Region:Global

Author(s):Geetanshi

Product Code:KRAA2280

Pages:92

Published On:August 2025

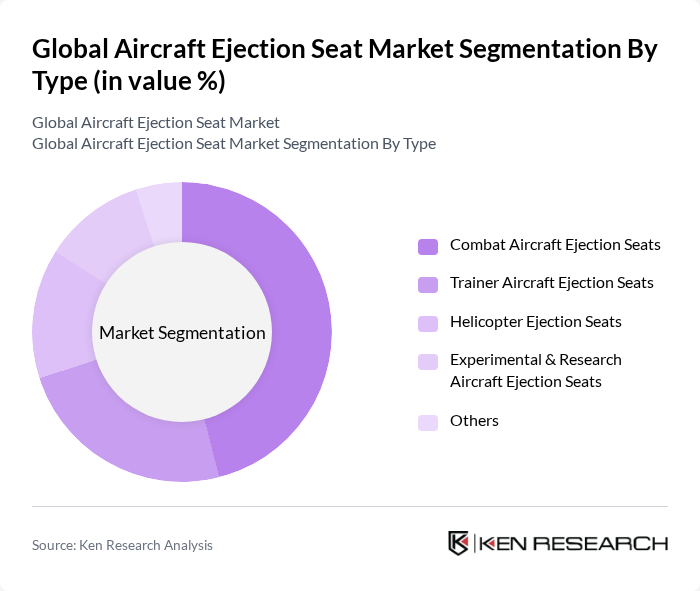

By Type:The market is segmented into Combat Aircraft Ejection Seats, Trainer Aircraft Ejection Seats, Helicopter Ejection Seats, Experimental & Research Aircraft Ejection Seats, and Others. Among these, Combat Aircraft Ejection Seats hold the largest share, reflecting their essential role in frontline military operations where pilot safety is critical. The global increase in procurement of advanced fighter jets, coupled with upgrades to existing fleets, drives robust demand for these high-performance ejection systems.

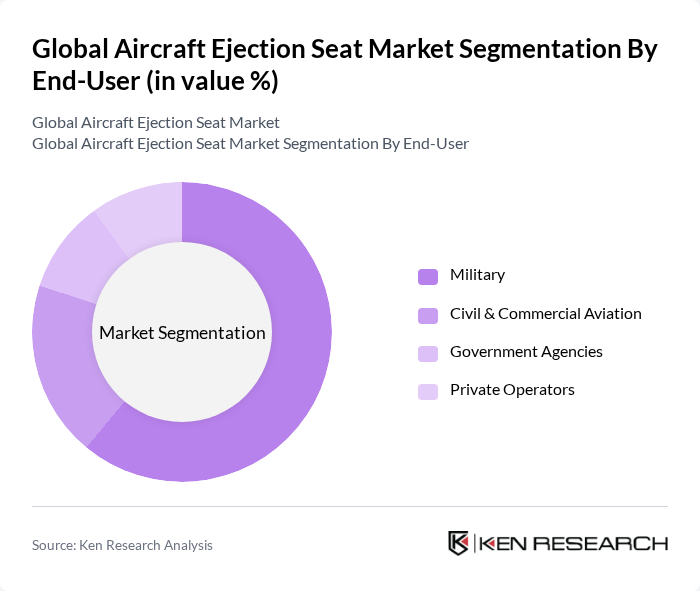

By End-User:The market is categorized into Military, Civil & Commercial Aviation, Government Agencies, and Private Operators. The Military segment accounts for the largest share, driven by ongoing modernization programs, increased pilot training requirements, and the adoption of advanced safety technologies. Civil & Commercial Aviation and Government Agencies are also investing in ejection seat systems for specialized applications, while Private Operators represent a niche but growing segment.

The Global Aircraft Ejection Seat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Martin-Baker Aircraft Company Limited, Collins Aerospace (Raytheon Technologies Corporation), Safran SA, Survival Equipment Services Ltd., RLC Group, EDM Limited, UTC Aerospace Systems (now part of Collins Aerospace), Zvezda Research & Production Enterprise, The Boeing Company, Elbit Systems Ltd., BAE Systems plc, GKN Aerospace, Northrop Grumman Corporation, Textron Inc., Honeywell International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft ejection seat market appears promising, driven by technological advancements and increasing safety regulations. As the aviation industry evolves, manufacturers are likely to focus on integrating smart technologies and automation into ejection systems. Additionally, the growing emphasis on sustainability will push companies to adopt eco-friendly materials and practices. With emerging markets expanding their defense capabilities, the demand for innovative ejection seats is expected to rise, creating new opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Combat Aircraft Ejection Seats Trainer Aircraft Ejection Seats Helicopter Ejection Seats Experimental & Research Aircraft Ejection Seats Others |

| By End-User | Military Civil & Commercial Aviation Government Agencies Private Operators |

| By Application | Fighter Jets Bombers Trainer Aircraft Reconnaissance Aircraft |

| By Component | Ejection Mechanism (Rocket, Cartridge, Pyrotechnic) Seat Structure & Frame Parachute & Survival Kit Restraint & Harness Systems Electronic Control & Monitoring Systems |

| By Sales Channel | Direct Sales (OEMs) Distributors & Integrators |

| By Distribution Mode | Domestic Distribution International Distribution |

| By Price Range | Budget Ejection Seats Mid-Range Ejection Seats Premium Ejection Seats |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Ejection Seat Systems | 100 | Defense Procurement Officers, Military Aviation Experts |

| Civilian Aircraft Safety Equipment | 80 | Commercial Aviation Safety Managers, Aircraft Manufacturers |

| Research & Development in Ejection Technology | 60 | Aerospace Engineers, R&D Directors |

| Regulatory Compliance and Safety Standards | 50 | Regulatory Affairs Specialists, Safety Inspectors |

| End-User Feedback on Ejection Seats | 70 | Active Pilots, Flight Safety Officers |

The Global Aircraft Ejection Seat Market is valued at approximately USD 1.1 billion, driven by increasing defense budgets, modernization of air fleets, and advancements in ejection technologies aimed at enhancing pilot safety and survivability.