Region:Global

Author(s):Shubham

Product Code:KRAD0765

Pages:94

Published On:August 2025

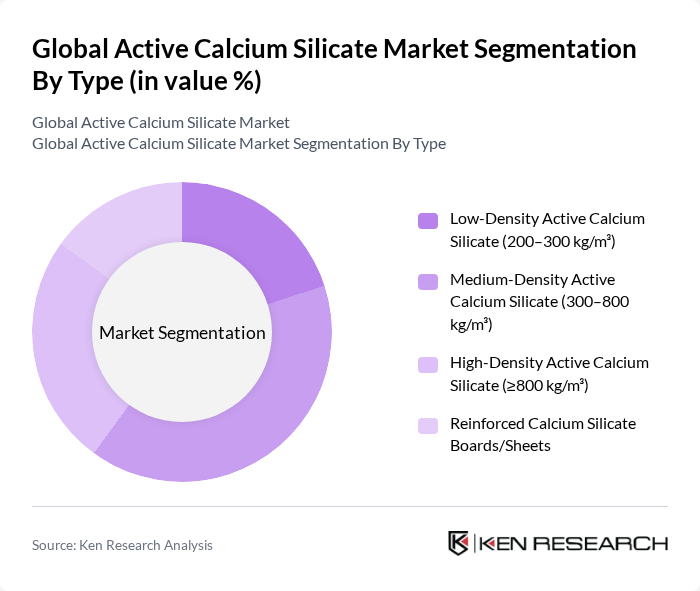

By Type:The market is segmented into four types: Low-Density Active Calcium Silicate (200–300 kg/m³), Medium-Density Active Calcium Silicate (300–800 kg/m³), High-Density Active Calcium Silicate (?800 kg/m³), and Reinforced Calcium Silicate Boards/Sheets. Medium-Density Active Calcium Silicate is widely used because it balances mechanical strength with thermal insulation and machinability, fitting lining, partition, and equipment insulation uses across construction and industrial settings.

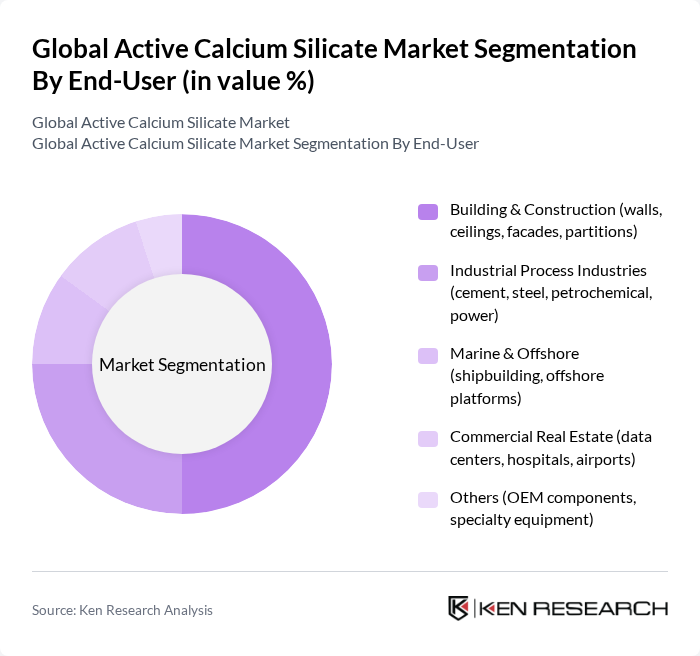

By End-User:The market is segmented into Building & Construction, Industrial Process Industries, Marine & Offshore, Commercial Real Estate, and Others. Building & Construction leads due to the need for passive fire protection, noncombustible partitions, and thermal/acoustic performance, reinforced by enforcement of building codes and energy efficiency programs; industrial process industries adopt calcium silicate for high-temperature piping, equipment, and kiln/furnace insulation.

The Global Active Calcium Silicate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Skamol (A.P. Moller Holding portfolio), Promat International N.V. (Etex Group), HIL Limited (former Hyderabad Industries Ltd.), Johns Manville, American Elements, NICHIAS Corporation, A&A Material Corporation, Saint-Gobain, KIMMCO-ISOVER, Etex Group, TCC Materials, ZIRCAR Refractory Composites, Inc., BNZ Materials, Inc., Pyrotek Inc., Imerys S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the active calcium silicate market appears promising, driven by increasing investments in infrastructure and a growing focus on sustainability. As governments worldwide prioritize green building initiatives, the demand for eco-friendly materials is expected to rise. Additionally, advancements in manufacturing technologies will likely enhance product quality and reduce costs, making active calcium silicate more competitive. The market is poised for growth as industries adapt to evolving regulations and consumer preferences, fostering innovation and expansion opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Low-Density Active Calcium Silicate (200–300 kg/m³) Medium-Density Active Calcium Silicate (300–800 kg/m³) High-Density Active Calcium Silicate (?800 kg/m³) Reinforced Calcium Silicate Boards/Sheets |

| By End-User | Building & Construction (walls, ceilings, facades, partitions) Industrial Process Industries (cement, steel, petrochemical, power) Marine & Offshore (shipbuilding, offshore platforms) Commercial Real Estate (data centers, hospitals, airports) Others (OEM components, specialty equipment) |

| By Application | Thermal Insulation (high-temperature piping, equipment) Passive Fire Protection (fireproof boards, duct/structural protection) Acoustic Panels and False Ceilings Refractory Back-up and Kiln Insulation Others (filler/anti-caking, specialty uses) |

| By Distribution Channel | Direct/Project Sales (EPCs, OEMs, large contractors) Industrial Distributors/Stockists Online/Procurement Portals Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging (palletized boards, slabs) Bagged/Pouched (powders, granules) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 100 | Project Managers, Materials Engineers |

| Food and Beverage Sector Usage | 80 | Quality Control Managers, Product Developers |

| Pharmaceuticals and Healthcare Applications | 70 | Regulatory Affairs Specialists, R&D Managers |

| Environmental Applications and Sustainability | 60 | Sustainability Officers, Environmental Engineers |

| Consumer Goods and Packaging | 90 | Product Managers, Supply Chain Analysts |

The Global Active Calcium Silicate Market is valued at approximately USD 360 million, driven by increasing demand for fire-resistant and thermal insulation materials across various industries, particularly construction and manufacturing.