Region:Global

Author(s):Dev

Product Code:KRAA1669

Pages:88

Published On:August 2025

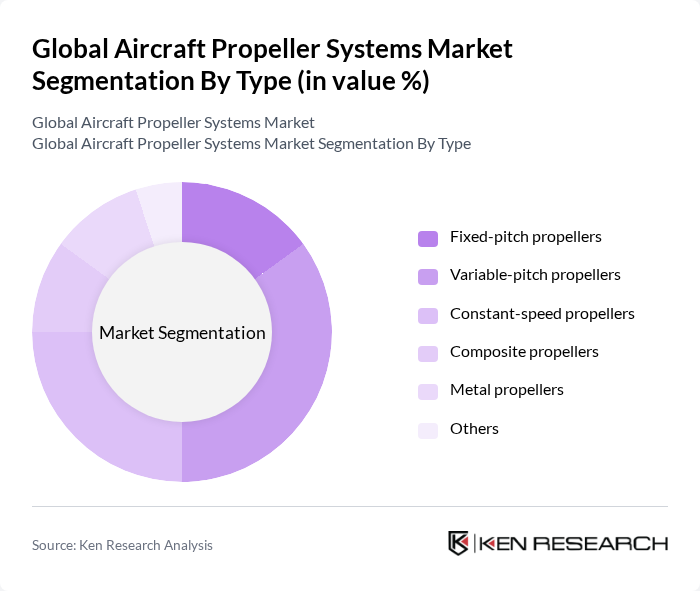

By Type:The market is segmented into various types of propellers, including fixed-pitch, variable-pitch, constant-speed, composite, metal, and others. Each type serves different applications and user preferences, with specific advantages in terms of performance, efficiency, and maintenance. The demand for variable-pitch and constant-speed propellers remains strong in certificated general aviation and regional turboprops due to performance optimization across flight regimes and fuel-efficiency gains, while composite-material propellers continue to grow for weight and noise benefits.

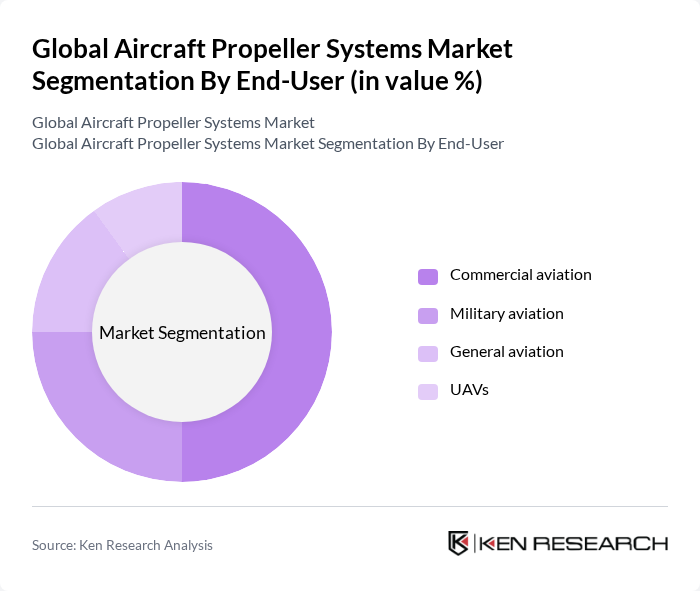

By End-User:The end-user segmentation includes commercial aviation, military aviation, general aviation, and UAVs. Each segment has distinct requirements and growth drivers. The commercial and regional turboprop sector is a key end-user for multi-blade controllable/constant-speed propellers, driven by cost-efficient regional connectivity and fuel efficiency; military demand is supported by special-mission turboprops and trainer fleets; general aviation shows steady demand for OEM fit and aftermarket upgrades; and UAVs increasingly adopt composite propellers optimized for endurance and low acoustic signatures.

The Global Aircraft Propeller Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hartzell Propeller Inc., McCauley Propeller Systems, Dowty Propellers (GE Aerospace), MT-Propeller Entwicklung GmbH, Sensenich Propeller Manufacturing Co., Woodward, Inc. (propeller governors), Hartzell Engine Technologies LLC (governors & accessories), Airmaster Propellers Ltd., Prince Aircraft Company, RATIER-Figeac (Collins Aerospace), AVIC Xian Aircraft Industry Co., Ltd. (propeller systems), Hoffmann Propeller GmbH & Co. KG, CFS Aero (CFS Aeroproducts Ltd.), Mecklenburger Metallguss GmbH (MMG), and TQ-Group (TQ-Systems GmbH) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft propeller systems market is poised for transformation, driven by a shift towards sustainable aviation solutions and the integration of smart technologies. As environmental concerns intensify, manufacturers are likely to focus on developing eco-friendly propeller systems that minimize emissions. Additionally, advancements in automation and data analytics will enhance operational efficiency, allowing for real-time performance monitoring and predictive maintenance, ultimately leading to improved safety and reduced operational costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-pitch propellers Variable-pitch propellers Constant-speed propellers Composite propellers Metal propellers Others |

| By End-User | Commercial aviation Military aviation General aviation UAVs |

| By Application | Passenger aircraft Cargo aircraft Military aircraft Agricultural aircraft |

| By Component | Blades Hub Control mechanisms Accessories |

| By Sales Channel | OEM (factory fit) Aftermarket (MRO and replacements) Distributors/independent dealers |

| By Platform | Civil (general aviation, regional/commuter) Military (trainer, ISR, transport) |

| By Engine Type | Piston (spark-ignition) Turboprop Electric & hybrid-electric |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Propeller Systems | 120 | Fleet Managers, Aircraft Maintenance Engineers |

| General Aviation Propeller Systems | 100 | Private Aircraft Owners, Flight School Administrators |

| Military Aircraft Propeller Systems | 80 | Defense Procurement Officers, Military Aviation Engineers |

| Propeller Manufacturing Insights | 70 | Production Managers, R&D Engineers |

| MRO Services for Propeller Systems | 90 | MRO Service Managers, Quality Assurance Inspectors |

The Global Aircraft Propeller Systems Market is valued at approximately USD 370 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for efficient aircraft and advancements in propeller technology.