Region:Global

Author(s):Rebecca

Product Code:KRAD7418

Pages:99

Published On:December 2025

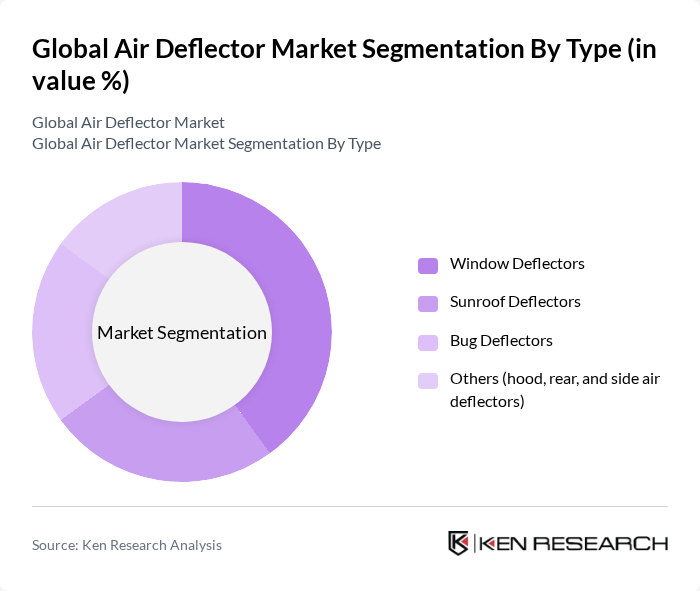

By Type:The air deflector market is segmented into various types, including window deflectors, sunroof deflectors, bug deflectors, and others such as hood, rear, and side air deflectors. This aligns with industry categorizations that highlight window/side deflectors, hood/bonnet deflectors, and roof deflectors as key product groups. Among these, window deflectors are the most popular due to their ability to enhance ventilation while minimizing wind noise and rain intrusion, and they are consistently reported as the leading type segment by share. Sunroof deflectors are also gaining traction as they provide an added layer of comfort for passengers by reducing buffeting and noise when the roof is open. Bug deflectors are favored for their protective features against debris and insects, particularly in pickup trucks and SUVs in North America, while the 'others' category includes specialized hood, rear, and side air deflectors tailored for specific models, commercial fleets, and performance applications.

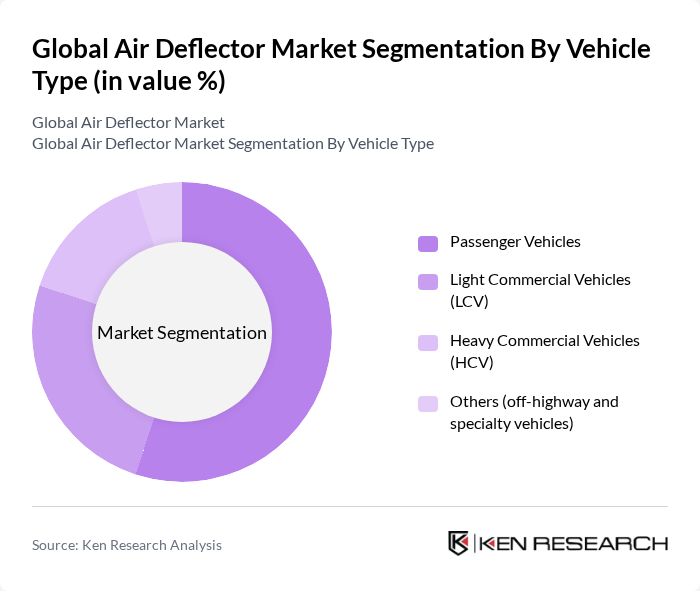

By Vehicle Type:The market is further segmented by vehicle type, including passenger vehicles, light commercial vehicles (LCV), heavy commercial vehicles (HCV), and others such as off-highway and specialty vehicles. Major syndicated studies similarly segment the market by passenger cars, light commercial vehicles, and heavy commercial vehicles, with passenger vehicles consistently accounting for the largest share due to their high global parc and consumer preference for comfort and customization. The LCV segment is also significant, driven by the growing demand for last?mile delivery and logistics services and the use of roof fairings and side deflectors to improve fuel efficiency in vans and small trucks. HCVs are increasingly adopting air deflectors, such as cab roof and side fairings, to reduce drag and achieve lower fuel consumption and CO? emissions in long?haul operations, while the 'others' category caters to off?highway, recreational, and specialty vehicles that require tailored aerodynamic solutions and protective deflectors.

The Global Air Deflector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lund International, Heko Sp. z o.o., ClimAir Plava Kunststoffe GmbH, DGA Srl, ELLEDI Srl, P.I. e C.F. Srl, Hatcher Components Ltd, Piedmont Plastics, LLC, Spoiler Factory, Farad Group, Team HEKO USA, Inc., WeatherTech (MacNeil IP LLC), Rugged Ridge / Omix-ADA, Inc., AVS – Auto Ventshade (a Lund International brand), EGR Group contribute to innovation, geographic expansion, and service delivery in this space, alongside larger automotive component suppliers and material specialists that support aerodynamic solutions for OEMs and the aftermarket.

The future of the air deflector market appears promising, driven by technological advancements and increasing environmental awareness. As smart technologies become more integrated into building systems, the demand for innovative air deflector solutions is expected to rise. Additionally, the focus on sustainability will likely lead to more stringent regulations, pushing manufacturers to develop compliant, energy-efficient products. This evolving landscape presents opportunities for growth, particularly in emerging markets where energy efficiency is becoming a priority.

| Segment | Sub-Segments |

|---|---|

| By Type | Window Deflectors Sunroof Deflectors Bug Deflectors Others (hood, rear, and side air deflectors) |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Others (off-highway and specialty vehicles) |

| By Mounting Method | Tape-on Deflectors In-channel Deflectors Bolt-on / Clamp-on Deflectors Others |

| By Material | Acrylic / Polycarbonate ABS Plastic Metal Composite & Other Advanced Materials |

| By Sales Channel | OEM Aftermarket – Offline Aftermarket – Online Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By End-Use Industry | Automotive OEMs Automotive Aftermarket Specialty & Customization Workshops Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 45 | Product Development Managers, Design Engineers |

| Commercial Vehicle Sector | 40 | Fleet Managers, Procurement Specialists |

| Aftermarket Suppliers | 35 | Sales Directors, Marketing Managers |

| Regulatory Bodies | 30 | Policy Analysts, Environmental Compliance Officers |

| Automotive Research Institutions | 40 | Research Scientists, Aerodynamics Experts |

The Global Air Deflector Market is valued at approximately USD 12 billion, driven by increasing demand for vehicle customization, enhanced aerodynamics, and improved fuel efficiency. This growth reflects a five-year historical analysis of market trends and consumer preferences.