Region:Global

Author(s):Shubham

Product Code:KRAC2223

Pages:81

Published On:October 2025

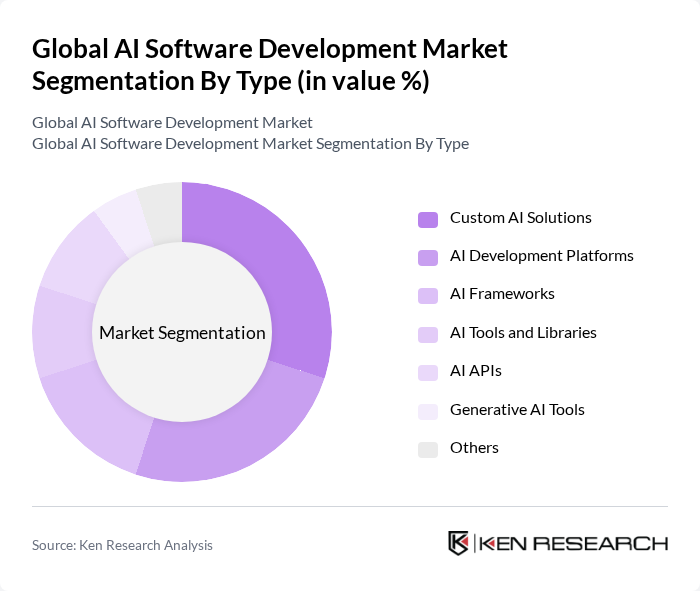

By Type:The market is segmented into Custom AI Solutions, AI Development Platforms, AI Frameworks, AI Tools and Libraries, AI APIs, Generative AI Tools, and Others. Each subsegment plays a crucial role in market dynamics, supporting diverse business needs and technological advancements. Custom AI Solutions are particularly important for organizations requiring tailored applications, while AI Development Platforms and Frameworks enable scalable and efficient deployment of AI models. Generative AI Tools are gaining traction for content creation and automation, reflecting the latest advancements in deep learning and natural language processing .

The Custom AI Solutions subsegment is currently dominating the market, driven by the demand for tailored AI applications that address specific business requirements. Organizations are investing in custom solutions to enhance operational efficiency and gain a competitive edge. The flexibility of custom AI solutions allows businesses to address unique challenges, making them a preferred choice among enterprises. This trend is further supported by rapid advancements in machine learning, generative AI, and data analytics, enabling the creation of sophisticated, bespoke applications .

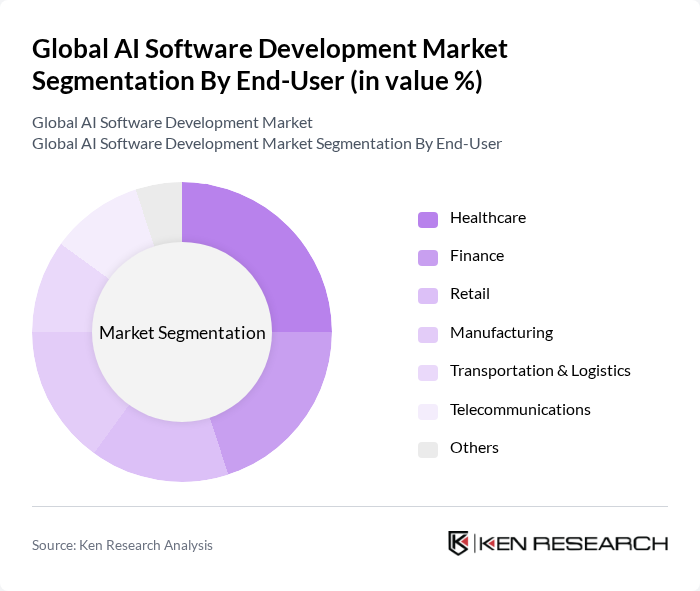

By End-User:The market is segmented by end-user industries, including Healthcare, Finance, Retail, Manufacturing, Transportation & Logistics, Telecommunications, and Others. Each sector has unique requirements and applications for AI software, driving the demand for specialized solutions. Healthcare leads due to the adoption of AI for diagnostics, patient care, and operational efficiency. Finance leverages AI for fraud detection, risk management, and algorithmic trading, while Retail and Manufacturing utilize AI for supply chain optimization and personalized customer experiences. Transportation & Logistics and Telecommunications are increasingly adopting AI for predictive maintenance, network optimization, and customer service automation .

The Healthcare sector is leading the market, propelled by the increasing adoption of AI for diagnostics, predictive analytics, and personalized medicine. AI applications in healthcare are transforming patient outcomes, streamlining administrative processes, and supporting data-driven decision-making. The finance sector is also a major adopter, utilizing AI for fraud detection, compliance, and customer insights. Retail, manufacturing, and logistics continue to expand AI use for automation, efficiency, and customer engagement .

The Global AI Software Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, IBM Corporation, Google LLC (Alphabet Inc.), Amazon Web Services, Inc., Salesforce, Inc., Oracle Corporation, SAP SE, NVIDIA Corporation, Intel Corporation, Accenture PLC, Infosys Limited, Wipro Limited, Cognizant Technology Solutions, Capgemini SE, Tata Consultancy Services (TCS), OpenAI, Inc., DataRobot, Inc., InData Labs, Neoteric, DataToBiz contribute to innovation, geographic expansion, and service delivery in this space .

The future of the AI software development market appears promising, driven by continuous technological advancements and increasing integration across various sectors. As organizations prioritize digital transformation, the demand for AI solutions is expected to rise significantly. Furthermore, the focus on ethical AI practices and regulatory compliance will shape the development landscape, encouraging innovation while addressing societal concerns. Companies that adapt to these trends will likely gain a competitive edge in the evolving market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Custom AI Solutions AI Development Platforms AI Frameworks AI Tools and Libraries AI APIs Generative AI Tools Others |

| By End-User | Healthcare Finance Retail Manufacturing Transportation & Logistics Telecommunications Others |

| By Application | Natural Language Processing (NLP) Computer Vision Predictive Analytics Robotics Process Automation (RPA) Code Generation & Auto-completion Automated Testing Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Automotive Telecommunications Education Energy Government & Public Sector Others |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Software Solutions | 100 | Healthcare IT Managers, Clinical Data Analysts |

| Financial Services AI Applications | 75 | Risk Management Officers, Financial Analysts |

| Retail AI Customer Experience Tools | 90 | Marketing Directors, Customer Experience Managers |

| Manufacturing AI Process Automation | 60 | Operations Managers, Production Engineers |

| AI in Cybersecurity Solutions | 50 | Cybersecurity Analysts, IT Security Managers |

The Global AI Software Development Market is valued at approximately USD 675 million, reflecting significant growth driven by the increasing adoption of AI technologies across various sectors, including healthcare, finance, and retail.