Region:Global

Author(s):Rebecca

Product Code:KRAD0221

Pages:93

Published On:August 2025

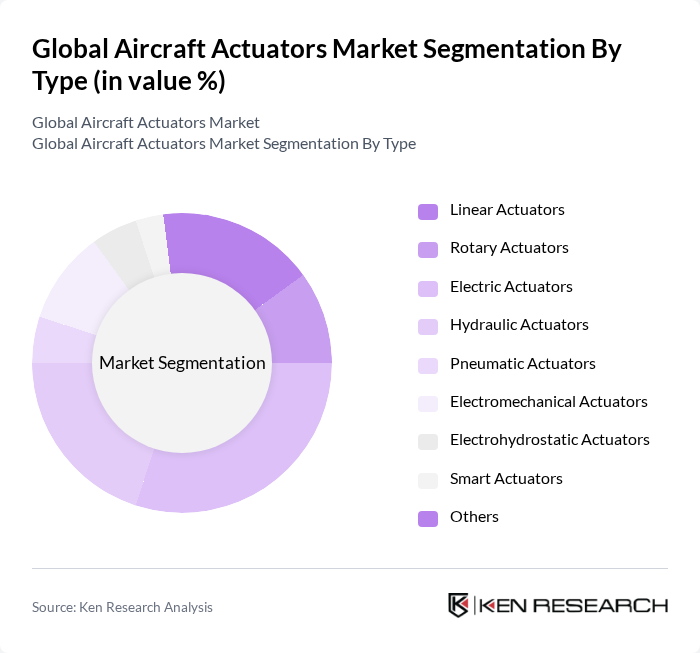

By Type:The market is segmented into various types of actuators, including Linear Actuators, Rotary Actuators, Electric Actuators, Hydraulic Actuators, Pneumatic Actuators, Electromechanical Actuators, Electrohydrostatic Actuators, Smart Actuators, and Others. Among these, Electric Actuators are gaining significant traction due to their efficiency, reduced maintenance needs, and alignment with the aviation industry's shift toward more electric aircraft. The demand for Electric Actuators is driven by the increasing focus on energy efficiency, sustainability, and the growing trend towards automation and digitalization in aircraft systems .

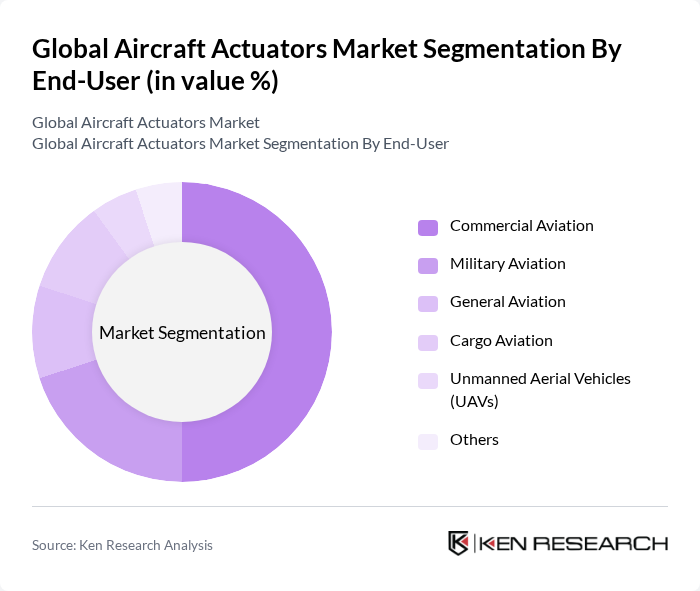

By End-User:The market is segmented by end-users, including Commercial Aviation, Military Aviation, General Aviation, Cargo Aviation, Unmanned Aerial Vehicles (UAVs), and Others. The Commercial Aviation segment is the largest, driven by the increasing number of air travelers and the expansion of airline fleets globally. This segment's growth is further supported by the rising demand for fuel-efficient aircraft, which necessitates advanced actuator systems for improved performance, safety, and compliance with evolving environmental regulations .

The Global Aircraft Actuators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Moog Inc., Parker Hannifin Corporation, Safran S.A., Collins Aerospace (Raytheon Technologies Corporation), Thales Group, Eaton Corporation plc, Woodward, Inc., Curtiss-Wright Corporation, Liebherr Group, Triumph Group, Inc., BAE Systems plc, Meggitt PLC (now part of Parker Hannifin), Kongsberg Gruppen ASA, AMETEK, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft actuators market appears promising, driven by ongoing advancements in technology and increasing demand for automation in aviation. As the industry shifts towards electric and hybrid aircraft, the need for innovative actuator solutions will grow. Furthermore, the integration of IoT technologies is expected to enhance operational efficiency and predictive maintenance capabilities, allowing for more reliable aircraft systems and improved safety standards in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Actuators Rotary Actuators Electric Actuators Hydraulic Actuators Pneumatic Actuators Electromechanical Actuators Electrohydrostatic Actuators Smart Actuators Others |

| By End-User | Commercial Aviation Military Aviation General Aviation Cargo Aviation Unmanned Aerial Vehicles (UAVs) Others |

| By Application | Flight Control Systems Landing Gear Systems Engine Control Systems Thrust Reverser Systems Cabin Control Systems Braking Systems Others |

| By Component | Actuator Motors Control Units Sensors Feedback Mechanisms Power Electronics Others |

| By Sales Channel | OEM (Original Equipment Manufacturer) Aftermarket Distributors Online Sales Others |

| By Distribution Mode | Domestic Distribution International Distribution Direct Shipping Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Manufacturers | 100 | Design Engineers, Product Development Managers |

| Military Aircraft Suppliers | 60 | Procurement Officers, Technical Directors |

| Aftermarket Service Providers | 50 | MRO Managers, Supply Chain Coordinators |

| Aerospace Regulatory Bodies | 40 | Compliance Officers, Safety Inspectors |

| Research and Development Institutions | 45 | Research Scientists, Aerospace Analysts |

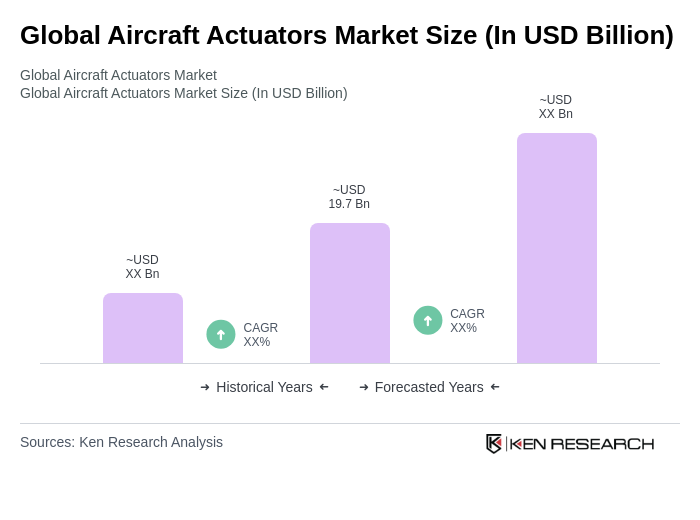

The Global Aircraft Actuators Market is valued at approximately USD 19.7 billion, driven by the demand for advanced aircraft systems, technological advancements, and the need for fuel-efficient components in aviation.