. Butyl Acrylate is widely used in waterborne and solvent-borne adhesives and architectural/industrial coatings; Ethyl Acrylate and Methyl Acrylate are important for plastics, resins, and paints; 2?Ethylhexyl Acrylate is a key soft monomer for pressure-sensitive adhesives; Acrylic Acid is fundamental for downstream esters and superabsorbent polymers .

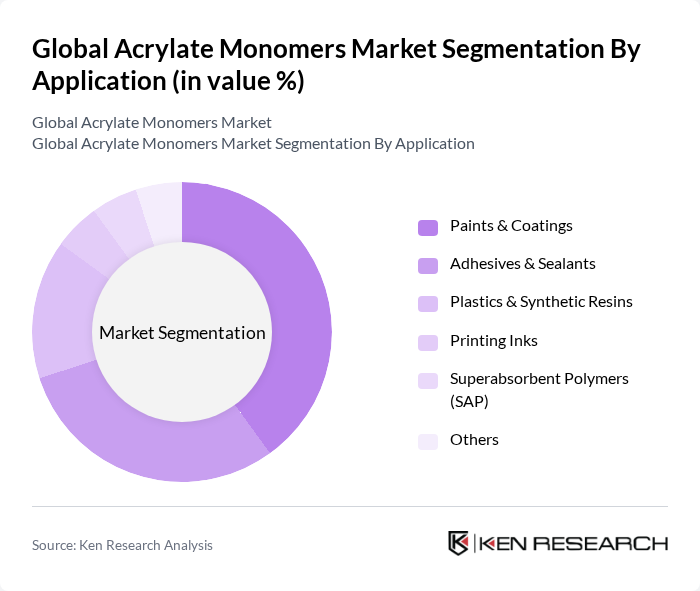

By Application:Major applications include Paints & Coatings, Adhesives & Sealants, Plastics & Synthetic Resins, Printing Inks, Superabsorbent Polymers (SAP), and others. Paints & Coatings remain the largest outlet due to architectural and industrial demand; Adhesives & Sealants are supported by packaging, tapes/labels, woodworking, and transportation; SAP consumes acrylic acid derivatives for hygiene applications .

The Global Acrylate Monomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Arkema S.A., Evonik Industries AG, LG Chem Ltd., Nippon Shokubai Co., Ltd., Mitsubishi Chemical Group Corporation, Wanhua Chemical Group Co., Ltd., Formosa Plastics Corporation, Sasol Limited, Hexion Inc., Shanghai Huayi Acrylic Monomer Co., Ltd. (Shenyang Chemical), LyondellBasell Industries N.V., Sinopec (China Petroleum & Chemical Corporation), Eastman Chemical Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the acrylate monomers market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production processes are expected to enhance efficiency and reduce environmental impact. Additionally, the increasing demand for eco-friendly products will likely spur the development of bio-based acrylate monomers. As industries adapt to changing consumer preferences, the market is poised for significant transformation, with a focus on sustainable practices and product customization to meet specific application needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Butyl Acrylate Ethyl Acrylate Methyl Acrylate Ethylhexyl Acrylate Acrylic Acid Specialty/Acrylate Derivatives (e.g., Polyfunctional, Fluorinated, UV-curable) |

| By Application | Paints & Coatings Adhesives & Sealants Plastics & Synthetic Resins Printing Inks Superabsorbent Polymers (SAP) Others |

| By End-User | Building & Construction Automotive & Transportation Packaging Textiles & Nonwovens Electronics Others |

| By Distribution Channel | Direct (Producer to End-User) Distributors/Traders Online/B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Production Process | Direct Esterification Olefin Oxidation Others |

| By Product Form | Liquid Solid Emulsion/Suspension |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings Industry | 110 | Product Development Managers, Technical Directors |

| Adhesives and Sealants | 80 | Procurement Managers, R&D Specialists |

| Plastics Manufacturing | 90 | Operations Managers, Quality Control Analysts |

| Textile Applications | 70 | Product Managers, Sustainability Coordinators |

| Construction Chemicals | 60 | Sales Managers, Market Analysts |

The Global Acrylate Monomers Market is valued at approximately USD 10.5 billion, based on a five-year historical analysis. This valuation is supported by demand across various sectors, including paints, coatings, adhesives, and plastics.