Region:Global

Author(s):Shubham

Product Code:KRAB0676

Pages:92

Published On:August 2025

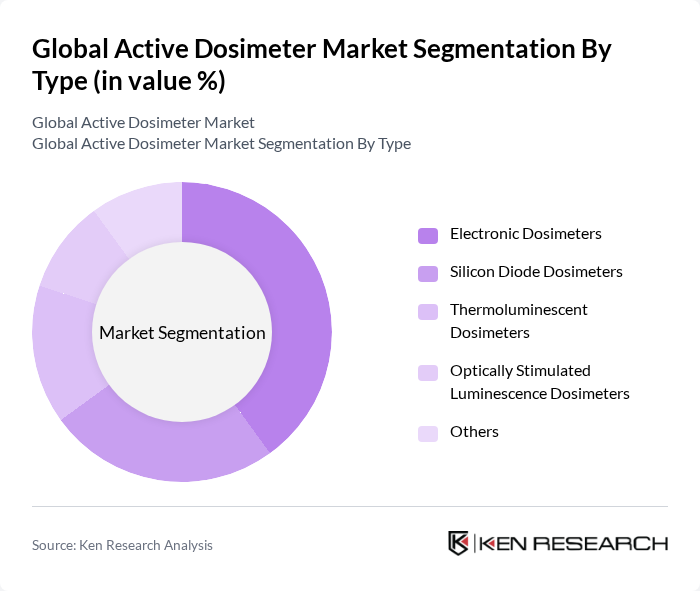

By Type:The market is segmented into various types of dosimeters, including Electronic Dosimeters, Silicon Diode Dosimeters, Thermoluminescent Dosimeters, Optically Stimulated Luminescence Dosimeters, and Others. Among these,Electronic Dosimetersare gaining traction due to their real-time monitoring capabilities, digital data storage, and user-friendly interfaces. The increasing adoption of these devices in healthcare, industrial, and defense applications is driving their market dominance.Silicon Diode Dosimetersare also widely used for their precision and reliability, particularly in medical imaging, radiotherapy, and research environments .

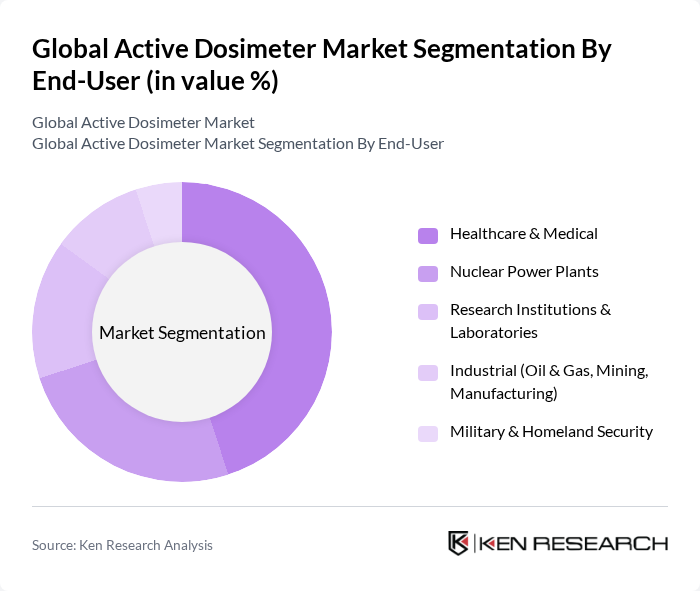

By End-User:The end-user segmentation includes Healthcare & Medical, Nuclear Power Plants, Research Institutions & Laboratories, Industrial (Oil & Gas, Mining, Manufacturing), Military & Homeland Security, and Others. TheHealthcare & Medicalsector is the leading end-user, driven by the need for accurate radiation monitoring in diagnostic imaging, radiotherapy, and nuclear medicine. TheNuclear Power Plantssegment also holds a significant share due to strict safety regulations and the necessity for continuous radiation monitoring in these facilities. Industrial and defense applications are expanding rapidly, supported by regulatory compliance and increased awareness of occupational radiation hazards .

The Global Active Dosimeter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Landauer, Inc., Mirion Technologies, Inc., Thermo Fisher Scientific Inc., Polimaster Inc., Fuji Electric Co., Ltd., Atomtex SPE, Tracerco Limited, Rotunda Scientific Technologies LLC, Ludlum Measurements, Inc., Radiation Detection Company, LLC, Dosimetry Services, Inc., Aware Electronics, Inc., Canberra Industries, Inc., Fluke Biomedical, Nuvia Ltd., Rados Technology, S.E. International, Inc., IBA Dosimetry GmbH, PTW Freiburg GmbH, Radiation Protection Services, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the active dosimeter market appears promising, driven by ongoing technological advancements and increasing regulatory scrutiny. As industries continue to prioritize radiation safety, the integration of IoT and real-time monitoring capabilities will likely become standard features in dosimetry solutions. Furthermore, the expansion of healthcare and nuclear sectors in developing regions presents significant growth potential, as these markets increasingly recognize the importance of effective radiation management and safety protocols.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Dosimeters Silicon Diode Dosimeters Thermoluminescent Dosimeters Optically Stimulated Luminescence Dosimeters Others |

| By End-User | Healthcare & Medical Nuclear Power Plants Research Institutions & Laboratories Industrial (Oil & Gas, Mining, Manufacturing) Military & Homeland Security Others |

| By Application | Personal Monitoring Environmental Monitoring Area/Workplace Safety Monitoring Diagnostic & Therapeutic Monitoring Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Digital Dosimetry Analog Dosimetry Hybrid Systems Wireless Dosimetry Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Active Dosimeter Usage | 100 | Radiation Safety Officers, Medical Physicists |

| Nuclear Power Plant Monitoring | 75 | Health Physicists, Plant Managers |

| Research Laboratory Applications | 60 | Laboratory Managers, Research Scientists |

| Industrial Radiation Safety | 50 | Safety Managers, Compliance Officers |

| Environmental Monitoring Initiatives | 80 | Environmental Scientists, Regulatory Affairs Specialists |

The Global Active Dosimeter Market is valued at approximately USD 2.9 billion, driven by increasing awareness of radiation safety and advancements in dosimetry technology, particularly in healthcare, nuclear energy, and industrial sectors.