Region:Global

Author(s):Geetanshi

Product Code:KRAA2769

Pages:81

Published On:August 2025

By Type:The advertising services market is segmented into various types, including Digital Advertising, Print Advertising, Broadcast Advertising, Outdoor Advertising, Direct Mail Advertising, Social Media Advertising, Retail Media Advertising, Audio Advertising, Search Advertising, and Others. Digital Advertising has emerged as the dominant segment due to the increasing reliance on online platforms for marketing and consumer engagement. The shift towards digital channels is driven by the growing use of smartphones and social media, enabling advertisers to reach a broader audience with targeted campaigns .

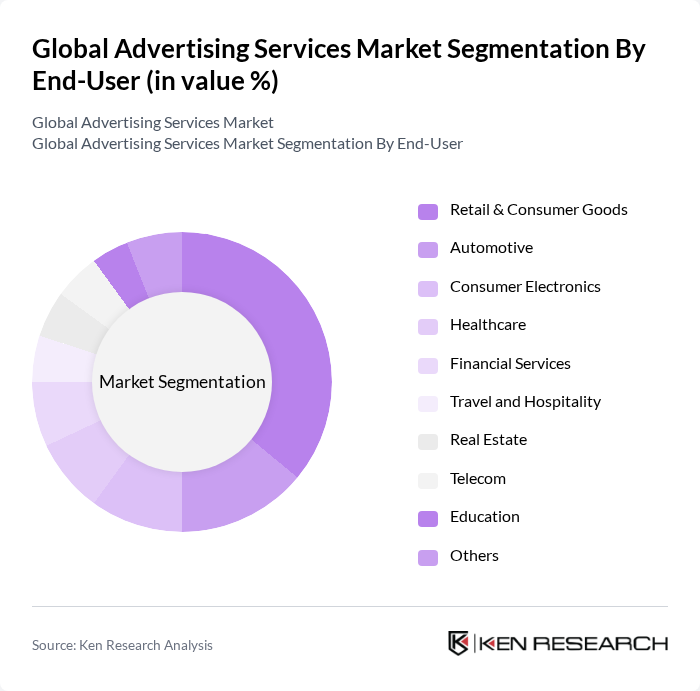

By End-User:The end-user segmentation includes Retail & Consumer Goods, Automotive, Consumer Electronics, Healthcare, Financial Services, Travel and Hospitality, Real Estate, Telecom, Education, and Others. The Retail & Consumer Goods sector is the leading end-user, driven by the need for effective marketing strategies to attract consumers in a highly competitive market. The increasing trend of e-commerce and online shopping has further propelled the demand for advertising services in this sector, as brands seek to enhance their visibility and engagement with potential customers .

The Global Advertising Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as WPP plc, Omnicom Group Inc., Publicis Groupe S.A., Interpublic Group of Companies, Inc., Dentsu Group Inc., Havas Group, Accenture Song, Adobe Inc., Meta Platforms, Inc. (Facebook), Google LLC, Amazon Ads, Snap Inc., X Corp. (formerly Twitter, Inc.), TikTok (ByteDance Ltd.), LinkedIn Corporation (Microsoft) contribute to innovation, geographic expansion, and service delivery in this space.

The advertising services market is poised for transformative changes driven by technological advancements and evolving consumer preferences. As programmatic advertising continues to gain traction, automated buying and selling of ads will streamline processes, enhancing efficiency. Additionally, the focus on sustainability will shape advertising strategies, with brands increasingly prioritizing eco-friendly practices. The integration of AI technologies will further personalize advertising experiences, ensuring relevance and engagement, thus positioning the market for robust growth in the None region.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Advertising Print Advertising Broadcast Advertising Outdoor Advertising Direct Mail Advertising Social Media Advertising Retail Media Advertising Audio Advertising Search Advertising Others |

| By End-User | Retail & Consumer Goods Automotive Consumer Electronics Healthcare Financial Services Travel and Hospitality Real Estate Telecom Education Others |

| By Channel | Online Advertising Offline Advertising Mobile Advertising Programmatic Advertising Affiliate Marketing Digital Out-of-Home (DOOH) Advertising Streaming TV Advertising Others |

| By Format | Display Ads Video Ads Native Ads Sponsored Content Search Ads Audio Ads Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| By Geographic Focus | Local Advertising National Advertising International Advertising Regional Advertising Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Strategies | 100 | Marketing Directors, Digital Strategists |

| Television Advertising Effectiveness | 80 | Media Buyers, Brand Managers |

| Print Media Trends | 60 | Advertising Managers, Print Media Buyers |

| Social Media Advertising Insights | 90 | Social Media Managers, Content Creators |

| Influencer Marketing Impact | 70 | Brand Strategists, Influencer Marketing Coordinators |

The Global Advertising Services Market is valued at approximately USD 770 billion, reflecting significant growth driven by digital transformation and increased internet penetration, as businesses shift their advertising budgets from traditional to digital platforms.