Region:Global

Author(s):Shubham

Product Code:KRAA1786

Pages:98

Published On:August 2025

By Type:The market is segmented into various types of maintenance services, including line maintenance, base/heavy maintenance, component MRO, engine MRO, modifications & retrofits, airframe maintenance, and specialized services. Among these, line maintenance is gaining traction due to the increasing number of flights and the need for quick turnaround times. Base/heavy maintenance is also significant, driven by regulatory requirements for periodic checks and overhauls. Predictive maintenance, use of digital twins, drones for inspections, and additive manufacturing for parts are increasingly integrated across segments to reduce turnaround time and improve availability .

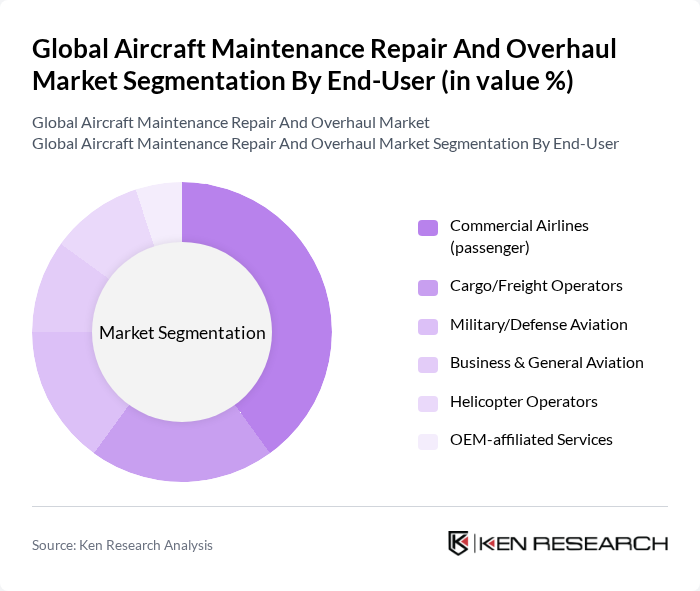

By End-User:The end-user segmentation includes commercial airlines, cargo/freight operators, military/defense aviation, business & general aviation, helicopter operators, and OEM-affiliated services. Commercial airlines dominate the market due to high passenger traffic and regulatory maintenance requirements; cargo/freight operators continue to sustain elevated maintenance needs with freighter utilization; defense aviation remains significant given mission readiness imperatives .

The Global Aircraft Maintenance Repair And Overhaul Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lufthansa Technik AG, Air France Industries KLM Engineering & Maintenance (AFI KLM E&M), ST Engineering Aerospace Ltd., AAR Corp., HAECO Group (Hong Kong Aircraft Engineering Company Limited), SR Technics, Collins Aerospace (Raytheon Technologies), Safran Aircraft Engines & Safran Nacelles, Rolls-Royce plc (Civil Aerospace Services), MTU Aero Engines AG, GE Aerospace (GE Aviation Services), Pratt & Whitney (Pratt & Whitney Engine Services), Delta TechOps (Delta Air Lines), Turkish Technic, Singapore Airlines Engineering Company (SIAEC), Boeing Global Services, Airbus Services (Airbus Customer Services), Etihad Engineering, TAP Maintenance & Engineering, GMF AeroAsia (Garuda Maintenance Facility AeroAsia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft maintenance, repair, and overhaul market appears promising, driven by technological innovations and increasing air traffic. As airlines invest in digital transformation and predictive maintenance, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly practices in MRO operations. These trends indicate a dynamic shift in the industry, positioning it for robust growth and adaptation to evolving market demands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Line Maintenance Base/Heavy Maintenance (C- and D-checks) Component MRO (rotable and repairables) Engine MRO (shop visit, overhaul, parts repair) Modifications & Retrofits (cabin, connectivity, PTF conversions) Airframe Maintenance (structural/composite repairs) Specialized Services (painting, NDT, landing gear, APU) |

| By End-User | Commercial Airlines (passenger) Cargo/Freight Operators Military/Defense Aviation Business & General Aviation Helicopter Operators OEM-affiliated Services |

| By Service Type | Engine Overhaul Airframe Maintenance Line Maintenance Components Repair & Exchange Modifications & Upgrades |

| By Component | Engines Airframe & Structures Avionics & Electrical Systems Landing Gear & APU Interiors & Cabin Systems |

| By Organization Type | Airline/Operator MRO Independent MRO OEM MRO |

| By Aircraft Type | Narrow-body Wide-body Regional Jets & Turboprops Helicopters Military Aircraft |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airline MRO Services | 120 | Maintenance Directors, Operations Managers |

| Business Aviation Maintenance | 90 | Chief Engineers, Maintenance Supervisors |

| Helicopter MRO Operations | 70 | Technical Managers, Safety Officers |

| Military Aircraft Maintenance | 60 | Logistics Officers, Maintenance Planners |

| Component Repair and Overhaul | 80 | Quality Assurance Managers, Parts Managers |

The Global Aircraft Maintenance Repair and Overhaul Market is valued at approximately USD 90 billion, reflecting a recovery in flight activity and sustained maintenance demand following the pandemic, alongside a normalization of deferred shop visits.