Region:Global

Author(s):Dev

Product Code:KRAA1534

Pages:88

Published On:August 2025

By Type:The acrylic fiber market is segmented into four main types: Staple Fiber, Filament (Tow/Top), Modacrylic Fiber, and Carbon Fiber Precursor (PAN). Among these, Staple Fiber is the most widely used due to its versatility in various applications, particularly in the apparel and home furnishings sectors. The demand for Staple Fiber is driven by its favorable properties such as softness, warmth, and ease of dyeing, making it a preferred choice for manufacturers.

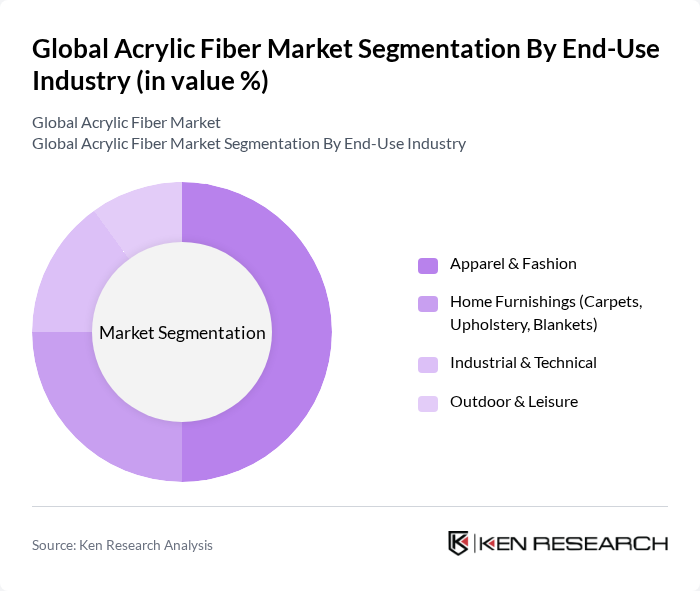

By End-Use Industry:The acrylic fiber market is categorized into four end-use industries: Apparel & Fashion, Home Furnishings (Carpets, Upholstery, Blankets), Industrial & Technical (filters, geotextiles, concrete reinforcement), and Outdoor & Leisure (awnings, outdoor fabrics). The Apparel & Fashion segment leads the market due to the high demand for lightweight and comfortable clothing, which is increasingly being made from acrylic fibers due to their durability and aesthetic appeal.

The Global Acrylic Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aksa Akrilik Kimya Sanayii A.?., Thai Acrylic Fibre Co., Ltd. (Aditya Birla Group), Dralon GmbH, Jilin Chemical Fiber Group Co., Ltd., Kaneka Corporation, Pasupati Acrylon Limited, Montefibre Hispania S.A., Formosa Plastics Corporation, Toray Industries, Inc., Sinopec Group (China Petrochemical Corporation), Shanghai Petrochemical Company Limited (Sinopec SPC), Zhejiang Hengyi Group Co., Ltd., Shandong Yulong Petrochemical Co., Ltd., Kaltex Fibers, S.A. de C.V., Indian Acrylics Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acrylic fiber market appears promising, driven by increasing consumer demand for sustainable textiles and technological advancements in production methods. As manufacturers invest in eco-friendly practices and innovative fiber blends, the market is likely to expand, particularly in emerging economies. Additionally, the rise of online retail channels will facilitate greater accessibility to acrylic fiber products, further enhancing market growth and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Staple Fiber Filament (Tow/Top) Modacrylic Fiber Carbon Fiber Precursor (PAN) |

| By End-Use Industry | Apparel & Fashion Home Furnishings (Carpets, Upholstery, Blankets) Industrial & Technical (filters, geotextiles, concrete reinforcement) Outdoor & Leisure (awnings, outdoor fabrics) |

| By Application | Sweaters, Knitwear & Socks Carpets & Rugs Upholstery & Blankets Protective & Flame-Retardant Textiles (modacrylic blends) |

| By Processing Technology | Wet Spinning Dry Spinning Blending & Dyeing (solution-dyed/mélange) |

| By Region | North America Europe Asia-Pacific Latin America |

| By Dye Type | Solution-Dyed (Dope-Dyed) Piece-Dyed Stock/Top-Dyed |

| By Denier/Filament Count | Fine Denier Medium Denier Coarse Denier |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Acrylic Fiber Manufacturers | 90 | Production Managers, Quality Control Supervisors |

| Textile Industry End-Users | 80 | Procurement Managers, Product Development Heads |

| Automotive Sector Suppliers | 60 | Supply Chain Managers, Materials Engineers |

| Home Furnishing Manufacturers | 70 | Design Managers, Operations Directors |

| Research Institutions and Academia | 50 | Textile Researchers, Industry Analysts |

The Global Acrylic Fiber Market is valued at approximately USD 5 billion, reflecting a five-year historical analysis. This valuation highlights the increasing demand for lightweight and durable textiles across various applications, including apparel and home furnishings.