Region:Global

Author(s):Geetanshi

Product Code:KRAA0151

Pages:80

Published On:August 2025

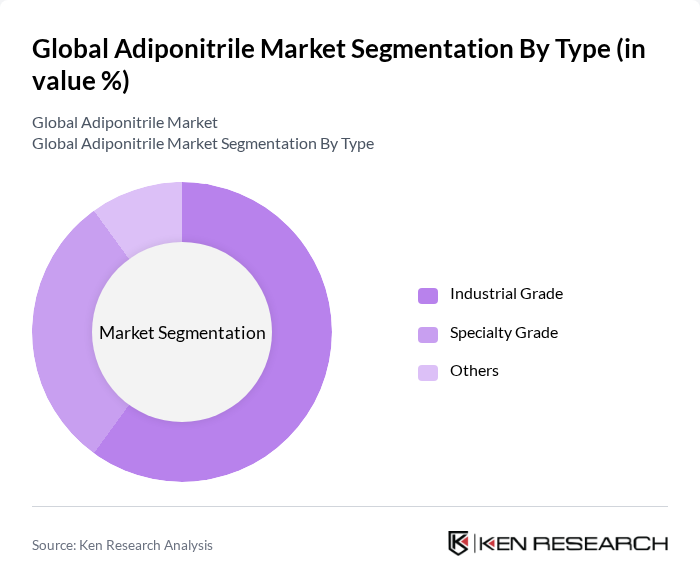

By Type:The adiponitrile market is segmented into three main types:Industrial Grade,Specialty Grade, andOthers. Industrial Grade is primarily used in large-scale applications such as nylon 6,6 production, while Specialty Grade caters to niche markets requiring higher purity and specific performance characteristics. The Others category includes grades used for research, specialty polymers, and less common industrial applications .

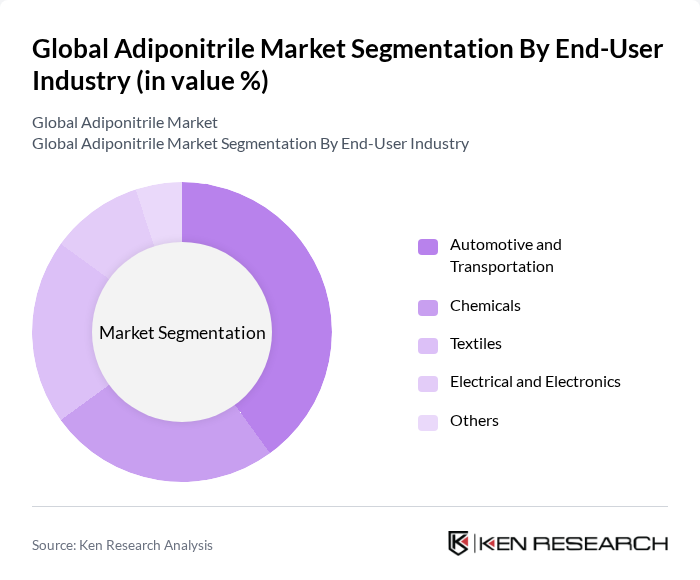

By End-User Industry:The adiponitrile market is segmented based on end-user industries, includingAutomotive and Transportation,Chemicals,Textiles,Electrical and Electronics, andOthers. Each segment has distinct requirements for adiponitrile, influencing demand and market dynamics. Automotive and transportation require lightweight, heat-resistant materials, while the chemicals sector uses adiponitrile as a key intermediate for various polymers. Textiles and electronics leverage its properties for specialty fibers and components .

TheAutomotive and Transportationsegment is the leading end-user industry for adiponitrile, driven by the increasing demand for lightweight and durable materials in vehicle manufacturing. The transition towards electric vehicles and the need for high-performance engineering plastics further enhance the demand for adiponitrile in this sector. Growth in chemicals and textiles also significantly contributes to overall market expansion .

The Global Adiponitrile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ascend Performance Materials, BASF SE, Invista, Mitsubishi Chemical Corporation, AdvanSix Inc., Solvay S.A., Butachimie (Joint Venture of BASF and Invista), Shenma Industrial Co., Ltd., Asahi Kasei Corporation, Radici Group, Toray Industries, Inc., LyondellBasell Industries, Lanxess AG, Eastman Chemical Company, and Sinopec Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the adiponitrile market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production processes are expected to enhance efficiency and reduce environmental impact, aligning with global sustainability goals. Additionally, the increasing focus on circular economy principles will likely encourage the development of recycling methods for nylon products, further boosting the demand for adiponitrile as a key raw material in various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Specialty Grade Others |

| By End-User Industry | Automotive and Transportation Chemicals Textiles Electrical and Electronics Others |

| By Application | Nylon 6,6 Production Engineering Plastics Chemical Intermediates Coatings and Adhesives Others |

| By Production Process | Hydrocyanation Electrochemical Hydrodimerization Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (Saudi Arabia, South Africa, Rest of Middle East & Africa) |

| By Policy Support | Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Managers, Supply Chain Analysts |

| Textile Manufacturing Processes | 60 | Production Managers, Quality Control Officers |

| Electronics Component Production | 50 | R&D Engineers, Procurement Specialists |

| Specialty Chemical Applications | 70 | Technical Directors, Market Development Managers |

| Regulatory Compliance in Chemical Production | 40 | Compliance Officers, Environmental Managers |

The Global Adiponitrile Market is valued at approximately USD 10.0 billion, driven by the increasing demand for nylon 6,6 in various applications such as automotive, textiles, and engineering plastics.