Region:Global

Author(s):Dev

Product Code:KRAB0531

Pages:93

Published On:August 2025

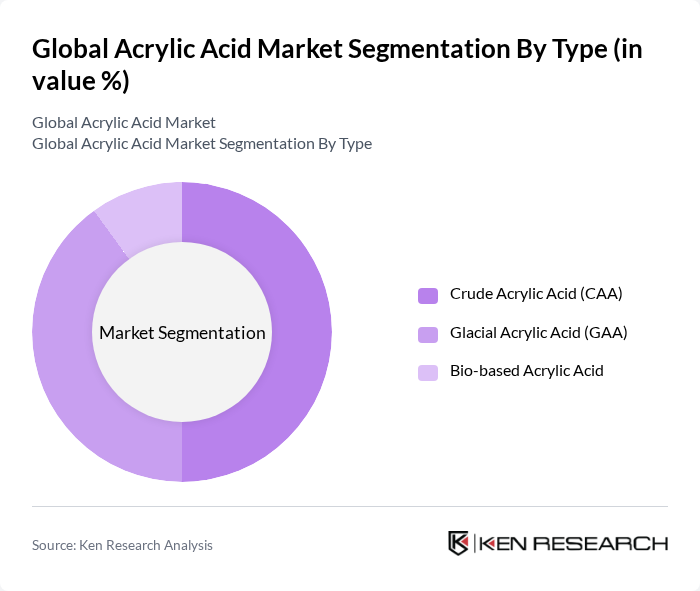

By Type:The acrylic acid market is segmented into three main types: Crude Acrylic Acid (CAA), Glacial Acrylic Acid (GAA), and Bio-based Acrylic Acid. Each type serves different applications and industries, with varying production processes and environmental impacts.

The Crude Acrylic Acid (CAA) segment dominates the market due to its extensive use in the production of various acrylate esters used in adhesives, paints, and coatings, supported by cost-effective large-scale oxidation processes from propylene. Glacial Acrylic Acid (GAA) follows closely, underpinning high-purity needs and downstream SAP and water treatment chemistries, while the bio-based segment is gaining traction on environmental and regulatory pressures spurring low-carbon chemistries development.

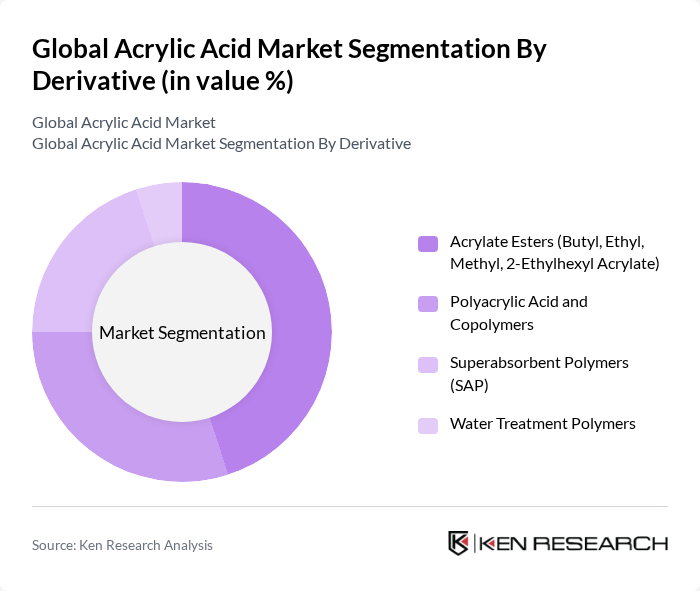

By Derivative:The derivatives of acrylic acid include Acrylate Esters (Butyl, Ethyl, Methyl, 2-Ethylhexyl Acrylate), Polyacrylic Acid and Copolymers, Superabsorbent Polymers (SAP), and Water Treatment Polymers. These derivatives are crucial for various applications across multiple industries.

Acrylate Esters dominate the derivatives segment due to their widespread use in adhesives, coatings, and sealants, underpinned by construction, automotive, and packaging demand. Polyacrylic Acid and Copolymers are significant in detergents and personal care for dispersancy and thickening, while Superabsorbent Polymers (SAP) see sustained consumption in diapers and adult incontinence products; Water Treatment Polymers remain a smaller but essential niche.

The Global Acrylic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Mitsubishi Chemical Group Corporation, LG Chem Ltd., Arkema S.A., Evonik Industries AG, Nippon Shokubai Co., Ltd., Formosa Plastics Corporation, SIBUR Holding PJSC, Wanhua Chemical Group Co., Ltd., Shanghai Huayi Group Corporation Limited, San-Dia Polymers, Ltd. (SDP Global Co., Ltd.), Zhejiang Satellite Petrochemical Co., Ltd. (Satellite Chemical), NIPPON PAPER INDUSTRIES CO., LTD. (SAP end-use integration), BASF-YPC Company Limited (BASF/Sinopec JV) contribute to innovation, geographic expansion, and service delivery in this space.

The acrylic acid market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. Innovations in production methods, such as bio-based acrylic acid, are gaining traction, potentially reducing environmental impact. Additionally, the expansion into emerging markets is expected to open new avenues for growth, as demand for acrylic acid in various applications continues to rise. Companies that adapt to these trends will likely enhance their market position and profitability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Acrylic Acid (CAA) Glacial Acrylic Acid (GAA) Bio-based Acrylic Acid |

| By Derivative | Acrylate Esters (Butyl, Ethyl, Methyl, 2?Ethylhexyl Acrylate) Polyacrylic Acid and Copolymers Superabsorbent Polymers (SAP) Water Treatment Polymers |

| By Application | Superabsorbent Polymers for Hygiene (Diapers, Adult Incontinence, Feminine Care) Paints & Coatings Adhesives & Sealants Water Treatment & Detergent Co?builders Textiles & Nonwovens Plastics & Polymer Additives |

| By End-Use Industry | Personal Care & Hygiene Building & Construction Automotive & Transportation Packaging & Consumer Goods Water & Wastewater Treatment |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct (Producers to End Users) Distributors/Traders |

| By Others | Bio/Low?carbon Grades & Circular Applications Specialty & High?purity Grades (Electronics, Medical) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Acrylic Acid Production Facilities | 120 | Plant Managers, Production Supervisors |

| End-User Industries (Coatings & Adhesives) | 90 | Product Managers, R&D Directors |

| Superabsorbent Polymer Manufacturers | 80 | Procurement Managers, Technical Directors |

| Market Analysts and Consultants | 60 | Market Research Analysts, Industry Consultants |

| Regulatory Bodies and Associations | 40 | Policy Makers, Regulatory Affairs Managers |

The Global Acrylic Acid Market is valued at approximately USD 13.6 billion, driven by increasing demand for superabsorbent polymers in hygiene products and robust consumption in paints and coatings through acrylate esters.