Region:Global

Author(s):Shubham

Product Code:KRAB0724

Pages:89

Published On:August 2025

Market.png)

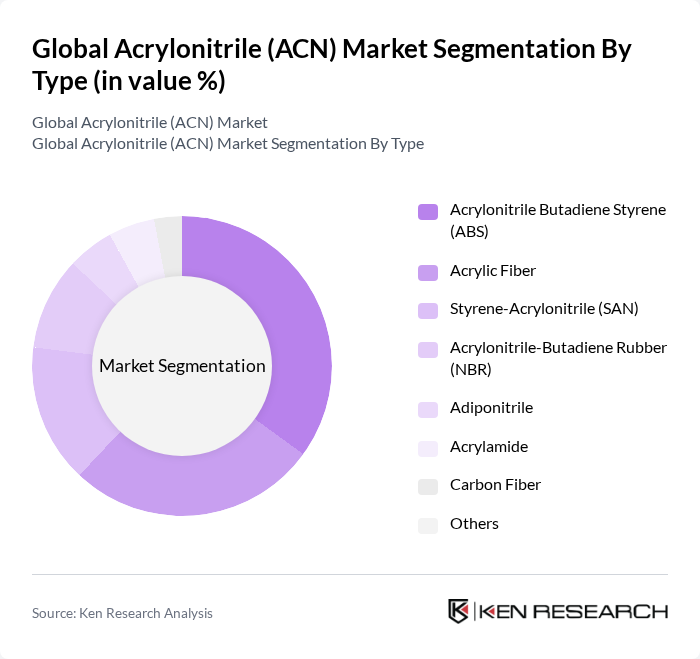

By Type:The market is segmented into Acrylonitrile Butadiene Styrene (ABS), Acrylic Fiber, Styrene-Acrylonitrile (SAN), Acrylonitrile-Butadiene Rubber (NBR), Adiponitrile, Acrylamide, Carbon Fiber, and Others. Acrylonitrile Butadiene Styrene (ABS) leads the segment, driven by its widespread use in automotive, electronics, and consumer goods due to its mechanical strength, chemical resistance, and versatility. Demand for ABS is further supported by the automotive industry's focus on lightweight and high-performance materials .

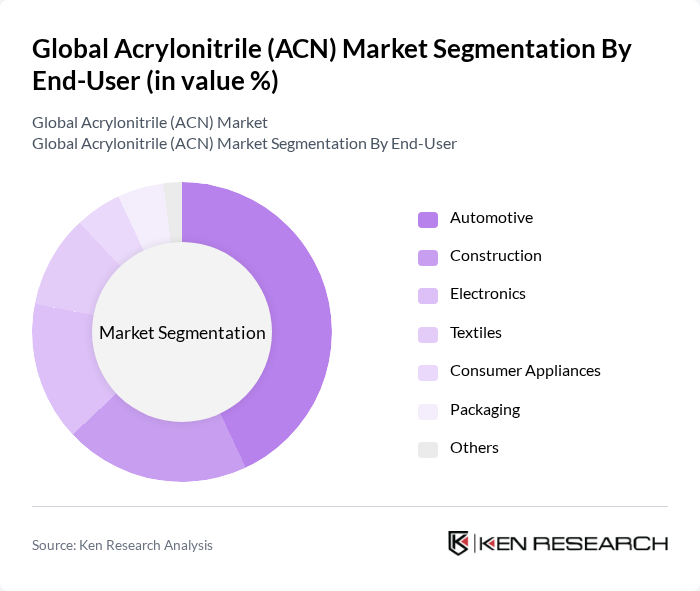

By End-User:The end-user segmentation includes Automotive, Construction, Electronics, Textiles, Consumer Appliances, Packaging, and Others. The automotive sector is the dominant end-user, accounting for the largest share due to increased adoption of lightweight, durable, and high-performance materials in vehicle manufacturing. The electronics and construction sectors also represent significant demand, driven by growth in consumer electronics and infrastructure projects. The trend toward electric vehicles and sustainability continues to boost acrylonitrile consumption in automotive and related industries .

The Global Acrylonitrile (ACN) Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, INEOS Group, Asahi Kasei Corporation, Mitsubishi Chemical Corporation, LG Chem Ltd., Sinopec Limited, Formosa Plastics Corporation, LyondellBasell Industries N.V., Huntsman Corporation, Toray Industries, Inc., Reliance Industries Limited, Eastman Chemical Company, Covestro AG, SABIC, DuPont de Nemours, Inc., Lotte Chemical Corporation, Thai Acrylic Fiber Co. Ltd., CHIMEI Corporation, Zibo Qixiang Tengda Chemical Co. Ltd., CPDC (Chang Chun Plastics Co. Ltd.), Nanjing Chemical Material Corp., Gihi Chemicals Co., Ltd., Blackwell Plastics, Krada CPS Industry S.L. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acrylonitrile market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt bio-based alternatives and innovative production methods, the market is likely to witness a shift towards greener practices. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, will provide new avenues for growth. Companies that invest in research and development to enhance product performance and sustainability will be well-positioned to capitalize on these trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylonitrile Butadiene Styrene (ABS) Acrylic Fiber Styrene-Acrylonitrile (SAN) Acrylonitrile-Butadiene Rubber (NBR) Adiponitrile Acrylamide Carbon Fiber Others |

| By End-User | Automotive Construction Electronics Textiles Consumer Appliances Packaging Others |

| By Application | Coatings Adhesives Plastics Synthetic Rubber Water Treatment Chemicals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Product Form | Liquid Solid Gas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Acrylonitrile Production Facilities | 60 | Plant Managers, Production Supervisors |

| End-User Industries (Textiles) | 50 | Procurement Managers, Product Development Heads |

| Automotive Sector Applications | 40 | Supply Chain Managers, Quality Assurance Officers |

| Research Institutions and Academia | 40 | Research Scientists, Chemical Engineers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

The Global Acrylonitrile (ACN) Market is valued at approximately USD 12.4 billion, driven by increasing demand in various sectors such as plastics, textiles, automotive components, and electronics, particularly in regions like Asia-Pacific and North America.