Region:Global

Author(s):Shubham

Product Code:KRAB0712

Pages:90

Published On:August 2025

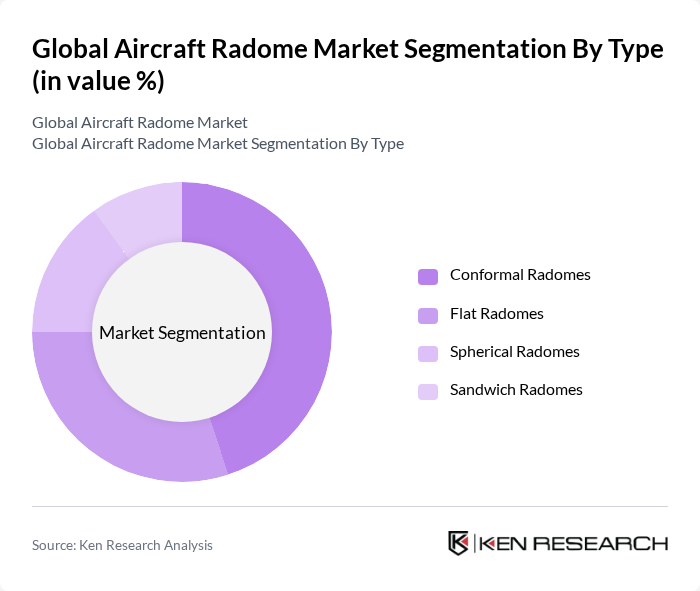

By Type:

The segmentation by type includes Conformal Radomes, Flat Radomes, Spherical Radomes, and Sandwich Radomes. Among these, Conformal Radomes are leading the market due to their aerodynamic advantages and lightweight properties, making them ideal for modern aircraft designs. The increasing focus on fuel efficiency, performance optimization, and stealth capabilities in aviation has led to a growing preference for these radomes. Flat Radomes are also gaining traction, particularly in military and UAV applications, due to their robust design and ease of integration with advanced radar and communication systems .

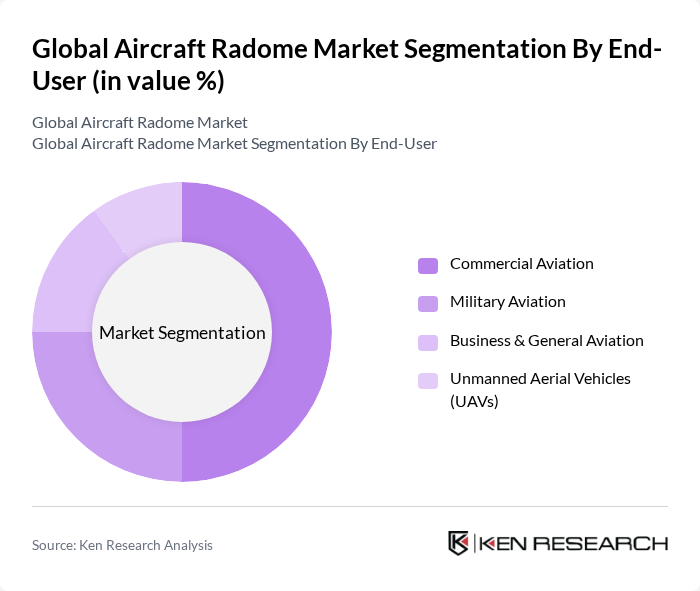

By End-User:

This segmentation includes Commercial Aviation, Military Aviation, Business & General Aviation, and Unmanned Aerial Vehicles (UAVs). The Commercial Aviation segment holds the largest share, driven by the increasing number of air travelers, expansion of airline fleets, and the need for advanced in-flight connectivity and navigation systems. Military Aviation is also significant, as defense budgets are being allocated towards upgrading existing aircraft with advanced radar and communication systems. The UAV segment is witnessing rapid growth due to the rising adoption of drones for surveillance, intelligence, and cargo transport applications .

The Global Aircraft Radome Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation, RTX Corporation (formerly Raytheon Technologies Corporation), Honeywell International Inc., L3Harris Technologies, Inc., Safran Electronics & Defense, GKN Aerospace Services Limited, RUAG AG, AMETEK, Inc., Ducommun Incorporated, Cobham Limited, Spirit AeroSystems Holdings, Inc., FACC AG, Aernnova Aerospace S.A., Triumph Group, Inc., Trelleborg AB, General Dynamics Corporation, Airbus SE, The NORDAM Group LLC, Saint-Gobain Performance Plastics, Starwin Industries, Meggitt PLC, Kitsap Composites, Vermont Composites Inc., Jenoptik AG, Royal Engineered Composites, Aviation Industry Corporation of China (AVIC), CPI Aerostructures, Inc., Leonardo S.p.A., Pacific Radomes, Orbital ATK (now part of Northrop Grumman), Kelvin Hughes Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft radome market appears promising, driven by ongoing advancements in technology and increasing demand for efficient aviation solutions. As the commercial aviation sector continues to expand, manufacturers are likely to focus on developing innovative radome designs that enhance performance while reducing weight. Additionally, the integration of IoT technologies in aircraft systems is expected to create new opportunities for radome applications, further driving market growth. The emphasis on sustainability will also push manufacturers to explore eco-friendly materials and production methods.

| Segment | Sub-Segments |

|---|---|

| By Type | Conformal Radomes Flat Radomes Spherical Radomes Sandwich Radomes |

| By End-User | Commercial Aviation Military Aviation Business & General Aviation Unmanned Aerial Vehicles (UAVs) |

| By Material | Composite Materials (e.g., fiberglass, quartz, carbon fiber) Metal Radomes (e.g., aluminum alloys) Plastic Radomes (e.g., polycarbonate, ABS) Advanced Ceramics & Others |

| By Application | Communication Systems Radar Systems Navigation & Weather Systems Electronic Warfare & Surveillance |

| By Distribution Channel | Direct Sales (OEMs & Tier-1 Suppliers) Distributors & Integrators Aftermarket/Replacement Sales Online Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (U.K., Germany, France, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of APAC) Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range Custom/Project-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Manufacturers | 100 | Design Engineers, Procurement Managers |

| Defense Contractors | 80 | Program Managers, Technical Directors |

| MRO Service Providers | 70 | Maintenance Managers, Quality Assurance Officers |

| Radome Material Suppliers | 60 | Product Development Managers, Sales Directors |

| Aerospace Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

The Global Aircraft Radome Market is valued at approximately USD 1.5 billion, driven by the increasing demand for advanced radar and communication systems in both commercial and military aviation sectors.