Region:Global

Author(s):Shubham

Product Code:KRAD0715

Pages:88

Published On:August 2025

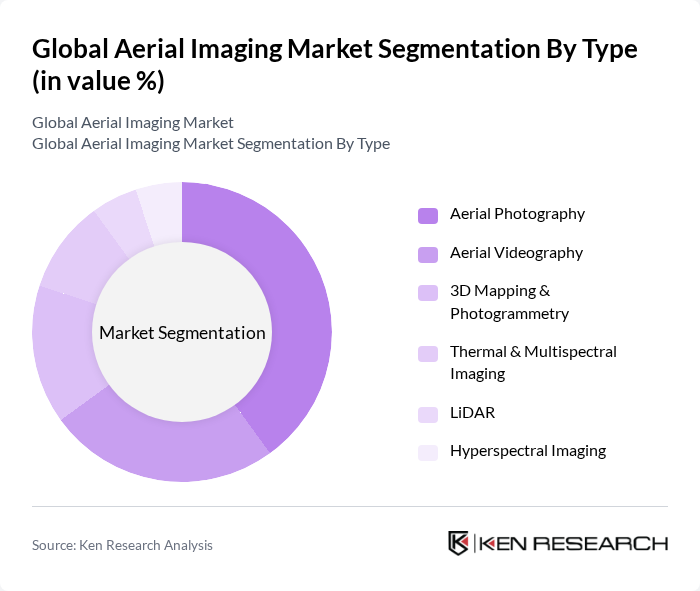

By Type:The aerial imaging market is segmented into various types, including Aerial Photography, Aerial Videography, 3D Mapping & Photogrammetry, Thermal & Multispectral Imaging, LiDAR, and Hyperspectral Imaging. Among these,Aerial Photographyis the most dominant segment, supported by extensive use in real estate listings, infrastructure documentation, and environmental monitoring; the proliferation of consumer and professional drones with high-resolution cameras has accelerated adoption.Aerial Videographyfollows closely, gaining traction in media and entertainment as well as marketing and inspections where high-quality stabilized video is essential; improving gimbals and onboard processing have supported growth.3D Mapping & Photogrammetrycontinues to expand with surveying, construction progress monitoring, and digital twin initiatives, whileThermal & Multispectral Imagingis increasingly used in energy inspections and precision agriculture for vegetation and asset health assessment;LiDARadoption is rising for corridor mapping and detailed elevation models, andHyperspectral Imagingis emerging for specialized applications such as mineral exploration and advanced environmental analysis.

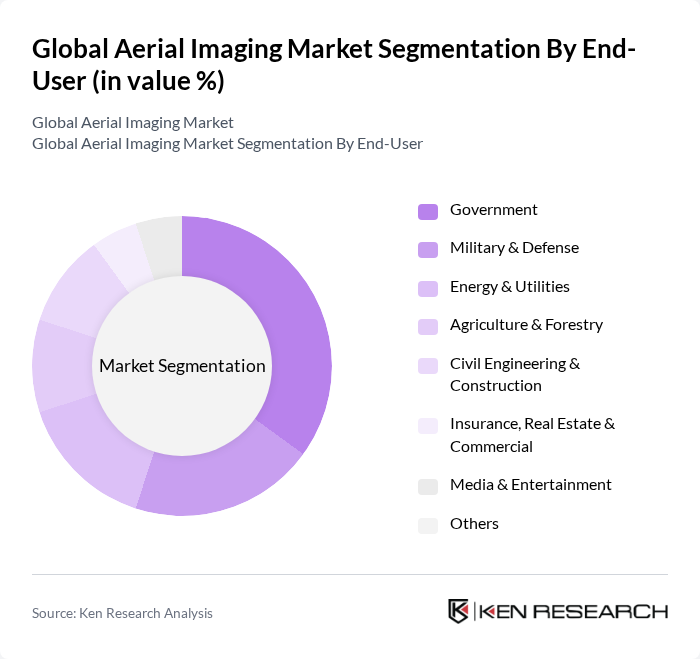

By End-User:The end-user segmentation of the aerial imaging market includes Government, Military & Defense, Energy & Utilities, Agriculture & Forestry, Civil Engineering & Construction, Insurance, Real Estate & Commercial, Media & Entertainment, and Others. TheGovernmentsector is a leading end-user, leveraging aerial imaging for geospatial mapping, disaster response, permitting, and urban planning; public agencies increasingly use aerial data to support land use, infrastructure, and environmental assessments.Military & Defenseremains significant for reconnaissance, situational awareness, and training.Agriculture & Forestryis growing with precision agriculture and vegetation health monitoring using multispectral and thermal sensors;Energy & Utilitiesrely on aerial imaging for transmission line, pipeline, and solar/wind asset inspections that reduce costs and improve safety;Civil Engineering & Constructionuse cases include surveying, progress tracking, and 3D modeling for digital twins and BIM workflows.

The Global Aerial Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., senseFly SA (AgEagle Aerial Systems Inc.), Nearmap Ltd, Delair SAS, EagleView Technologies, Inc., Pix4D SA, Trimble Inc., Parrot Drones SAS, Skydio, Inc., Quantum-Systems GmbH, Vexcel Imaging GmbH, Aerodata International Surveys, DroneDeploy, Inc., Hexagon AB (Leica Geosystems), Teledyne FLIR LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aerial imaging market appears promising, driven by technological advancements and increasing integration with AI. As industries seek real-time data for decision-making, the demand for aerial imaging solutions is expected to rise. Additionally, the collaboration between tech companies and government agencies will likely enhance regulatory frameworks, fostering innovation. The market is poised for growth as businesses recognize the value of aerial imaging in improving operational efficiency and data accuracy across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Aerial Photography Aerial Videography D Mapping & Photogrammetry Thermal & Multispectral Imaging LiDAR Hyperspectral Imaging |

| By End-User | Government Military & Defense Energy & Utilities Agriculture & Forestry Civil Engineering & Construction Insurance, Real Estate & Commercial Media & Entertainment Others |

| By Application | Geospatial Mapping Disaster Management & Emergency Response Surveillance & Monitoring Energy and Resource Management Urban Planning & Land Use Infrastructure Inspection Others |

| By Distribution Channel | Direct Enterprise Sales Online Platforms & Marketplaces Value-Added Resellers (VARs) & System Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based (SaaS) Project-Based / Pay-Per-Use License + Maintenance Others |

| By Data Type | Raw Imagery (RGB, Thermal, Multispectral) Processed Orthomosaics & Point Clouds Analytical Reports & Dashboards D Models & Digital Twins |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerial Imaging in Agriculture | 120 | Agronomists, Farm Managers |

| Construction Site Monitoring | 100 | Project Managers, Site Supervisors |

| Environmental Impact Assessments | 80 | Environmental Scientists, Policy Makers |

| Real Estate and Property Management | 60 | Real Estate Agents, Property Developers |

| Infrastructure Inspection Services | 90 | Infrastructure Engineers, Safety Inspectors |

The Global Aerial Imaging Market is valued at approximately USD 3.4 billion, driven by advancements in drone technology, high-resolution sensors, and improved data processing capabilities that enhance the quality and accessibility of aerial imagery.