Region:Global

Author(s):Dev

Product Code:KRAA1514

Pages:99

Published On:August 2025

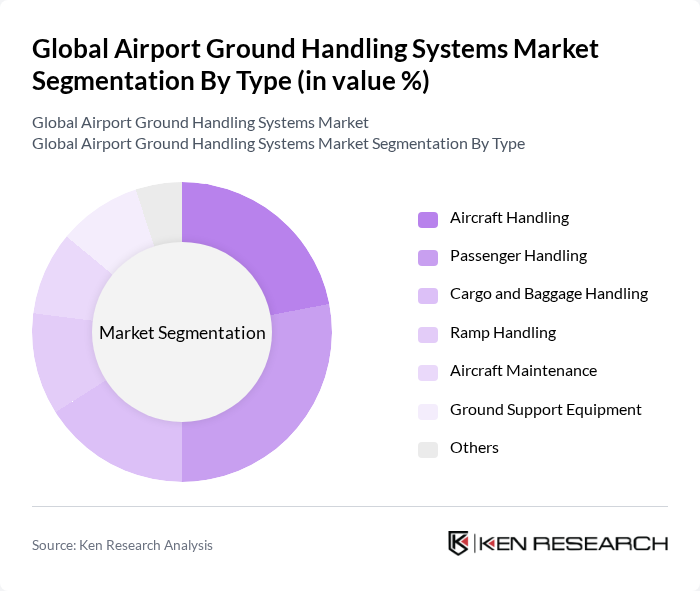

By Type:The market is segmented into various types, including Aircraft Handling, Passenger Handling, Cargo and Baggage Handling, Ramp Handling, Aircraft Maintenance, Ground Support Equipment, and Others. Each of these segments plays a crucial role in ensuring the smooth operation of airport services. Among these, Aircraft Handling is currently the leading segment, driven by the need for efficient aircraft turnaround, refueling, and servicing. However, Passenger Handling remains a key focus area due to the increasing number of air travelers and the demand for efficient check-in and boarding processes. The rise in air travel has led to a greater focus on enhancing passenger experience, thus driving growth in this segment.

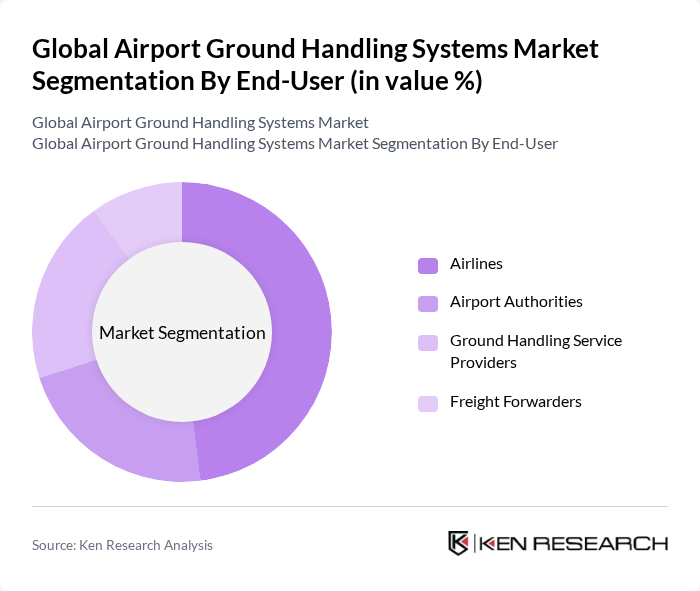

By End-User:The end-user segmentation includes Airlines, Airport Authorities, Ground Handling Service Providers, and Freight Forwarders. Airlines are the dominant end-user segment, driven by the need for efficient ground handling services to manage increasing passenger volumes and operational complexities. The growing competition among airlines to provide superior customer service has led to a heightened focus on optimizing ground handling processes, making this segment crucial for market growth. Airport authorities and service providers are also investing in automation and digital solutions to streamline operations and improve turnaround times.

The Global Airport Ground Handling Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swissport International AG, Menzies Aviation plc, dnata (The Emirates Group), Worldwide Flight Services (WFS), SATS Ltd., Celebi Aviation Holding Inc., Qatar Aviation Services (QAS), Aviapartner Group, Air France KLM Martinair Cargo, TCR Group, Fraport AG, Tokyo International Air Terminal Corporation, Aéroports de Paris (Groupe ADP), Hava? Ground Handling Co., Çelebi Hava Servisi A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the airport ground handling systems market in None appears promising, driven by ongoing technological advancements and increasing air traffic. As airports continue to modernize their infrastructure, the adoption of automation and digital solutions will become more prevalent. Additionally, the focus on sustainability will lead to the development of eco-friendly ground handling practices, enhancing operational efficiency while reducing environmental impact. These trends are expected to shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Aircraft Handling Passenger Handling Cargo and Baggage Handling Ramp Handling Aircraft Maintenance Ground Support Equipment Others |

| By End-User | Airlines Airport Authorities Ground Handling Service Providers Freight Forwarders |

| By Service Type | Full-Service Handling Self-Service Handling Hybrid Handling |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Power Source | Non-electric Electric |

| By Technology | Automated Systems Manual Systems Hybrid Systems |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Ground Handling Services | 120 | Airport Operations Managers, Ground Service Providers |

| Cargo Handling Operations | 90 | Cargo Managers, Logistics Coordinators |

| Ramp Services Management | 60 | Ramp Supervisors, Equipment Operators |

| Technology Integration in Ground Handling | 50 | IT Managers, Innovation Officers |

| Regulatory Compliance in Ground Handling | 40 | Compliance Officers, Safety Managers |

The Global Airport Ground Handling Systems Market is valued at approximately USD 6 billion, driven by increasing air passenger traffic, airport infrastructure expansion, and the demand for efficient ground handling services.