Region:Global

Author(s):Rebecca

Product Code:KRAD0287

Pages:100

Published On:August 2025

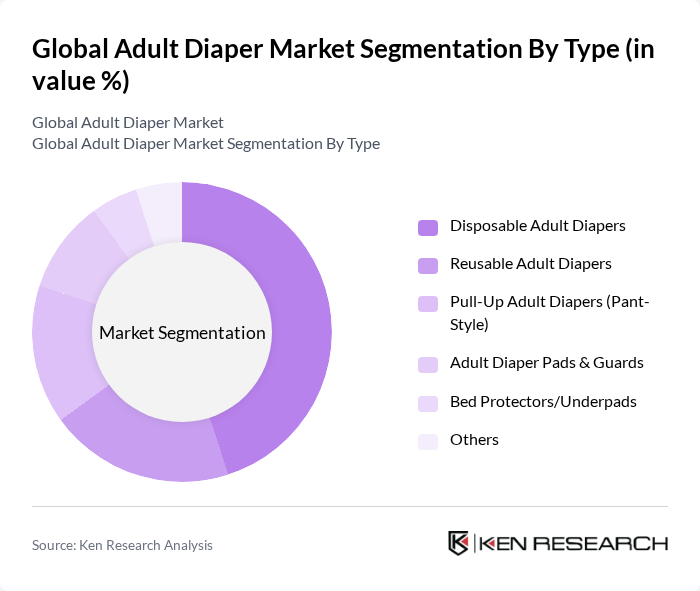

By Type:The adult diaper market is segmented into various types, including disposable adult diapers, reusable adult diapers, pull-up adult diapers (pant-style), adult diaper pads & guards, bed protectors/underpads, and others. Among these, disposable adult diapers dominate the market due to their convenience, high absorbency, and ease of use, making them the preferred choice for consumers. The trend towards disposable products is further driven by increasing demand for hygiene and comfort, particularly among elderly individuals and caregivers. Innovations such as ultra-absorbent core technology, odor-lock systems, and biodegradable materials are expanding the appeal of disposable products .

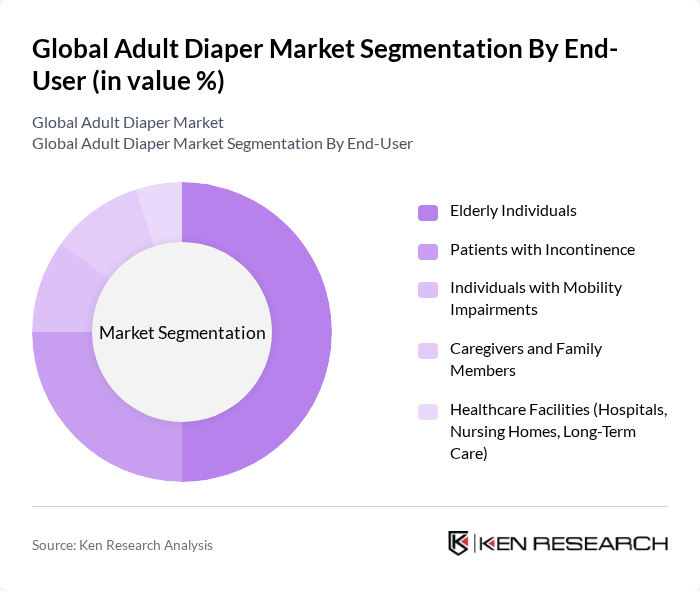

By End-User:The end-user segmentation includes elderly individuals, patients with incontinence, individuals with mobility impairments, caregivers and family members, and healthcare facilities such as hospitals and nursing homes. The elderly population is the largest segment, as they often require assistance with incontinence management. This demographic shift towards an aging population is driving the demand for adult diapers, as families and caregivers seek reliable solutions to enhance the quality of life for their loved ones. The increasing prevalence of chronic conditions and the expansion of long-term care facilities further support market growth in this segment .

The Global Adult Diaper Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Kimberly-Clark Corporation, Unicharm Corporation, Essity AB, Attends Healthcare Products, Inc., Medline Industries, LP, Paul Hartmann AG, Ontex Group NV, First Quality Enterprises, Inc., Domtar Corporation, Cuddlz Ltd., Abena A/S, Dry Direct, LLC, Dignity Medical Supplies, LLC, TENA (Essity AB) contribute to innovation, geographic expansion, and service delivery in this space. These companies are investing in product innovation, sustainability initiatives, and expanding their manufacturing and distribution networks to strengthen their market positions .

The future of the adult diaper market appears promising, driven by demographic shifts and evolving consumer preferences. As the aging population continues to grow, the demand for innovative and comfortable products will likely increase. Additionally, the rise of e-commerce platforms is expected to enhance accessibility, allowing consumers to purchase products discreetly. Companies that focus on sustainability and eco-friendly options will also find new opportunities, aligning with global trends toward environmental responsibility and health consciousness.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Adult Diapers Reusable Adult Diapers Pull-Up Adult Diapers (Pant-Style) Adult Diaper Pads & Guards Bed Protectors/Underpads Others |

| By End-User | Elderly Individuals Patients with Incontinence Individuals with Mobility Impairments Caregivers and Family Members Healthcare Facilities (Hospitals, Nursing Homes, Long-Term Care) |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Pharmacies/Drug Stores Specialty Stores Convenience Stores Others |

| By Price Range | Budget Mid-Range Premium |

| By Material Type | Cotton Synthetic Materials (SAP, Non-woven, etc.) Biodegradable Materials |

| By Brand Type | National Brands Private Labels Generic Brands |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Geriatricians, Nurses, Occupational Therapists |

| Caregivers and Family Members | 80 | Primary Caregivers, Family Members of Users |

| Manufacturers and Distributors | 60 | Product Managers, Sales Directors |

| Retail Sector Insights | 50 | Store Managers, Category Buyers |

| Market Analysts and Researchers | 40 | Market Research Analysts, Industry Consultants |

The Global Adult Diaper Market is valued at approximately USD 18.2 billion, driven by factors such as an increasing aging population, rising awareness of personal hygiene, and the growing prevalence of incontinence among adults.