Region:Global

Author(s):Dev

Product Code:KRAC0482

Pages:92

Published On:August 2025

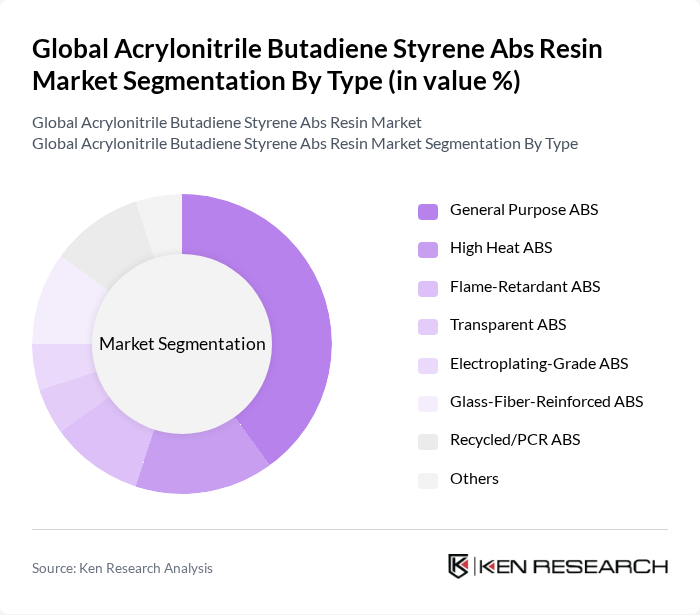

By Type:The ABS resin market is segmented into various types, including General Purpose ABS, High Heat ABS, Flame-Retardant ABS, Transparent ABS, Electroplating-Grade ABS, Glass-Fiber-Reinforced ABS, Recycled/PCR ABS, and Others. Among these, General Purpose ABS is the most widely used due to its excellent balance of properties, making it suitable for a variety of applications. High Heat ABS is gaining traction in industries requiring materials that can withstand elevated temperatures, while Flame-Retardant ABS is increasingly demanded for safety-critical applications.

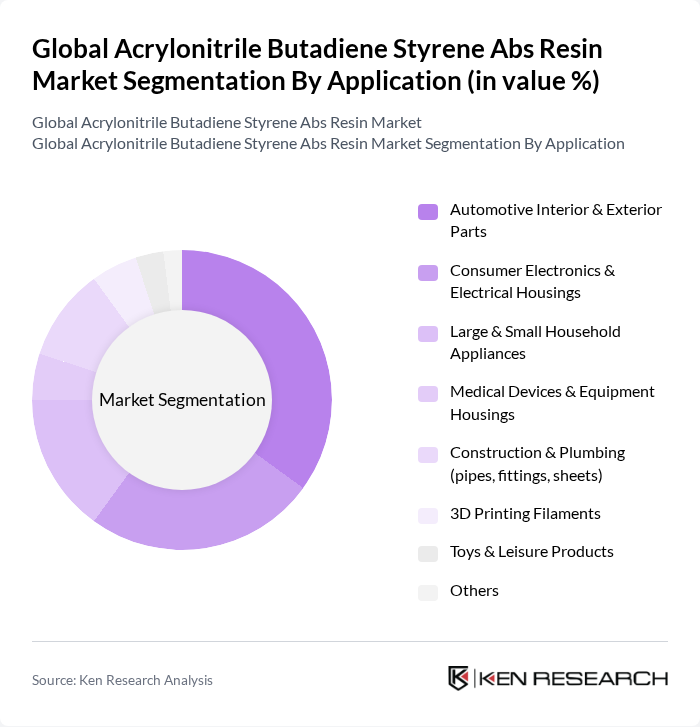

By Application:The ABS resin market is also segmented by application, which includes Automotive Interior & Exterior Parts, Consumer Electronics & Electrical Housings, Large & Small Household Appliances, Medical Devices & Equipment Housings, Construction & Plumbing (pipes, fittings, sheets), 3D Printing Filaments, Toys & Leisure Products, and Others. The automotive sector is the largest consumer of ABS due to its lightweight and impact-resistant properties, while the electronics sector is rapidly adopting ABS for its excellent electrical insulation and aesthetic qualities.

The Global Acrylonitrile Butadiene Styrene Abs Resin Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Chem Ltd. (LG Chem / LG Chem ABS, including formerly LG MMA), INEOS Styrolution Group GmbH, Trinseo PLC, SABIC, Chi Mei Corporation, Formosa Plastics Corporation, Kumho Petrochemical Co., Ltd., Lotte Chemical Corporation, Toray Industries, Inc., Denka Company Limited, Techno-UMG Co., Ltd. (Acrylonitrile Butadiene Styrene specialist; Japan), Shandong Hi-tech Chemical Group Co., Ltd., Kingfa Science & Technology Co., Ltd., ELIX Polymers, S.L.U. (A Ravago Company), LOTTE Advanced Materials Co., Ltd. (now part of Hanwha Solutions Advanced Materials) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ABS resin market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production techniques are expected to enhance efficiency and reduce environmental impact, while the growing emphasis on recycling initiatives will likely create new avenues for growth. Additionally, the expansion of the electric vehicle market will further boost demand for high-performance materials, positioning ABS as a key player in the evolving landscape of manufacturing and materials science.

| Segment | Sub-Segments |

|---|---|

| By Type | General Purpose ABS High Heat ABS Flame-Retardant ABS Transparent ABS Electroplating-Grade ABS Glass-Fiber-Reinforced ABS Recycled/PCR ABS Others |

| By Application | Automotive Interior & Exterior Parts Consumer Electronics & Electrical Housings Large & Small Household Appliances Medical Devices & Equipment Housings Construction & Plumbing (pipes, fittings, sheets) D Printing Filaments Toys & Leisure Products Others |

| By End-User | Automotive & Transportation Electronics & Electrical Building & Construction Consumer Goods & Appliances Healthcare Industrial & 3D Printing Others |

| By Sales Channel | Direct Sales (Producers to OEMs) Distributors & Compounders Online/Marketplace Sales Retail/Dealer Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grades Specialty/Engineering Grades Recycled Grades |

| By Product Form | Pellets/Granules Sheets/Plates Films Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 110 | Product Engineers, Procurement Managers |

| Consumer Goods Sector | 85 | Brand Managers, Supply Chain Analysts |

| Electronics Manufacturing | 95 | Operations Managers, Quality Control Specialists |

| Construction Materials | 75 | Project Managers, Material Suppliers |

| Packaging Industry | 65 | Product Development Managers, Marketing Directors |

The Global Acrylonitrile Butadiene Styrene (ABS) resin market is valued at approximately USD 26 billion, reflecting a robust demand driven by various industries such as automotive, electronics, and consumer goods, particularly for lightweight and durable materials.