Region:Global

Author(s):Rebecca

Product Code:KRAA1362

Pages:83

Published On:August 2025

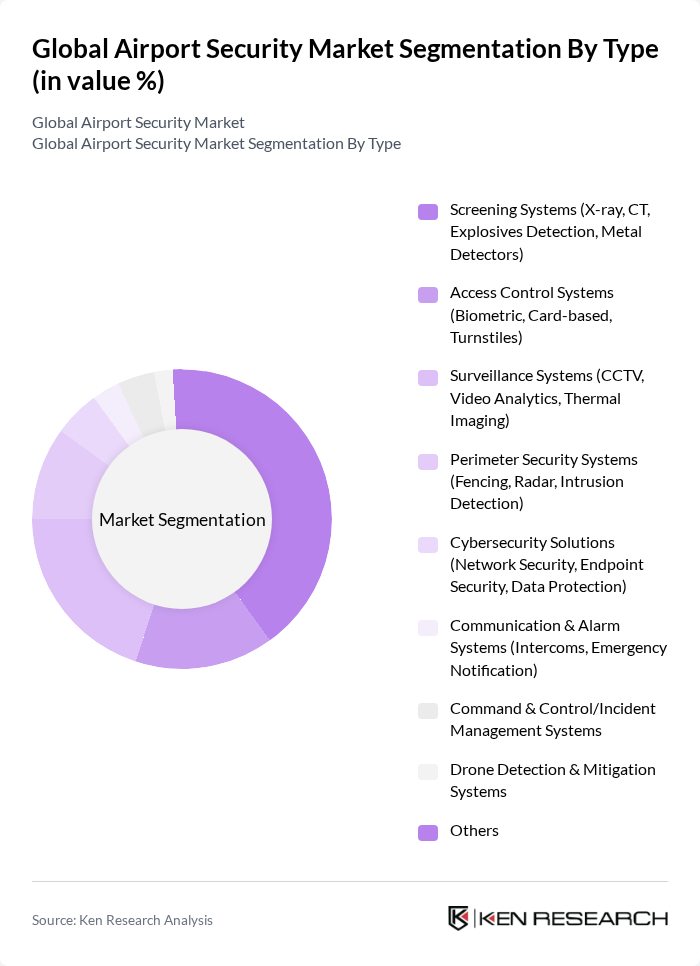

By Type:The market is segmented into various types of security systems, each catering to specific security needs at airports. The primary segments include Screening Systems, Access Control Systems, Surveillance Systems, Perimeter Security Systems, Cybersecurity Solutions, Communication & Alarm Systems, Command & Control/Incident Management Systems, Drone Detection & Mitigation Systems, and Others. Among these, Screening Systems are currently the most dominant due to the increasing focus on passenger safety, regulatory mandates for advanced screening, and the need for efficient baggage handling. Access Control and Biometric Systems are also experiencing rapid growth as airports move toward seamless identity verification and touchless processing .

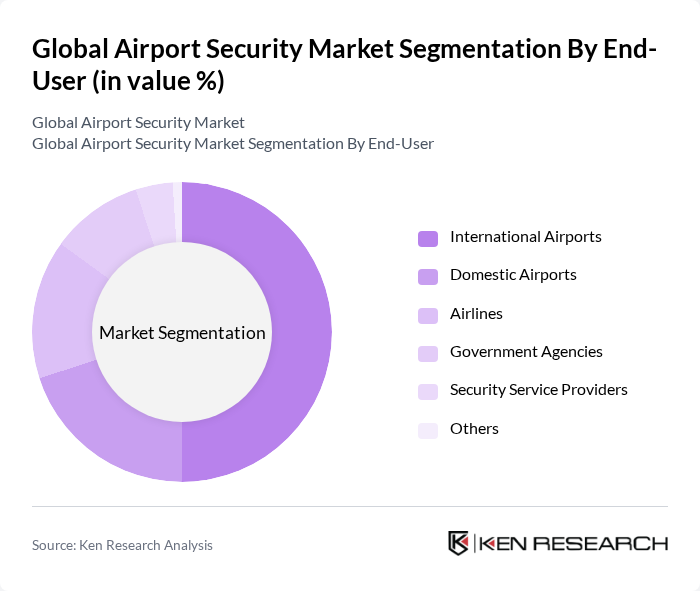

By End-User:The market is segmented based on end-users, which include International Airports, Domestic Airports, Airlines, Government Agencies, Security Service Providers, and Others. International Airports are the leading segment, driven by the need for stringent security measures to protect a high volume of international travelers and cargo, necessitating advanced security technologies. Domestic airports are also increasing investments in security modernization, while airlines and government agencies are adopting integrated security management platforms for compliance and operational efficiency .

The Global Airport Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, L3Harris Technologies, Smiths Detection, Rapiscan Systems (OSI Systems, Inc.), Bosch Sicherheitssysteme GmbH, SITA, Amadeus IT Group, Honeywell International Inc., Siemens AG, Axis Communications AB, Teledyne FLIR LLC, Dahua Technology Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., Genetec Inc., Johnson Controls International plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the airport security market is poised for significant transformation, driven by technological innovations and an increasing emphasis on passenger experience. As airports adopt smart technologies, including AI and machine learning, the efficiency of security processes will improve. Additionally, the integration of cybersecurity measures into airport operations will become critical, ensuring that both physical and digital security are prioritized. This dual focus will likely shape the market landscape in the coming years, fostering growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Screening Systems (X-ray, CT, Explosives Detection, Metal Detectors) Access Control Systems (Biometric, Card-based, Turnstiles) Surveillance Systems (CCTV, Video Analytics, Thermal Imaging) Perimeter Security Systems (Fencing, Radar, Intrusion Detection) Cybersecurity Solutions (Network Security, Endpoint Security, Data Protection) Communication & Alarm Systems (Intercoms, Emergency Notification) Command & Control/Incident Management Systems Drone Detection & Mitigation Systems Others |

| By End-User | International Airports Domestic Airports Airlines Government Agencies Security Service Providers Others |

| By Component | Hardware Software Services (Installation, Maintenance, Training) |

| By Sales Channel | Direct Sales Distributors/Resellers System Integrators Online Sales |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America |

| By Airport Size | Large Airports ( >30 million passengers/year) Medium Airports (15–30 million passengers/year) Small Airports ( <15 million passengers/year) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Security Management | 100 | Security Managers, Airport Operations Directors |

| Security Technology Providers | 60 | Product Managers, Sales Directors |

| Regulatory Compliance Officers | 50 | Compliance Managers, Legal Advisors |

| Passenger Experience and Safety | 55 | Customer Experience Managers, Safety Officers |

| Airport Infrastructure Development | 70 | Project Managers, Infrastructure Planners |

The Global Airport Security Market is valued at approximately USD 15.75 billion, driven by increasing passenger traffic, security concerns, and technological advancements in security solutions.