Region:Global

Author(s):Rebecca

Product Code:KRAA2920

Pages:88

Published On:August 2025

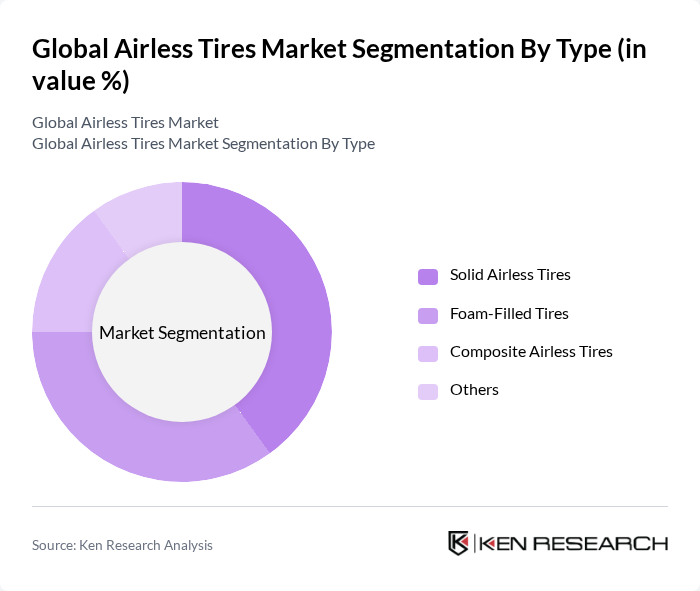

By Type:The airless tires market is segmented into four main types: Solid Airless Tires, Foam-Filled Tires, Composite Airless Tires, and Others. Solid Airless Tires are gaining traction due to their robustness and ability to withstand harsh conditions, making them ideal for industrial and agricultural applications. Foam-Filled Tires are also popular for their puncture resistance and comfort, particularly in construction and material handling. Composite Airless Tires are emerging as a lightweight alternative, appealing to the automotive sector for their energy efficiency and improved traction. The "Others" category includes niche products that cater to specialized needs, such as military and off-road vehicles.

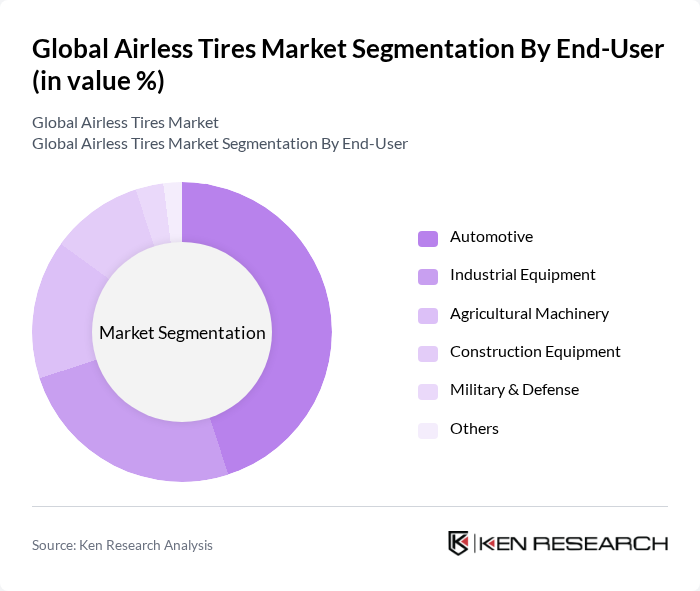

By End-User:The market is segmented by end-user into Automotive, Industrial Equipment, Agricultural Machinery, Construction Equipment, Military & Defense, and Others. The automotive sector is the largest consumer of airless tires, driven by the need for enhanced safety, performance, and the shift toward electric and autonomous vehicles. Industrial equipment also represents a significant portion of the market, as companies seek durable solutions for material handling and logistics. Agricultural machinery is increasingly adopting airless tires for their reliability in challenging terrains, while construction equipment benefits from their puncture resistance and low maintenance. The military and defense sector is exploring airless tires for tactical vehicles, leveraging their durability and resistance to extreme conditions.

The Global Airless Tires Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Continental AG, Trelleborg AB, Hankook Tire & Technology Co., Ltd., Sumitomo Rubber Industries, Ltd., The Yokohama Rubber Co., Ltd., Pirelli & C. S.p.A., Nokian Tyres plc, Kenda Rubber Industrial Co., Ltd., Cheng Shin Rubber Ind. Co., Ltd. (CST Tires), Maxxis International, Balkrishna Industries Limited (BKT Tires), Greenball Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of airless tires appears promising, driven by technological advancements and increasing environmental awareness. As manufacturers invest in innovative materials and production methods, the performance and affordability of airless tires are expected to improve significantly. Additionally, the rise of electric and autonomous vehicles will likely create new demand for airless solutions, as these vehicles prioritize safety and sustainability. The integration of smart technologies into tire systems will further enhance their appeal, positioning airless tires as a key component of future mobility solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid Airless Tires Foam-Filled Tires Composite Airless Tires Others |

| By End-User | Automotive Industrial Equipment Agricultural Machinery Construction Equipment Military & Defense Others |

| By Application | Off-Road Vehicles Urban Mobility Solutions Military Vehicles Two-Wheelers Passenger Cars Commercial Vehicles Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Dealers OEM Supply Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-Range Premium |

| By Technology | Traditional Manufacturing Advanced Manufacturing Techniques Hybrid Technologies Smart Tire Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Managers, Engineering Directors |

| Commercial Fleet Operators | 80 | Fleet Managers, Operations Directors |

| Automotive Aftermarket Retailers | 60 | Sales Managers, Procurement Officers |

| Research Institutions in Automotive Technology | 50 | Research Scientists, Automotive Engineers |

| Regulatory Bodies and Safety Organizations | 40 | Policy Analysts, Compliance Officers |

The Global Airless Tires Market is valued at approximately USD 63 billion, driven by the increasing demand for durable and maintenance-free tire solutions across various sectors, including automotive, industrial, and military applications.