Region:Global

Author(s):Rebecca

Product Code:KRAA2472

Pages:80

Published On:August 2025

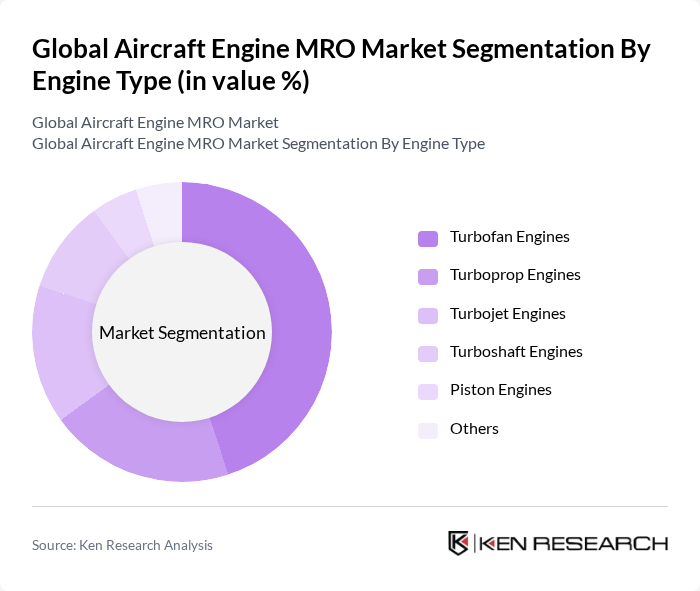

By Engine Type:The market is segmented into various engine types, including Turbofan Engines, Turboprop Engines, Turbojet Engines, Turboshaft Engines, Piston Engines, and Others. Among these, Turbofan Engines dominate the market due to their widespread use in commercial aviation, offering higher efficiency and lower operational costs. The increasing number of commercial flights, the shift toward next-generation aircraft, and the need for reliable engine performance continue to drive the demand for MRO services in this segment .

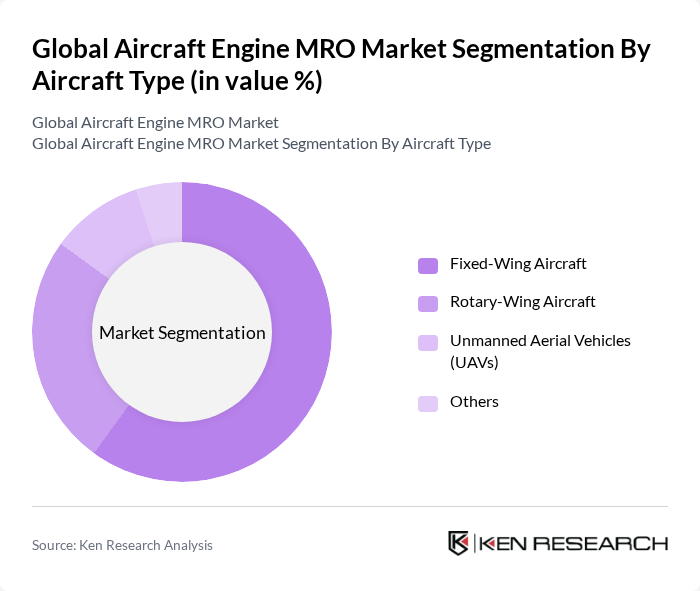

By Aircraft Type:The market is categorized into Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVs), and Others. Fixed-Wing Aircraft hold the largest share due to their extensive use in commercial and cargo aviation. The increasing demand for passenger and freight transport, combined with the modernization of airline fleets, has led to a rise in the number of fixed-wing aircraft, thereby boosting the need for MRO services in this category .

The Global Aircraft Engine MRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Electric Company, Rolls-Royce Holdings plc, Pratt & Whitney, Safran S.A., MTU Aero Engines AG, Honeywell International Inc., Lufthansa Technik AG, Air France Industries KLM Engineering & Maintenance, AAR Corp., Delta TechOps, HAECO Group, ST Engineering, BAE Systems plc, IAI Bedek Aviation Group, Turkish Technic Inc., CFM International, SIA Engineering Company, Sanad, Hindustan Aeronautics Ltd., Aviation Technical Services, TAP Maintenance & Engineering, ANA Engine Technics Co. Ltd., IAG Aero Group, Hong Kong Aircraft Engineering Company Limited (HAECO), Synerjet Corp., The Boeing Company, AZUL S.A., A J Walter Aviation Ltd., Singapore Technologies Engineering Ltd., Turkish Airlines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft engine MRO market is poised for transformation, driven by technological advancements and evolving industry standards. The integration of digital solutions, such as predictive maintenance and AI-driven analytics, is expected to enhance operational efficiency and reduce downtime. Additionally, the growing emphasis on sustainability will likely lead to increased investments in eco-friendly practices and technologies. As airlines adapt to these changes, the MRO sector will need to innovate continuously to meet the demands of a rapidly evolving aviation landscape.

| Segment | Sub-Segments |

|---|---|

| By Engine Type | Turbofan Engines Turboprop Engines Turbojet Engines Turboshaft Engines Piston Engines Others |

| By Aircraft Type | Fixed-Wing Aircraft Rotary-Wing Aircraft Unmanned Aerial Vehicles (UAVs) Others |

| By Application | Commercial Aviation Military Aviation General Aviation Cargo Operators Others |

| By Service Type | Engine Overhaul Engine Repair Engine Modification Others |

| By Component | Engine Accessories Engine Control Systems Fuel Systems Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Engine MRO | 120 | Maintenance Directors, Operations Managers |

| Military Aircraft Engine Maintenance | 90 | Logistics Officers, Procurement Managers |

| Business Jet Engine Services | 60 | Service Center Managers, Aviation Consultants |

| Helicopter Engine Overhaul | 40 | Maintenance Engineers, Fleet Managers |

| Regional Aircraft Engine Support | 50 | Technical Directors, Quality Assurance Managers |

The Global Aircraft Engine MRO Market is valued at approximately USD 41 billion, driven by increased air travel, fleet expansion, and the need for advanced maintenance services to ensure safety and efficiency in aviation operations.