Region:Global

Author(s):Dev

Product Code:KRAA1543

Pages:95

Published On:August 2025

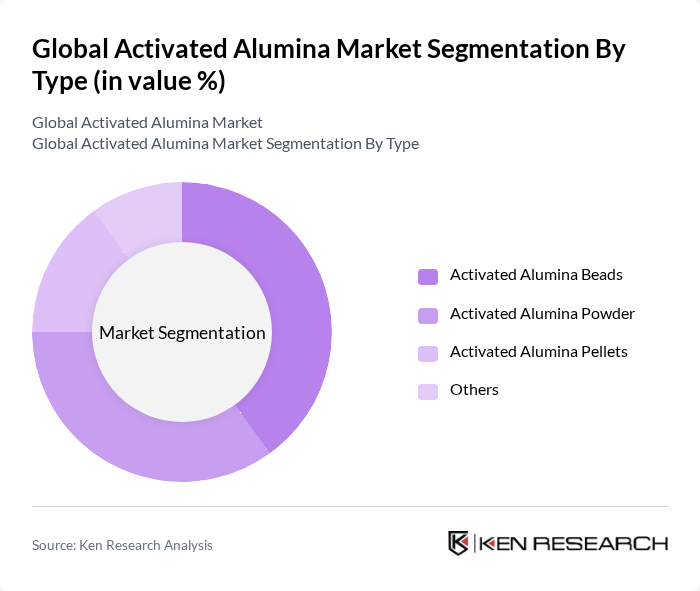

By Type:The market is segmented into various types of activated alumina products, including Activated Alumina Beads, Activated Alumina Powder, Activated Alumina Pellets, and Others. Each type serves distinct applications across industries, influencing their market dynamics.

The Activated Alumina Beads segment is currently leading the market due to their widespread use in water treatment applications, particularly for fluoride removal. Their high surface area and adsorption capacity make them ideal for various industrial processes. The demand for activated alumina beads is further fueled by regulatory requirements for safe drinking water, driving manufacturers to prioritize this segment.

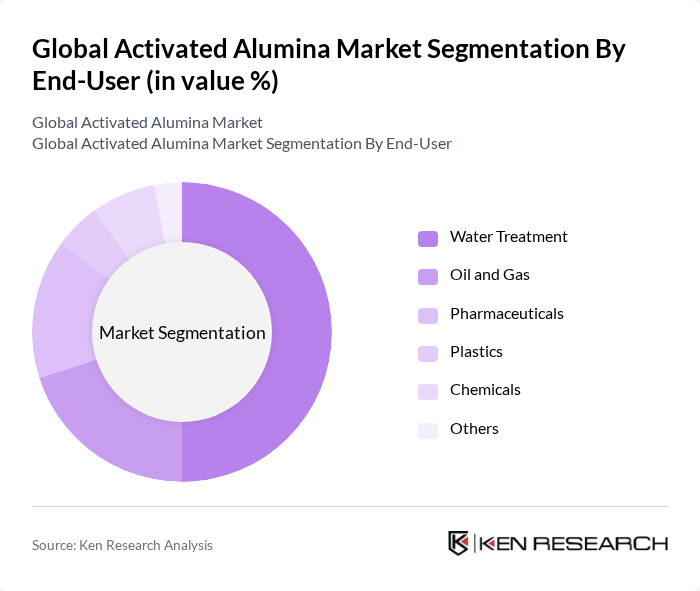

By End-User:The market is segmented based on end-users, including Water Treatment, Oil and Gas, Pharmaceuticals, Plastics, Chemicals, and Others. Each end-user category has unique requirements and applications for activated alumina, shaping the overall market landscape.

The Water Treatment segment dominates the market, accounting for a significant share due to the increasing global focus on clean water access and stringent regulations regarding water quality. Activated alumina is extensively used for fluoride and arsenic removal, making it a preferred choice in municipal and industrial water treatment facilities. The growing awareness of waterborne diseases further propels the demand in this sector.

The Global Activated Alumina Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Axens, Honeywell UOP, Porocel (Evonik), Sumitomo Chemical Co., Ltd., Dynamic Adsorbents Inc., Sorbead India, Huber Engineered Materials, Camfil, AGC Chemicals, Shandong Zhongxin New Materials Technology Co., Ltd., Jiangsu Jingjing New Material Co., Ltd., Sumitomo Chemical Advanced Materials (formerly Covalent), KNT Group, Desican Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the activated alumina market appears promising, driven by increasing environmental regulations and a shift towards sustainable practices. As industries prioritize eco-friendly solutions, the demand for activated alumina is expected to rise, particularly in water treatment and pharmaceuticals. Additionally, technological advancements in production methods are likely to enhance efficiency and reduce costs, further supporting market growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Activated Alumina Beads Activated Alumina Powder Activated Alumina Pellets Others |

| By End-User | Water Treatment Oil and Gas Pharmaceuticals Plastics Chemicals Others |

| By Application | Desiccant Catalyst Fluoride Adsorbent Catalyst Support Others |

| By Distribution Channel | Direct (Manufacturer to End-User) Industrial Distributors EPCs and System Integrators Online/Inside Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging (Super Sacks/IBC) Drums and Bags Custom/Pre-packed Cartridges Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Water Treatment Applications | 100 | Water Treatment Plant Managers, Environmental Engineers |

| Pharmaceutical Industry Usage | 80 | Quality Control Managers, Production Supervisors |

| Oil & Gas Sector Applications | 70 | Process Engineers, Operations Managers |

| Industrial Adsorbent Applications | 90 | Product Development Managers, Chemical Engineers |

| Desiccant Market Insights | 75 | Supply Chain Managers, Procurement Officers |

The Global Activated Alumina Market is valued at approximately USD 1.1 billion, reflecting a significant growth trajectory driven by increasing demand for water treatment solutions and efficient desiccants across various industries.