Region:Global

Author(s):Rebecca

Product Code:KRAD7530

Pages:100

Published On:December 2025

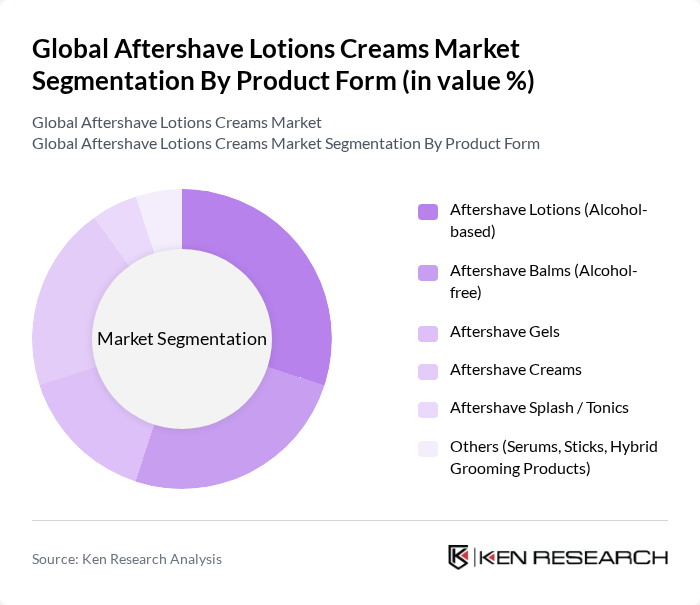

By Product Form:The product form segmentation includes various types of aftershave products that cater to different consumer preferences and needs. The subsegments are Aftershave Lotions (Alcohol-based), Aftershave Balms (Alcohol-free), Aftershave Gels, Aftershave Creams, Aftershave Splash / Tonics, and Others (Serums, Sticks, Hybrid Grooming Products). Each of these forms has unique characteristics that appeal to different demographics and skin types, and mirrors the wider diversification seen in the global fragrance and men’s grooming markets toward both functional and sensorial benefits.

The Aftershave Lotions (Alcohol-based) segment is currently dominating the market due to its traditional appeal and effectiveness in providing a refreshing post-shave experience, particularly in markets with a long-standing culture of classic splash aftershaves. Consumers often prefer these products for their quick absorption and cooling effects. However, the Aftershave Balms (Alcohol-free) segment is gaining traction, particularly among those with sensitive or dry skin, as they offer soothing, moisturizing properties with reduced stinging and are aligned with the broader shift toward gentler, skin-care-forward men’s grooming products. The trend towards natural, vegan, and clean-label ingredients, along with reduced alcohol content and the inclusion of multifunctional actives, is influencing consumer choices and driving a gradual shift in preferences from purely fragrance-led products to hybrid grooming and skincare formats.

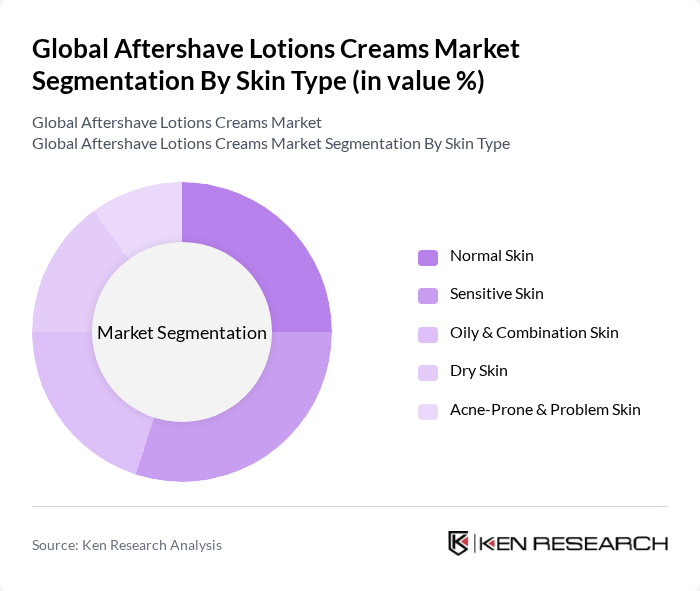

By Skin Type:The skin type segmentation includes Normal Skin, Sensitive Skin, Oily & Combination Skin, Dry Skin, and Acne-Prone & Problem Skin. Each subsegment addresses specific skin concerns and preferences, allowing consumers to choose products that best suit their skin type and needs, with many brands positioning aftershaves as targeted post-shave treatments that address hydration, barrier repair, oil control, and blemish management.

The Sensitive Skin segment is leading the market, driven by an increasing number of consumers seeking products that minimize irritation, razor burn, and ingrown hairs while providing gentle care, echoing wider beauty and personal care trends where sensitive-skin and hypoallergenic claims have become key purchase drivers. This trend is particularly prominent among younger consumers and those with specific skin conditions, who are more inclined to research ingredients and prefer alcohol-free, fragrance-moderated, or dermatologist-tested aftershaves. The Normal Skin segment also holds a significant share, as it encompasses a broad range of consumers who prefer versatile products suitable for daily use. The growing awareness of skincare, adoption of multi-step grooming routines, and the influence of online education and social media on skin health are influencing purchasing decisions across all skin types, including specialized offerings for oily, combination, dry, and acne-prone skin.

The Global Aftershave Lotions Creams Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Gillette), Unilever (Axe, Dove Men+Care), L'Oréal (L'Oréal Men Expert), Beiersdorf AG (NIVEA MEN), Colgate-Palmolive (Palmolive Men), Edgewell Personal Care (Schick, Wilkinson Sword), Coty Inc. (Brut, Adidas Fragrances), Shiseido Company, Limited, The Estée Lauder Companies Inc., Henkel AG & Co. KGaA (Fa, Schwarzkopf), Reckitt Benckiser Group PLC (Veet Men, Grooming Accessories), Johnson & Johnson (Neutrogena Men), LVMH Moët Hennessy Louis Vuitton (Dior, Givenchy Fragrances & Grooming), Natura &Co (The Body Shop, Natura Homem), Philips Norelco (Shaving Devices & Aftershave Partnerships) contribute to innovation, geographic expansion, and service delivery in this space, leveraging their broader fragrance and men’s grooming portfolios to support cross-branding, premiumization, and omnichannel distribution strategies.

The future of the aftershave lotions market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability is likely to shape product development, with brands investing in eco-friendly formulations and packaging. Additionally, the rise of personalized grooming solutions, enabled by data analytics and consumer feedback, will enhance customer engagement and loyalty. As the market adapts to these trends, it is poised for continued growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Form | Aftershave Lotions (Alcohol-based) Aftershave Balms (Alcohol-free) Aftershave Gels Aftershave Creams Aftershave Splash / Tonics Others (Serums, Sticks, Hybrid Grooming Products) |

| By Skin Type | Normal Skin Sensitive Skin Oily & Combination Skin Dry Skin Acne-Prone & Problem Skin |

| By Ingredient Type | Natural & Organic Ingredients Conventional / Synthetic Ingredients Hybrid & Dermatologist-tested Formulations |

| By Fragrance Type | Scented Aftershaves Fragrance-free / Hypoallergenic Aftershaves Mildly Scented (Low Allergen) Aftershaves |

| By Price Range | Mass / Budget Aftershaves Mid-range Aftershaves Premium Aftershaves Luxury & Niche Aftershaves |

| By Distribution Channel | Supermarkets & Hypermarkets Drugstores & Pharmacies Specialty Beauty & Grooming Stores Barbershops & Salons Online Retailers & Marketplaces Direct-to-Consumer (Brand E-commerce & Subscriptions) Others |

| By End-User Profile | Everyday Shavers Occasional / Event-based Shavers Professional Grooming (Barbers & Salons) Premium & Niche Grooming Enthusiasts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Men's Aftershave Lotions | 150 | Male Consumers, Grooming Product Buyers |

| Women's Aftershave Creams | 120 | Female Consumers, Beauty Product Enthusiasts |

| Retail Distribution Channels | 80 | Retail Managers, Category Buyers |

| Online Sales Trends | 70 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences and Trends | 90 | Market Researchers, Trend Analysts |

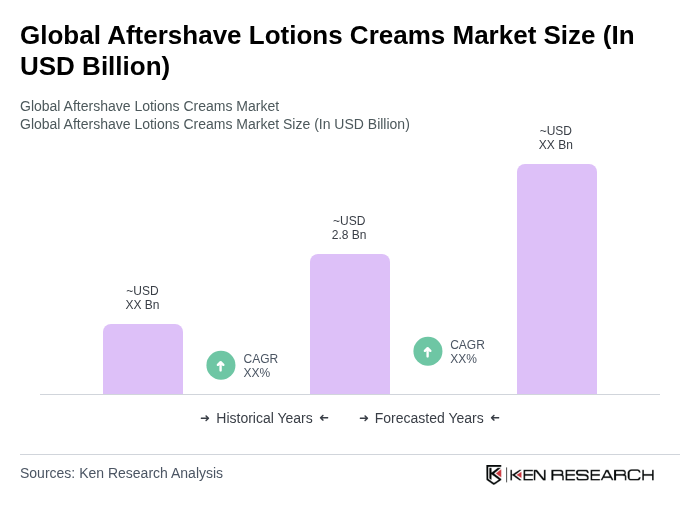

The Global Aftershave Lotions Creams Market is valued at approximately USD 2.8 billion, reflecting a significant growth trend driven by increasing grooming standards among men and rising disposable incomes.