Region:Global

Author(s):Dev

Product Code:KRAD0513

Pages:94

Published On:August 2025

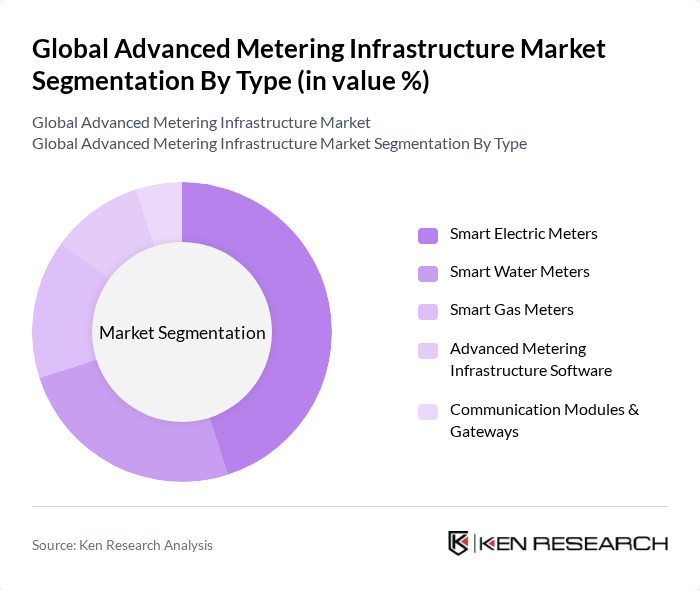

By Type:The market is segmented into various types, including Smart Electric Meters, Smart Water Meters, Smart Gas Meters, Advanced Metering Infrastructure Software, and Communication Modules & Gateways. Among these, Smart Electric Meters are leading the market due to widespread national rollouts and utility regulatory drivers; water and gas smart metering are growing as utilities target non-revenue water reduction, leak detection, and safety improvements.

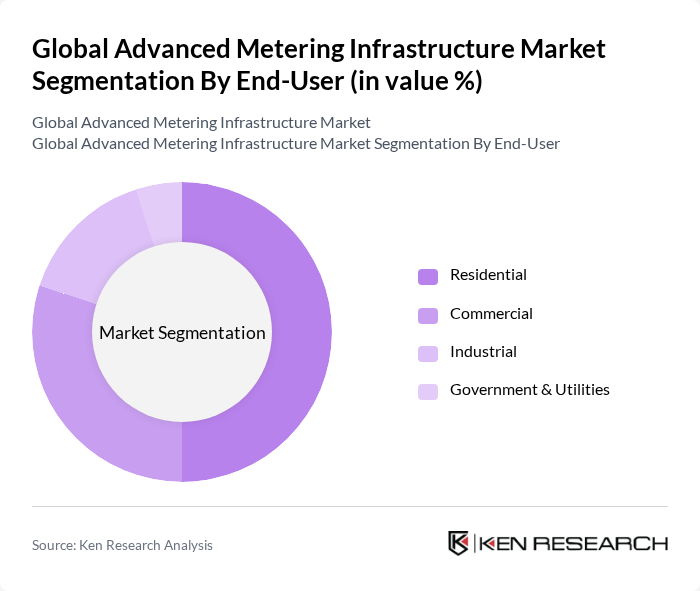

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the largest, reflecting the focus of most large-scale AMI deployments on mass-market households under national and utility programs; commercial and industrial users adopt AMI for interval data, power quality monitoring, and demand optimization; government and utilities segments are supported by smart grid mandates and modernization funding.

The Global Advanced Metering Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Itron, Inc., Landis+Gyr AG, Siemens AG, Schneider Electric SE, Honeywell International Inc., Sensus (Xylem Inc.), Aclara Technologies LLC (a Hubbell company), Elster Group GmbH (Elster, a Honeywell company), Kamstrup A/S, Trilliant Holdings, Inc., Oracle Corporation (Utilities & Opower), Cisco Systems, Inc., ABB Ltd., GE Vernova (Grid Solutions & Digital), Enel Grids (including e-distribuzione, Italy), Sagemcom Energy & Telecom, Hexing Electrical Co., Ltd., Ningbo Sanxing Electric Co., Ltd. (Sansion), Wasion Holdings Limited, Holley Technology Ltd., EDMI Limited (a TTCL company), Iskraemeco, d.d., ZIV Automation (Arteche Group), S&T Smart Energy (formerly Addnergie/Networked Energy Services), Vodafone Group Plc (IoT/NB-IoT for AMI), Telefonica Tech (IoT & Big Data for AMI), L&T Electrical & Automation (Schneider Electric India), Genus Power Infrastructures Ltd., Secure Meters Limited, CyanConnode Holdings plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AMI market appears promising, driven by ongoing technological advancements and increasing regulatory support. As utilities continue to modernize their infrastructure, the integration of AI and machine learning will enhance operational efficiencies and customer engagement. Additionally, the growing emphasis on sustainability will further accelerate the adoption of renewable energy sources, necessitating advanced metering solutions. This evolving landscape presents significant opportunities for innovation and collaboration among stakeholders in the energy sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Electric Meters Smart Water Meters Smart Gas Meters Advanced Metering Infrastructure Software Communication Modules & Gateways |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Cellular (2G/3G/4G LTE/5G) RF Mesh Power Line Communication (PLC) NB-IoT & LPWAN |

| By Application | Advanced Metering (AMI) & Meter Data Management Billing and Revenue Management Demand Response & Load Management Outage Management & Remote Connect/Disconnect |

| By Investment Source | Private Investments Public Funding Public-Private Partnerships (PPP) & Joint Ventures Multilateral & Development Finance |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Mandates & Standards Data Privacy & Cybersecurity Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Meter Adoption | 150 | Homeowners, Utility Customer Service Representatives |

| Commercial Metering Solutions | 100 | Facility Managers, Energy Efficiency Consultants |

| Industrial Metering Systems | 80 | Plant Managers, Energy Managers |

| Utility Infrastructure Investments | 120 | Utility Executives, Project Managers |

| Smart Grid Technology Providers | 90 | Product Development Managers, Sales Directors |

The Global Advanced Metering Infrastructure Market is valued at approximately USD 19.5 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for smart metering solutions driven by government mandates and digitalization in utilities.