Global Air Taxi Market Overview

- The Global Air Taxi Market is valued at USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in electric vertical takeoff and landing (eVTOL) technology, rapid urbanization, and the rising demand for efficient urban air mobility solutions. The market is witnessing significant investments from both private and public sectors, aiming to enhance infrastructure and regulatory frameworks to support air taxi operations. Key growth drivers include improvements in battery efficiency, autonomous flight systems, and lightweight materials, which are making eVTOL aircraft increasingly viable for commercial use. Additionally, government commitments to sustainable aviation and the integration of air taxis into public transport systems are accelerating market expansion .

- Key players in this market include the United States, Germany, and China, which dominate due to their robust aerospace industries, significant investments in research and development, and supportive government policies. The presence of major aerospace manufacturers and technology companies in these regions further accelerates the growth of the air taxi market, making them pivotal players in the global landscape. Notably, the United States and China are actively developing policies to enable safe urban air mobility, while Germany is recognized for its strong innovation ecosystem in eVTOL technology .

- In 2023, the European Union implemented the Urban Air Mobility Initiative, which aims to establish a regulatory framework for air taxi operations across member states. This initiative is governed by the "U-space Regulation (Regulation (EU) 2021/664)" issued by the European Commission in 2021. The regulation sets out operational requirements for the safe integration of urban air mobility, including air taxi services, into European airspace. It covers safety standards, air traffic management, and environmental regulations, facilitating the integration of air taxis into existing transportation systems and promoting sustainable urban mobility solutions .

Global Air Taxi Market Segmentation

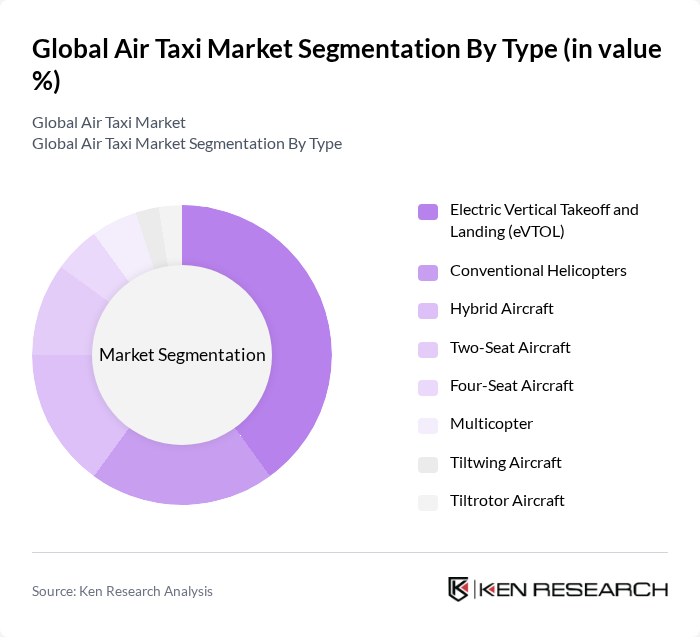

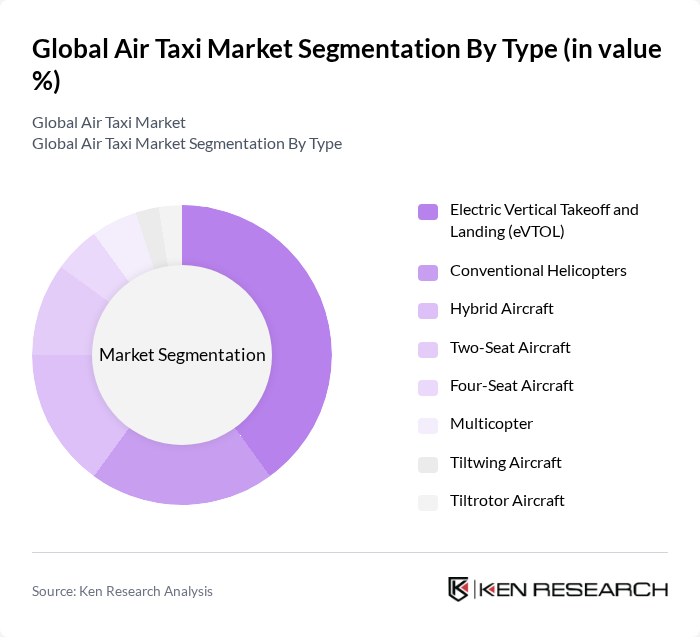

By Type:The air taxi market can be segmented into various types, including Electric Vertical Takeoff and Landing (eVTOL), Conventional Helicopters, Hybrid Aircraft, Two-Seat Aircraft, Four-Seat Aircraft, Multicopter, Tiltwing Aircraft, and Tiltrotor Aircraft. Among these, eVTOL is gaining significant traction due to its innovative design, eco-friendly operations, and suitability for urban environments. The segment benefits from rapid advancements in battery technology, electric propulsion, and autonomous flight systems, which enhance efficiency and sustainability for urban commuters .

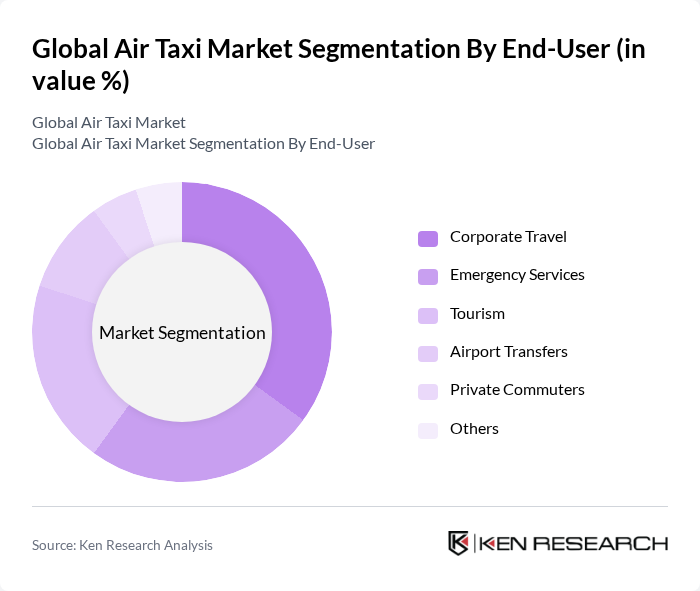

By End-User:The end-user segmentation includes Corporate Travel, Emergency Services, Tourism, Airport Transfers, Private Commuters, and Others. Corporate Travel is currently the leading segment, driven by the increasing demand for time-efficient travel solutions among business professionals, particularly in congested urban areas. Emergency Services and Tourism are also significant segments, with air taxis providing rapid response capabilities and unique travel experiences, respectively. The market is further supported by airport transfer partnerships and private commuter demand in high-density cities .

Global Air Taxi Market Competitive Landscape

The Global Air Taxi Market is characterized by a dynamic mix of regional and international players. Leading participants such as Joby Aviation, Archer Aviation, Volocopter, Lilium, Bell Textron Inc., Airbus, Boeing, Hyundai Motor Group (Supernal), Vertical Aerospace, EHang, Pipistrel (Textron eAviation), Terrafugia (a Geely company), Karem Aircraft, Wisk Aero, BLADE Urban Air Mobility contribute to innovation, geographic expansion, and service delivery in this space.

Global Air Taxi Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization is accelerating globally, with the United Nations projecting that in future, approximately 56% of the world's population will reside in urban areas, up from about 54% previously. This shift creates a pressing need for efficient transportation solutions. Cities like Tokyo and New York, with populations exceeding 9 million, face severe congestion, prompting the exploration of air taxis as a viable alternative to traditional ground transport, which is often gridlocked.

- Technological Advancements in Aviation:The aviation sector is witnessing rapid technological advancements, particularly in electric vertical takeoff and landing (eVTOL) aircraft. The global eVTOL market is expected to reach over $1 billion, driven by innovations in battery technology and autonomous systems. Companies like Joby Aviation and Archer are leading this charge, developing aircraft that promise to reduce travel times significantly, making air taxis a practical option for urban commuters.

- Demand for Sustainable Transportation:The global push for sustainable transportation is gaining momentum, with the International Energy Agency reporting that electric vehicles could account for nearly 30% of total vehicle sales in future. Air taxis, particularly those powered by electric propulsion, align with this trend, offering a cleaner alternative to traditional fossil fuel-powered transport. This demand is further supported by government initiatives aimed at reducing carbon emissions, creating a favorable environment for air taxi adoption.

Market Challenges

- High Development Costs:The development of air taxi technology involves substantial financial investment, with estimates suggesting that the cost to bring a single eVTOL aircraft to market can exceed $100 million. This high barrier to entry poses a significant challenge for startups and established companies alike, as they must secure funding while navigating the complexities of research, development, and certification processes, which can take years to complete.

- Regulatory Hurdles:The regulatory landscape for air taxis is complex and evolving. In future, the Federal Aviation Administration (FAA) is expected to finalize new regulations for eVTOL aircraft, but the process remains slow. Companies must comply with stringent safety standards and air traffic management regulations, which can delay market entry. The lack of a clear regulatory framework in many regions further complicates the operational landscape for air taxi services.

Global Air Taxi Market Future Outlook

The future of the air taxi market appears promising, driven by technological innovations and increasing urbanization. As cities continue to grow, the demand for efficient transportation solutions will likely rise. Furthermore, advancements in eVTOL technology and supportive government policies will facilitate the integration of air taxis into urban mobility systems. However, addressing regulatory challenges and public safety concerns will be crucial for widespread adoption, ensuring that air taxis become a reliable mode of transport in metropolitan areas.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant opportunities for air taxi services. With urban populations rapidly increasing, cities like Jakarta and Nairobi are exploring innovative transport solutions. In future, these regions are expected to invest tens of billions of USD in urban mobility infrastructure, creating a fertile ground for air taxi operators to establish services and capture new customer bases.

- Partnerships with Urban Mobility Services:Collaborations between air taxi companies and existing urban mobility services, such as ride-sharing platforms, can enhance market penetration. In future, the global ride-sharing market is estimated to be valued at over $100 billion. Strategic partnerships can facilitate seamless integration of air taxis into existing transport networks, improving accessibility and convenience for users, ultimately driving demand for air taxi services.