Region:Global

Author(s):Geetanshi

Product Code:KRAC0158

Pages:82

Published On:August 2025

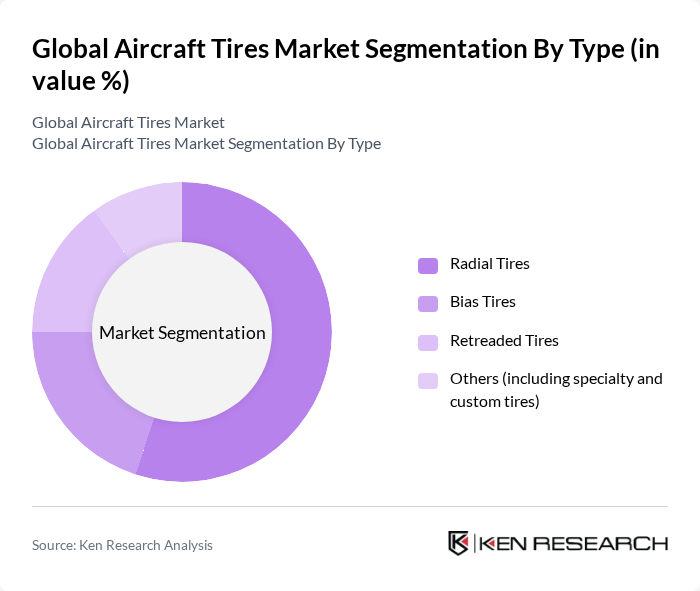

By Type:The market is segmented into Radial Tires, Bias Tires, Retreaded Tires, and Others (including specialty and custom tires). Among these, Radial Tires are the most dominant due to their superior performance, fuel efficiency, and longer lifespan, making them the preferred choice for commercial and military aircraft. Bias Tires, while still in use, are gradually being replaced by Radial Tires in many applications. Retreaded Tires are gaining traction as a cost-effective and environmentally friendly option, especially in the cargo and general aviation sectors .

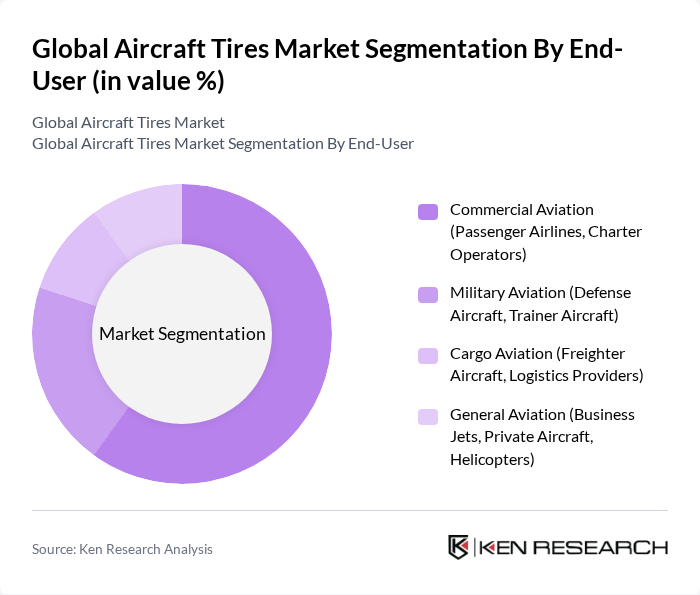

By End-User:The market is categorized into Commercial Aviation (Passenger Airlines, Charter Operators), Military Aviation (Defense Aircraft, Trainer Aircraft), Cargo Aviation (Freighter Aircraft, Logistics Providers), and General Aviation (Business Jets, Private Aircraft, Helicopters). The Commercial Aviation segment leads the market, driven by the increasing number of air travelers and the expansion of airline fleets. Military Aviation follows, supported by government defense budgets and modernization programs. Cargo Aviation is also growing due to the rise in e-commerce and global trade .

The Global Aircraft Tires Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Dunlop Aircraft Tyres Limited, Specialty Tires of America, Inc., Qingdao Sentury Tire Co., Ltd., Petlas Tire Corporation, Wilkerson Company, Inc., Aviation Tires & Treads, LLC, Desser Tire & Rubber Co., LLC, Yokohama Rubber Company, Ltd., Cheng Shin Rubber Ind. Co., Ltd. (Maxxis), Trelleborg AB, Safran Landing Systems, Parker Hannifin Corporation (Aerospace Tire Products) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aircraft tire market appears promising, driven by ongoing advancements in technology and a growing emphasis on sustainability. As airlines increasingly adopt eco-friendly practices, the demand for innovative tire solutions that reduce environmental impact is expected to rise. Additionally, the expansion of the commercial aviation sector in emerging markets will create new opportunities for manufacturers. The focus on cost-effective maintenance solutions will also shape the market, encouraging the development of retreaded tires and smart tire technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Radial Tires Bias Tires Retreaded Tires Others (including specialty and custom tires) |

| By End-User | Commercial Aviation (Passenger Airlines, Charter Operators) Military Aviation (Defense Aircraft, Trainer Aircraft) Cargo Aviation (Freighter Aircraft, Logistics Providers) General Aviation (Business Jets, Private Aircraft, Helicopters) |

| By Aircraft Type | Narrow-Body Aircraft Wide-Body Aircraft Regional Jets Turboprop Aircraft Helicopters Others (including business jets, UAVs) |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket (Replacement) Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Tire Application | Commercial Flights Cargo Operations Military Operations General Aviation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Tires | 100 | Fleet Managers, Procurement Officers |

| General Aviation Tires | 60 | Aircraft Owners, Maintenance Managers |

| Military Aircraft Tires | 50 | Defense Procurement Officers, Logistics Coordinators |

| Regional Aircraft Tires | 40 | Regional Airline Executives, Operations Managers |

| Specialty Aircraft Tires | 40 | Manufacturers, R&D Engineers |

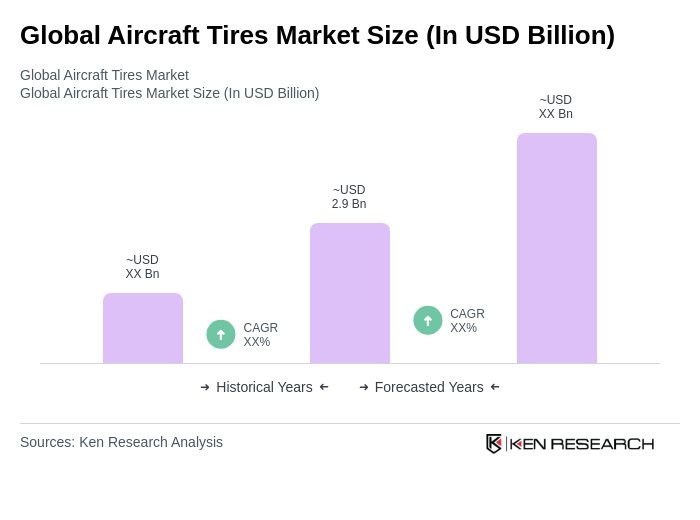

The Global Aircraft Tires Market is valued at approximately USD 2.9 billion, driven by increasing air travel demand, advancements in aircraft technology, and a focus on safety and performance standards in aviation.