Region:Global

Author(s):Shubham

Product Code:KRAA1785

Pages:90

Published On:August 2025

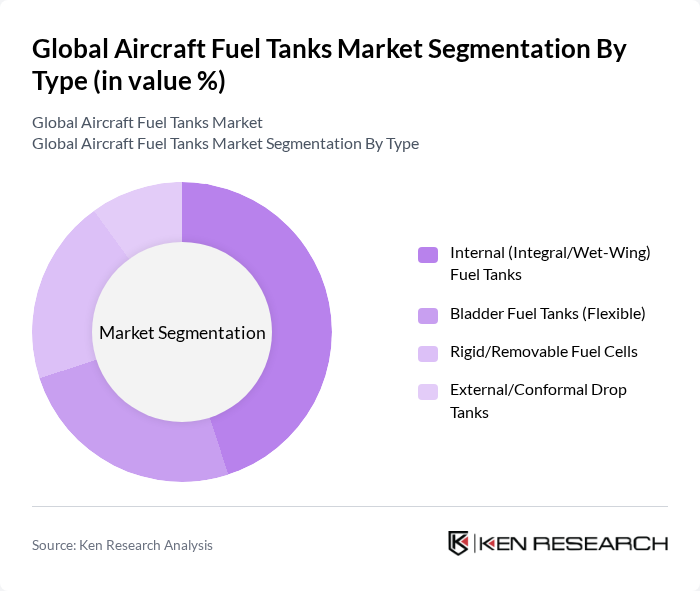

By Type:The market is segmented into four types of fuel tanks: Internal (Integral/Wet-Wing) Fuel Tanks, Bladder Fuel Tanks (Flexible), Rigid/Removable Fuel Cells, and External/Conformal Drop Tanks. Among these, Internal Fuel Tanks are the most widely used due to their integration into the aircraft structure, which optimizes space and weight. Bladder Fuel Tanks are also gaining traction in military applications due to their flexibility and ease of installation. The demand for Rigid Fuel Cells is increasing in specialized aircraft, while External Tanks are primarily used for extended range missions.

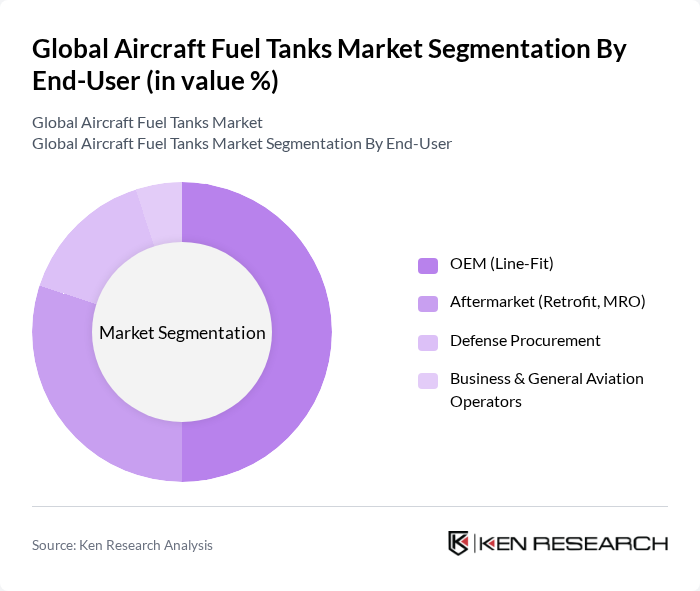

By End-User:The market is categorized into OEM (Line-Fit), Aftermarket (Retrofit, MRO), Defense Procurement, and Business & General Aviation Operators. The OEM segment is leading due to the increasing production of new aircraft, while the Aftermarket segment is growing as operators seek to retrofit existing fleets with advanced fuel tank technologies. Defense Procurement is also significant, driven by military modernization programs, and Business & General Aviation is expanding as more individuals and companies invest in private aircraft.

The Global Aircraft Fuel Tanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Parker Hannifin Corporation (Parker Aerospace), Eaton Corporation plc (Eaton Aerospace), Safran S.A. (Safran Aerosystems), GKN Aerospace (Melrose Industries), Triumph Group, Inc. (Triumph Systems & Support), Collins Aerospace (RTX Corporation), Spirit AeroSystems Holdings, Inc., Avcorp Industries Inc., Meggitt PLC (now part of Parker Hannifin), Marshall Aerospace and Defence Group, Cobham Limited, Northrop Grumman Corporation (External tanks, defense), Israel Aerospace Industries (IAI), Kautex Textron GmbH & Co. KG, Aero Tec Laboratories (ATL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft fuel tanks market appears promising, driven by ongoing innovations in materials and design. As airlines increasingly prioritize sustainability, the shift towards lightweight and composite materials is expected to gain momentum. Furthermore, advancements in smart fuel management systems will enhance operational efficiency, allowing airlines to optimize fuel usage. The market is likely to witness increased collaboration between fuel tank manufacturers and aerospace companies, fostering innovation and improving product offerings to meet evolving industry demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Internal (Integral/Wet-Wing) Fuel Tanks Bladder Fuel Tanks (Flexible) Rigid/Removable Fuel Cells External/Conformal Drop Tanks |

| By End-User | OEM (Line-Fit) Aftermarket (Retrofit, MRO) Defense Procurement Business & General Aviation Operators |

| By Material | Metallic Alloys (Aluminum, Titanium) Carbon-Based Composites Hybrid/Multimaterial Elastomers/Polymers (for Bladder Cells) |

| By Application | Commercial Transport (Narrow-body, Wide-body, Regional) Military Fixed-Wing (Fighter, Transport, Trainer) Rotary-Wing (Helicopters) UAVs/Unmanned Systems |

| By Distribution Channel | Direct Sales to OEMs Tier-1/Tier-2 Integrators Authorized Distributors & MRO Networks E-Procurement/Defense Portals |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Price Range | Standard Line-Fit Tanks Auxiliary/Range-Extension Kits Specialized/Missionized Tanks (e.g., Crashworthy, Inerted) Custom/Prototype & Certification-Intensive Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Fuel Tanks | 140 | Aircraft Manufacturers, Fleet Operations Managers |

| Military Aircraft Fuel Tanks | 100 | Defense Procurement Officers, Military Aviation Engineers |

| Helicopter Fuel Tank Systems | 80 | Helicopter Operators, Aviation Safety Inspectors |

| Fuel Tank Maintenance Services | 70 | Maintenance Managers, Aviation Service Providers |

| Emerging Technologies in Fuel Tanks | 90 | Aerospace Engineers, R&D Managers |

The Global Aircraft Fuel Tanks Market is valued at approximately USD 1 billion, driven by the increasing demand for fuel-efficient aircraft and advancements in fuel tank materials and technologies that enhance safety and performance.