Region:Global

Author(s):Dev

Product Code:KRAC0385

Pages:98

Published On:August 2025

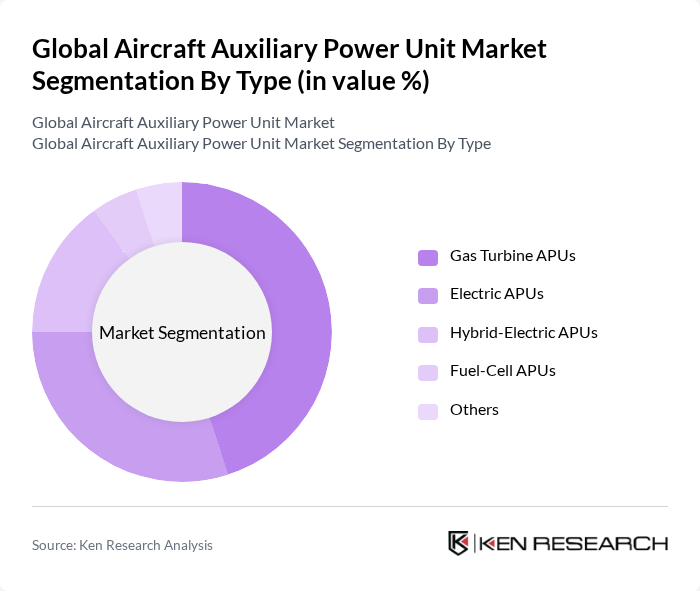

By Type:The market is segmented into various types of auxiliary power units, including Gas Turbine APUs, Electric APUs, Hybrid-Electric APUs, Fuel-Cell APUs, and Others. Among these, Gas Turbine APUs dominate the market due to their widespread use in commercial and military aircraft, offering high reliability and efficiency. Electric APUs are gaining traction as they align with the industry's shift towards electrification and sustainability. The demand for Hybrid-Electric and Fuel-Cell APUs is also increasing as manufacturers seek to innovate and reduce emissions.

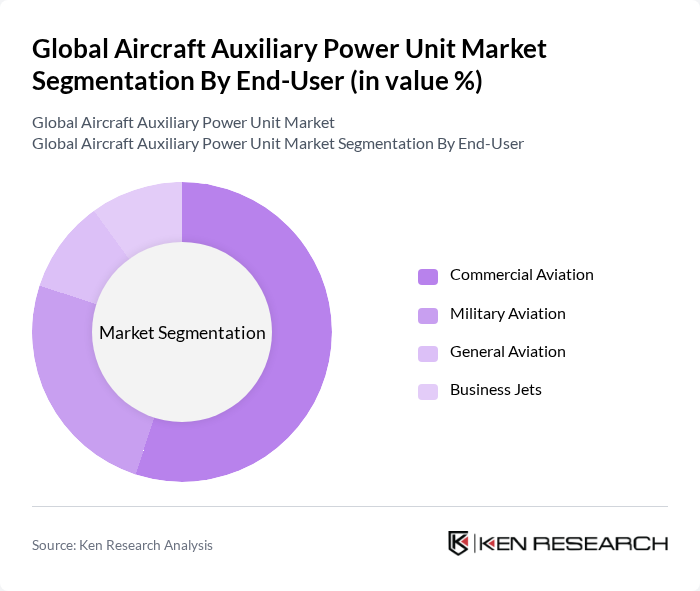

By End-User:The market is categorized into Commercial Aviation, Military Aviation, General Aviation, and Business Jets. Commercial Aviation is the leading segment, supported by large active fleets, aircraft deliveries, and high APU utilization in ground operations. Military Aviation follows, with modernization and readiness requirements sustaining APU upgrades and MRO. General Aviation and Business Jets segments are also growing, linked to resilient business travel and expanding high?net?worth operator bases.

The Global Aircraft Auxiliary Power Unit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Pratt & Whitney Canada, Safran Power Units, Rolls-Royce Holdings plc, MTU Aero Engines AG, General Electric Company, PBS Group, a.s. (PBS Velká Bíteš), Falck Schmidt Defence Systems A/S, AeroTech Inc., Lufthansa Technik AG, Collins Aerospace (Raytheon Technologies), Liebherr-Aerospace, Turbomeca (Safran Helicopter Engines), ThyssenKrupp Aerospace, Eaton Corporation plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APU market is poised for significant transformation, driven by the increasing emphasis on sustainable aviation solutions and the integration of advanced technologies. As airlines seek to comply with stringent environmental regulations, the demand for innovative APU systems that reduce emissions and enhance fuel efficiency will rise. Furthermore, the growing trend of digitalization in aviation, including IoT integration, will likely lead to smarter, more efficient APU operations, enhancing overall aircraft performance and reliability.

| Segment | Sub-Segments |

|---|---|

| By Type | Gas Turbine APUs Electric APUs Hybrid-Electric APUs Fuel-Cell APUs Others |

| By End-User | Commercial Aviation Military Aviation General Aviation Business Jets |

| By Application | Engine Starting Environmental Control Systems (Air Conditioning and Pressurization) Electric Power Generation Ground Operations Support |

| By Component | Power Section (Turbine/Generator) Control and Monitoring Systems (FADEC/ECU) Fuel and Pneumatic Systems Exhaust and Inlet Systems |

| By Platform | Commercial Aircraft (Narrow-body, Wide-body, Regional Jets) Military Aircraft (Transport, Combat, Special Mission) Rotary-Wing (Helicopters) UAVs and Special Platforms |

| By Power Rating | Less than 50 kVA –150 kVA More than 150 kVA Others |

| By Sales Channel | OEM Aftermarket (MRO, Spares & Overhaul) Distributors Direct Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft APUs | 120 | Fleet Managers, Maintenance Directors |

| Military Aircraft APUs | 90 | Defense Procurement Officers, Technical Advisors |

| General Aviation APUs | 60 | Aircraft Owners, Maintenance Technicians |

| APU Maintenance Services | 70 | Service Center Managers, Aviation Engineers |

| APU Technology Innovations | 50 | R&D Managers, Product Development Engineers |

The Global Aircraft Auxiliary Power Unit Market is valued at approximately USD 3.4 billion, reflecting steady growth driven by fleet additions and replacement cycles, as well as increasing demand for fuel-efficient and lower-emission aircraft systems.