Region:Global

Author(s):Shubham

Product Code:KRAD0821

Pages:93

Published On:August 2025

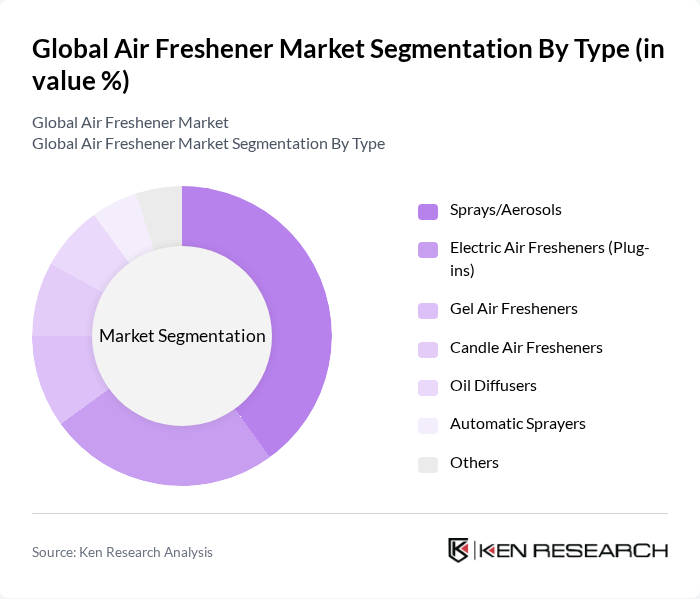

By Type:The air freshener market is segmented into various types, including sprays/aerosols, electric air fresheners (plug-ins), gel air fresheners, candle air fresheners, oil diffusers, automatic sprayers, and others. Among these, sprays/aerosols dominate the market due to their convenience and immediate effect, appealing to consumers looking for quick solutions to unpleasant odors. Electric air fresheners are also gaining traction, particularly in residential and commercial spaces, as they offer continuous fragrance release and are often perceived as more effective. Recent product launches feature natural and essential oil-based formulations, rechargeable plug-ins, and smart sensors for automated dispensing.

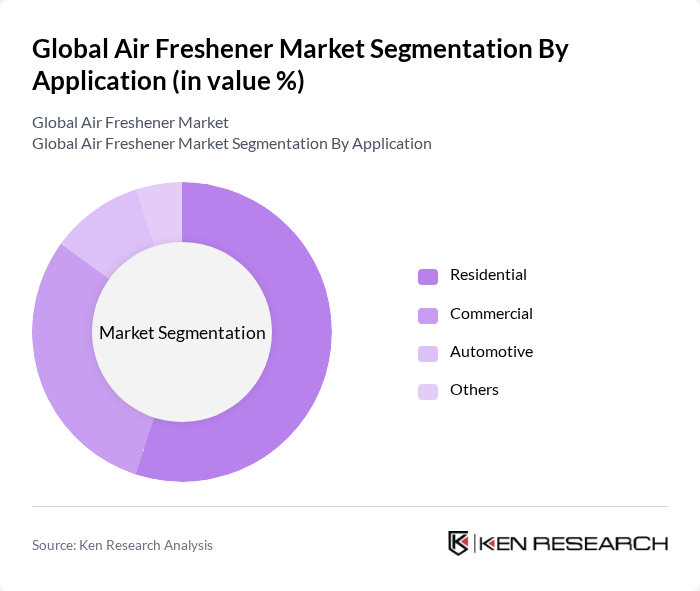

By Application:The air freshener market is segmented by application into residential, commercial, automotive, and others. The residential segment holds the largest share, driven by increasing consumer spending on home care products and a growing focus on creating pleasant living environments. The commercial segment is also significant, as businesses seek to enhance customer experiences and maintain a fresh atmosphere in their establishments. Automotive air fresheners are gaining popularity due to heightened awareness of vehicle interior air quality and personalization trends.

The Global Air Freshener Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., SC Johnson & Son, Inc., Reckitt Benckiser Group plc, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Air Wick (Reckitt Benckiser), Glade (SC Johnson), Yankee Candle Company, Poo~Pourri, LLC, Caldrea, Inc., Febreze (Procter & Gamble), Mrs. Meyer's Clean Day (S.C. Johnson), The Honest Company, Inc., ScentAir Technologies, LLC, Godrej Consumer Products Limited contribute to innovation, geographic expansion, and service delivery in this space.

The air freshener market is poised for transformation as consumer preferences shift towards sustainability and health-conscious products. Innovations in fragrance technology and the integration of smart home systems are expected to redefine product offerings. Additionally, the increasing focus on indoor air quality will drive demand for natural and organic air fresheners. Companies that adapt to these trends and invest in eco-friendly solutions will likely capture a larger market share, ensuring long-term growth and relevance in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Sprays/Aerosols Electric Air Fresheners (Plug-ins) Gel Air Fresheners Candle Air Fresheners Oil Diffusers Automatic Sprayers Others |

| By Application | Residential Commercial Automotive Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Others |

| By Fragrance Type | Floral Citrus Fresh Spicy Others |

| By Packaging Type | Bottles Cans Jars Sachets Others |

| By Price Range | Economy Mid-range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Air Freshener Usage | 120 | Homeowners, Renters |

| Commercial Air Freshener Applications | 60 | Facility Managers, Office Managers |

| Retail Distribution Insights | 50 | Retail Buyers, Category Managers |

| Consumer Preferences and Trends | 100 | General Consumers, Brand Loyalists |

| Environmental Impact Awareness | 40 | Sustainability Advocates, Eco-conscious Consumers |

The Global Air Freshener Market is valued at approximately USD 13.5 billion, reflecting a significant growth trend driven by consumer awareness of hygiene and the demand for pleasant indoor environments.