Region:Global

Author(s):Dev

Product Code:KRAC0355

Pages:82

Published On:August 2025

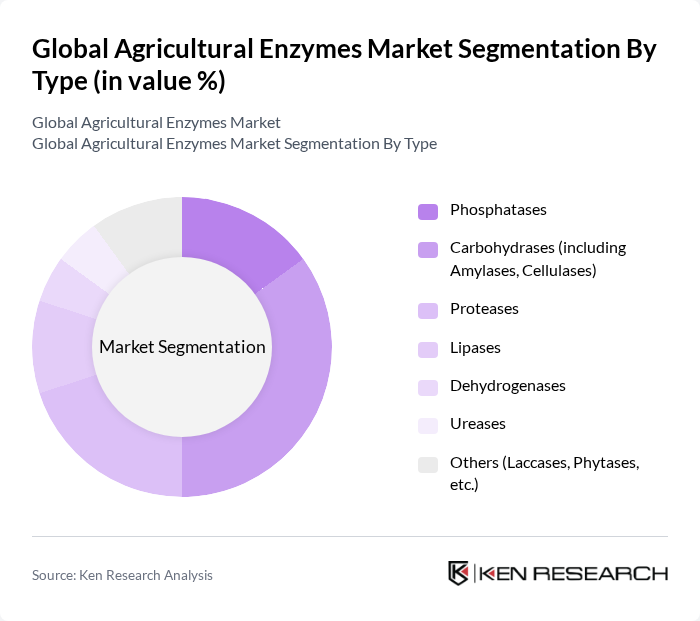

By Type:The market is segmented into various types of enzymes, including Phosphatases, Carbohydrases (including Amylases, Cellulases), Proteases, Lipases, Dehydrogenases, Ureases, and Others (Laccases, Phytases, etc.). Among these,Carbohydrasesare the most dominant due to their extensive application in improving crop yields, enhancing soil health, and increasing feed digestibility for livestock.

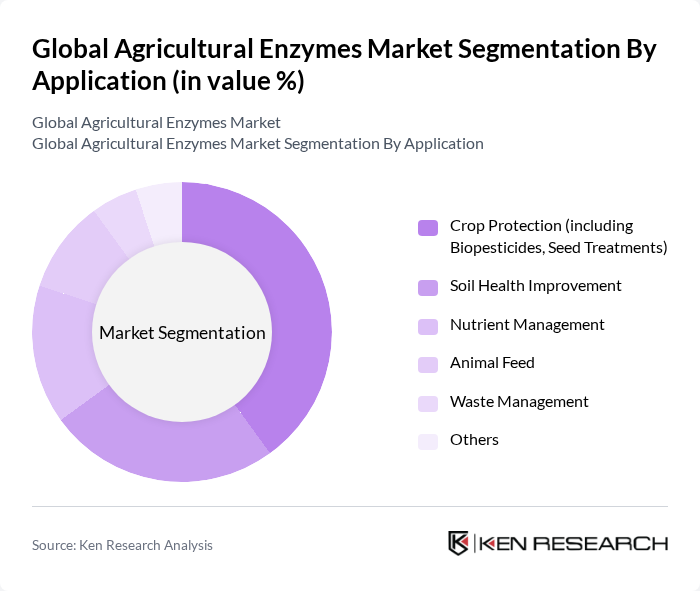

By Application:The applications of agricultural enzymes include Crop Protection (including Biopesticides, Seed Treatments), Soil Health Improvement, Nutrient Management, Animal Feed, Waste Management, and Others.Crop Protectionis the leading application segment, driven by the increasing need for sustainable pest management solutions and the rising adoption of enzyme-based biopesticides and seed treatments. The animal feed segment is also growing rapidly due to the focus on feed efficiency and livestock productivity.

The Global Agricultural Enzymes Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Novozymes A/S, DuPont de Nemours, Inc., Syngenta AG, Bayer AG, Corteva Agriscience, DSM-Firmenich AG, AB Enzymes GmbH, BioWorks, Inc., Aumgene Biosciences Pvt. Ltd., Greenlight Biosciences, Inc., Enzyme Development Corporation, Kemin Industries, Inc., Advanced Enzyme Technologies Ltd., Novozymes South Asia Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the agricultural enzymes market appears promising, driven by increasing investments in sustainable agriculture and technological advancements. As farmers seek to enhance productivity while minimizing environmental impact, the adoption of enzyme solutions is likely to accelerate. Additionally, the integration of digital technologies in agriculture will facilitate better monitoring and application of enzymes, optimizing their effectiveness. This trend is expected to create a dynamic landscape for innovation and growth in the agricultural enzymes sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Phosphatases Carbohydrases (including Amylases, Cellulases) Proteases Lipases Dehydrogenases Ureases Others (Laccases, Phytases, etc.) |

| By Application | Crop Protection (including Biopesticides, Seed Treatments) Soil Health Improvement Nutrient Management Animal Feed Waste Management Others |

| By Crop Type | Cereals & Grains Oilseeds & Pulses Fruits & Vegetables Turf & Ornamentals Others (Legumes, Forage Crops) |

| By End-User | Farmers Agricultural Cooperatives Research Institutions Agrochemical Companies Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Agricultural Supply Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Product Form | Liquid Enzymes Powder Enzymes Granular Enzymes Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Enzyme Usage | 120 | Farmers, Agronomists, Crop Consultants |

| Fruit and Vegetable Enzyme Applications | 90 | Horticulturists, Agricultural Technicians |

| Soil Health and Enzyme Impact | 60 | Soil Scientists, Environmental Consultants |

| Livestock Feed Enzyme Integration | 50 | Livestock Farmers, Feed Manufacturers |

| Biopesticide and Enzyme Synergies | 40 | Biotechnology Researchers, Product Developers |

The Global Agricultural Enzymes Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by the demand for sustainable agricultural practices and advancements in enzyme technology.