Region:Global

Author(s):Rebecca

Product Code:KRAC0316

Pages:99

Published On:August 2025

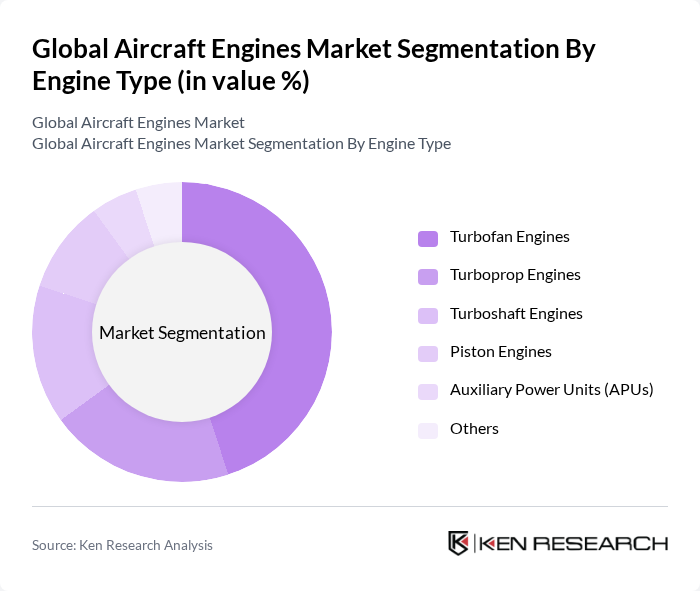

By Engine Type:The aircraft engines market is segmented into various engine types, including turbofan engines, turboprop engines, turboshaft engines, piston engines, auxiliary power units (APUs), and others. Among these, turbofan engines dominate the market due to their widespread use in commercial aviation, offering high efficiency and performance. The increasing demand for fuel-efficient and low-emission engines has further propelled the growth of turbofan engines, making them the preferred choice for airlines globally .

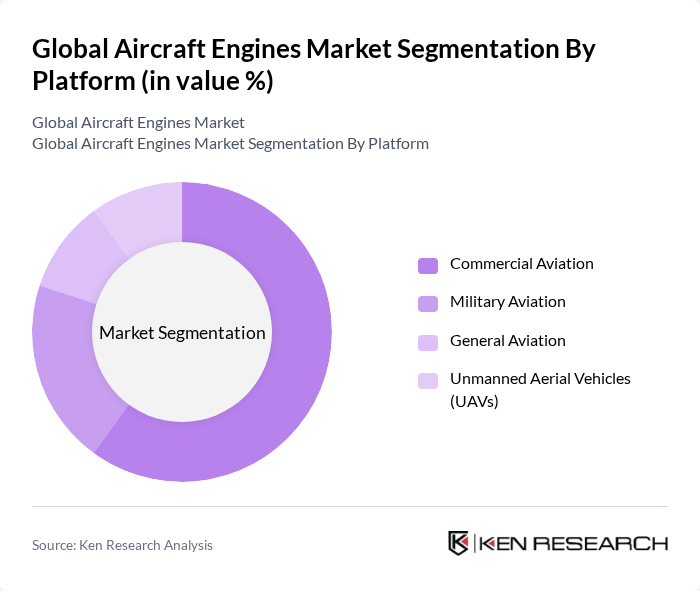

By Platform:The market is also segmented by platform, which includes commercial aviation, military aviation, general aviation, and unmanned aerial vehicles (UAVs). The commercial aviation segment holds the largest share, driven by the increasing number of air travelers and the expansion of airline networks. The demand for efficient and reliable engines in commercial aircraft is a key factor contributing to the growth of this segment, as airlines seek to enhance operational efficiency and reduce operational costs .

The Global Aircraft Engines Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Electric Company (GE Aviation), Rolls-Royce Holdings plc, Pratt & Whitney (Raytheon Technologies), Safran S.A., Honeywell International Inc., MTU Aero Engines AG, Engine Alliance (GE Aviation & Pratt & Whitney Joint Venture), International Aero Engines AG, Williams International, CFM International (GE Aviation & Safran Aircraft Engines Joint Venture), IHI Corporation, Kawasaki Heavy Industries, Ltd., Mitsubishi Heavy Industries, Ltd., Hindustan Aeronautics Limited, Avio Aero (A GE Aerospace Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft engines market is poised for transformative growth, driven by technological advancements and increasing environmental awareness. Innovations in hybrid and electric propulsion systems are expected to gain traction, with investments in sustainable aviation solutions projected to exceed $150 billion by in future. Additionally, the expansion of maintenance, repair, and overhaul (MRO) services will create new revenue streams, enhancing operational efficiency and supporting the growing fleet of aircraft worldwide.

| Segment | Sub-Segments |

|---|---|

| By Engine Type | Turbofan Engines Turboprop Engines Turboshaft Engines Piston Engines Auxiliary Power Units (APUs) Others |

| By Platform | Commercial Aviation Military Aviation General Aviation Unmanned Aerial Vehicles (UAVs) |

| By Engine Size | Small Engines Medium Engines Large Engines |

| By Application | Passenger Aircraft Cargo Aircraft Military Aircraft Business Jets Helicopters |

| By Component | Engine Core Fan Blades Combustion Chamber Turbine Blades Gearbox |

| By Sales Channel | OEM (Original Equipment Manufacturer) Aftermarket |

| By Maintenance Type | Line Maintenance Base Maintenance Overhaul Services |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Engines | 100 | Chief Engineers, Fleet Managers |

| Military Aircraft Engines | 60 | Defense Procurement Officers, Military Aviation Experts |

| Engine Maintenance Services | 50 | Maintenance Managers, Technical Directors |

| Emerging Engine Technologies | 40 | R&D Managers, Aerospace Engineers |

| Aftermarket Parts and Services | 50 | Supply Chain Managers, Parts Distribution Managers |

The Global Aircraft Engines Market is valued at approximately USD 81 billion, driven by increasing air travel demand, advancements in engine technology, and the need for fuel-efficient solutions. This valuation is based on a comprehensive five-year historical analysis.