Region:Global

Author(s):Dev

Product Code:KRAC0463

Pages:88

Published On:August 2025

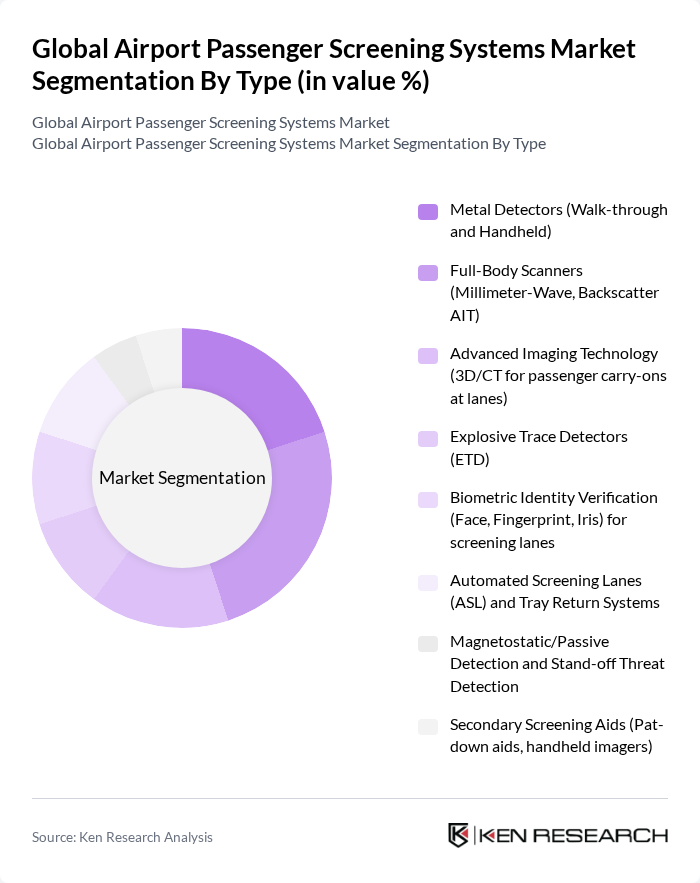

By Type:The market is segmented into various types of screening systems, each catering to specific security needs and technological advancements. The subsegments include Metal Detectors (Walk-through and Handheld), Full-Body Scanners (Millimeter-Wave, Backscatter AIT), Advanced Imaging Technology (3D/CT for passenger carry-ons at lanes), Explosive Trace Detectors (ETD), Biometric Identity Verification (Face, Fingerprint, Iris) for screening lanes, Automated Screening Lanes (ASL) and Tray Return Systems, Magnetostatic/Passive Detection and Stand-off Threat Detection, and Secondary Screening Aids (Pat-down aids, handheld imagers).

The Full-Body Scanners segment is currently dominating the market due to their ability to provide comprehensive security checks while minimizing passenger wait times. These scanners utilize advanced imaging technology that enhances detection capabilities for concealed threats, making them a preferred choice among airport operators. The increasing focus on passenger safety and the need for efficient screening processes have led to a significant rise in the adoption of full-body scanners across major airports globally.

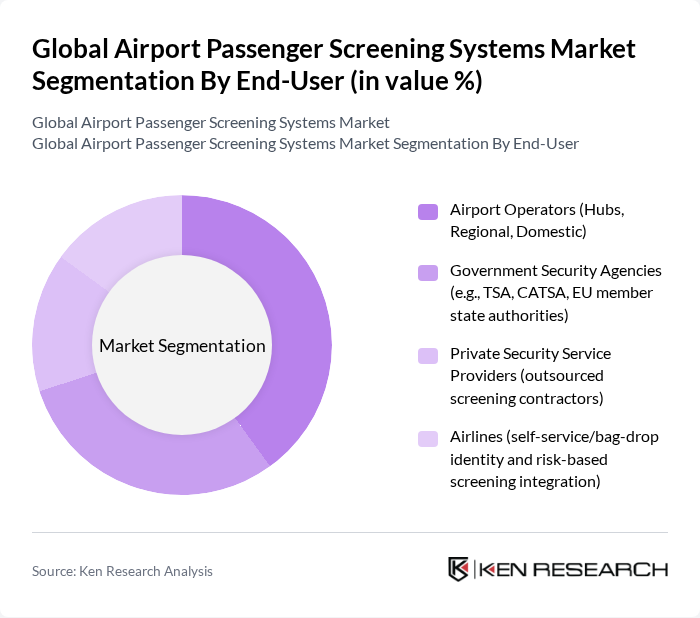

By End-User:The market is segmented based on end-users, which include Airport Operators (Hubs, Regional, Domestic), Government Security Agencies (e.g., TSA, CATSA, EU member state authorities), Private Security Service Providers (outsourced screening contractors), and Airlines (self-service/bag-drop identity and risk-based screening integration).

Airport Operators are the leading end-users in the market, driven by the need for enhanced security measures and efficient passenger processing. With the increasing volume of air travel, airport operators are investing heavily in advanced screening technologies to ensure safety and compliance with regulatory standards. This trend is further supported by government mandates for improved security infrastructure, making airport operators a critical segment in the airport passenger screening systems market.

The Global Airport Passenger Screening Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smiths Detection, Leidos, Rapiscan Systems (OSI Systems), L3Harris Security & Detection Systems (now part of Leidos), Analogic Corporation, Nuctech Company Limited, CEIA S.p.A., Astrophysics Inc., VOTI Detection, Garrett Metal Detectors, Evolv Technology, IDEMIA, Thales Group, Vision-Box, SITA contribute to innovation, geographic expansion, and service delivery in this space.

The future of airport passenger screening systems is poised for transformation, driven by technological innovations and evolving security needs. As airports increasingly adopt biometric screening and mobile solutions, the focus will shift towards enhancing passenger experience while maintaining stringent security protocols. The integration of data analytics will further optimize screening processes, enabling real-time decision-making. This evolution will not only improve operational efficiency but also foster greater passenger trust in airport security measures, ensuring a safer travel environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Metal Detectors (Walk-through and Handheld) Full-Body Scanners (Millimeter-Wave, Backscatter AIT) Advanced Imaging Technology (3D/CT for passenger carry-ons at lanes) Explosive Trace Detectors (ETD) Biometric Identity Verification (Face, Fingerprint, Iris) for screening lanes Automated Screening Lanes (ASL) and Tray Return Systems Magnetostatic/Passive Detection and Stand-off Threat Detection Secondary Screening Aids (Pat-down aids, handheld imagers) |

| By End-User | Airport Operators (Hubs, Regional, Domestic) Government Security Agencies (e.g., TSA, CATSA, EU member state authorities) Private Security Service Providers (outsourced screening contractors) Airlines (self-service/bag-drop identity and risk-based screening integration) |

| By Application | Passenger Screening (checkpoint, secondary, random screening) Cabin Baggage Screening at Passenger Lanes Access Control and Staff Screening Pre-security Identity/Document Verification (eGates, eKiosks) |

| By Component | Hardware (portals, scanners, ETD units, trays, conveyors) Software & Analytics (threat recognition algorithms, AI/ML) Services (installation, calibration, maintenance, training) |

| By Sales Channel | Direct to Government/Airport (tenders, framework contracts) System Integrators and Distributors OEM Partnerships/Alliances |

| By Distribution Mode | Offline Procurement (RFPs, framework agreements) Online/Framework Portals (e-procurement) |

| By Price Range | Entry-Level (basic metal detectors, handhelds) Mid-Range (ETD, standard AIT portals) Premium (mmWave AIT, CT scanners integrated with ASL) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Security Management | 90 | Security Directors, Operations Managers |

| Passenger Experience Feedback | 120 | Frequent Flyers, Airport Users |

| Screening Technology Providers | 70 | Product Managers, Sales Executives |

| Regulatory Compliance Insights | 60 | Compliance Officers, Legal Advisors |

| Airport Infrastructure Development | 60 | Project Managers, Airport Planners |

The Global Airport Passenger Screening Systems Market is valued at approximately USD 2.4 billion, driven by increasing passenger traffic, security concerns, and advancements in screening technologies. This growth reflects the heightened demand for effective airport security measures.