Region:Global

Author(s):Shubham

Product Code:KRAB0570

Pages:91

Published On:August 2025

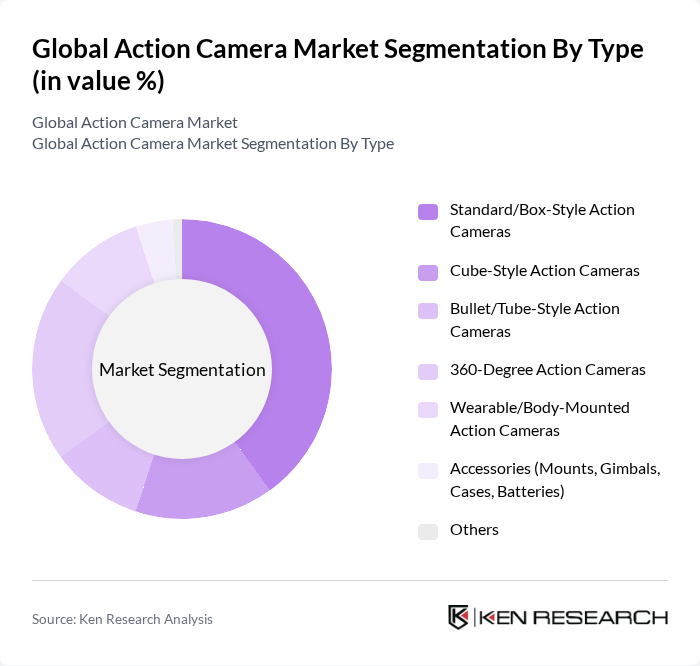

By Type:The action camera market is segmented into various types, including Standard/Box-Style Action Cameras, Cube-Style Action Cameras, Bullet/Tube-Style Action Cameras, 360-Degree Action Cameras, Wearable/Body-Mounted Action Cameras, Accessories (Mounts, Gimbals, Cases, Batteries), and Others. Among these, Standard/Box-Style Action Cameras are the most popular due to their versatility, ruggedized designs, strong accessory ecosystems, and ease of use, appealing to both amateur and professional users. The demand for 360-Degree Action Cameras is also rising, driven by immersive content creation, social media sharing, and the success of brands focused on 360 capture .

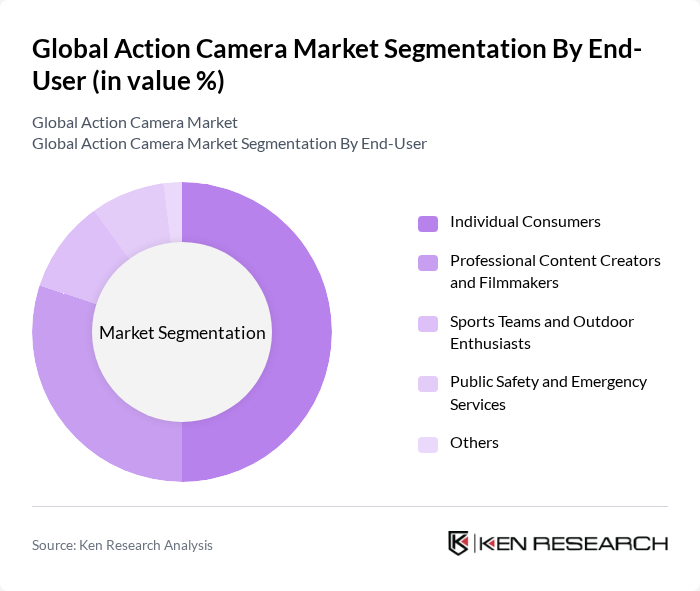

By End-User:The market is segmented by end-user into Individual Consumers, Professional Content Creators and Filmmakers, Sports Teams and Outdoor Enthusiasts, Public Safety and Emergency Services, and Others. Individual Consumers dominate the market, driven by the increasing trend of vlogging and social media sharing. Professional content creators are also significant users, as they require high-quality footage, robust stabilization, waterproofing, and workflow integrations for their projects, leading to a growing demand for advanced action cameras among creators and prosumers .

The Global Action Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as GoPro, Inc., DJI Technology Co., Ltd., Sony Group Corporation, Garmin Ltd., YI Technology (Shanghai Xiaoyi Technology Co., Ltd.), Insta360 (Arashi Vision Inc.), Polaroid, AKASO, SJCAM (Shenzhen SJCAM Technology Co., Ltd.), Drift Innovation Ltd., Veho Ltd., AEE Technology Co., Ltd., Campark (TOPTEL TECHNOLOGY CO., LTD.), Kodak (Eastman Kodak Company), Ricoh Company, Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The action camera market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As 360-degree cameras gain traction, their market share is expected to increase, appealing to adventure enthusiasts and content creators alike. Additionally, the integration of AI functionalities will enhance user experience, making cameras more intuitive. The rise of subscription-based services for cloud storage and editing tools will also reshape the market landscape, providing new revenue streams for manufacturers and content creators.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard/Box-Style Action Cameras Cube-Style Action Cameras Bullet/Tube-Style Action Cameras Degree Action Cameras Wearable/Body-Mounted Action Cameras Accessories (Mounts, Gimbals, Cases, Batteries) Others |

| By End-User | Individual Consumers Professional Content Creators and Filmmakers Sports Teams and Outdoor Enthusiasts Public Safety and Emergency Services Others |

| By Application | Sports and Adventure Travel and Tourism Vlogging and Content Creation Security, Training, and Documentation Others |

| By Distribution Channel | Online Retail (Brand Stores, Marketplaces) Offline Retail (Electronics & Specialty Stores) Direct-to-Consumer (Brand Outlets) Distributors/Wholesale Others |

| By Price Range | Budget (Sub-$150) Mid-Range ($150–$400) Premium ($400+) Others |

| By Brand | GoPro DJI Sony Insta360 Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Action Camera Users | 150 | Outdoor Enthusiasts, Travel Bloggers |

| Professional Videographers | 100 | Filmmakers, Content Creators |

| Retail Store Managers | 80 | Electronics Retailers, Sports Equipment Retailers |

| Action Camera Accessory Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The Global Action Camera Market is valued at approximately USD 3.1 billion, reflecting a significant growth trend driven by the popularity of adventure sports, social media influencers, and advancements in camera technology.