Region:Global

Author(s):Geetanshi

Product Code:KRAD0108

Pages:92

Published On:August 2025

By Type:The air separation unit market can be segmented into Cryogenic Air Separation Units, Non-Cryogenic Air Separation Units, Pressure Swing Adsorption (PSA) Units, Membrane Air Separation Units, and Others. Cryogenic Air Separation Units are the most widely used due to their efficiency in producing high-purity gases, especially for large-scale industrial applications. Non-Cryogenic Air Separation Units, including PSA and membrane technologies, are gaining traction for applications where lower purity is acceptable, compact design is required, or operational costs need to be minimized. PSA units are favored for their modularity and cost-effectiveness in smaller-scale operations, while membrane units are increasingly adopted for their simplicity, low maintenance, and suitability for on-site nitrogen generation .

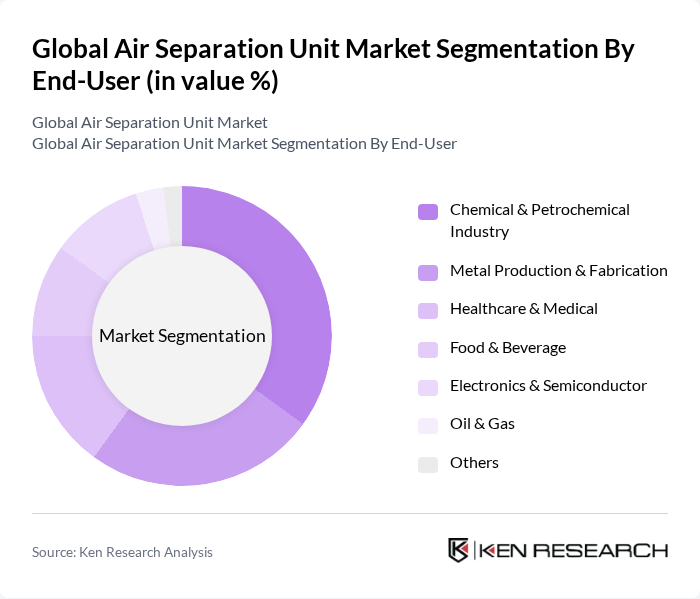

By End-User:The air separation unit market serves a diverse range of end-user industries, including the Chemical & Petrochemical Industry, Metal Production & Fabrication, Healthcare & Medical, Food & Beverage, Electronics & Semiconductor, Oil & Gas, and Others. The Chemical & Petrochemical Industry is the largest consumer, driven by the need for high-purity gases in chemical synthesis and processing. The healthcare sector is a significant user, particularly for oxygen supply in medical facilities. The food and beverage industry utilizes air separation units for modified atmosphere packaging and preservation, while the electronics and semiconductor sector requires high-purity gases for manufacturing processes. The oil and gas sector also relies on air separation units for enhanced oil recovery and refining applications .

The Global Air Separation Unit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Universal Industrial Gases, Inc., INOX Air Products Ltd., Cryogenmash JSC, Hangzhou Hangyang Co., Ltd., Sichuan Air Separation Plant Group, Air Water Inc., GCE Group, Airgas, Inc. (an Air Liquide company), TGE Gas Engineering GmbH, and Linde Engineering contribute to innovation, geographic expansion, and service delivery in this space.

The future of the air separation unit market appears promising, driven by technological advancements and increasing environmental awareness. As industries prioritize sustainability, the demand for energy-efficient ASUs is expected to rise. Furthermore, the integration of IoT technologies will enhance operational efficiency and monitoring capabilities. Companies are likely to invest in modular ASUs, allowing for flexible scaling and customization, which will cater to specific industry needs while addressing regulatory compliance and sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Cryogenic Air Separation Units Non-Cryogenic Air Separation Units Pressure Swing Adsorption (PSA) Units Membrane Air Separation Units Others |

| By End-User | Chemical & Petrochemical Industry Metal Production & Fabrication Healthcare & Medical Food & Beverage Electronics & Semiconductor Oil & Gas Others |

| By Application | Oxygen Production Nitrogen Production Argon Production Rare Gases (Neon, Krypton, Xenon) Others |

| By Component | Compressors Heat Exchangers Distillation Columns Expansion Turbines Control Systems Others |

| By Sales Channel | Direct Sales Distributors EPC Contractors Online Sales Others |

| By Distribution Mode | On-Site (Captive) Supply Bulk Supply Cylinder Supply Pipeline Supply Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Air Separation Units | 100 | Biomedical Engineers, Hospital Procurement Managers |

| Metallurgical Applications | 80 | Process Engineers, Plant Managers |

| Energy Sector Utilization | 70 | Energy Analysts, Operations Managers |

| Electronics Manufacturing | 50 | Production Managers, Quality Control Specialists |

| Research and Development Facilities | 60 | R&D Managers, Technical Directors |

The Global Air Separation Unit Market is valued at approximately USD 4.5 billion, driven by the increasing demand for industrial gases across various sectors, including healthcare, food and beverage, and energy.