Region:Global

Author(s):Shubham

Product Code:KRAA1930

Pages:98

Published On:August 2025

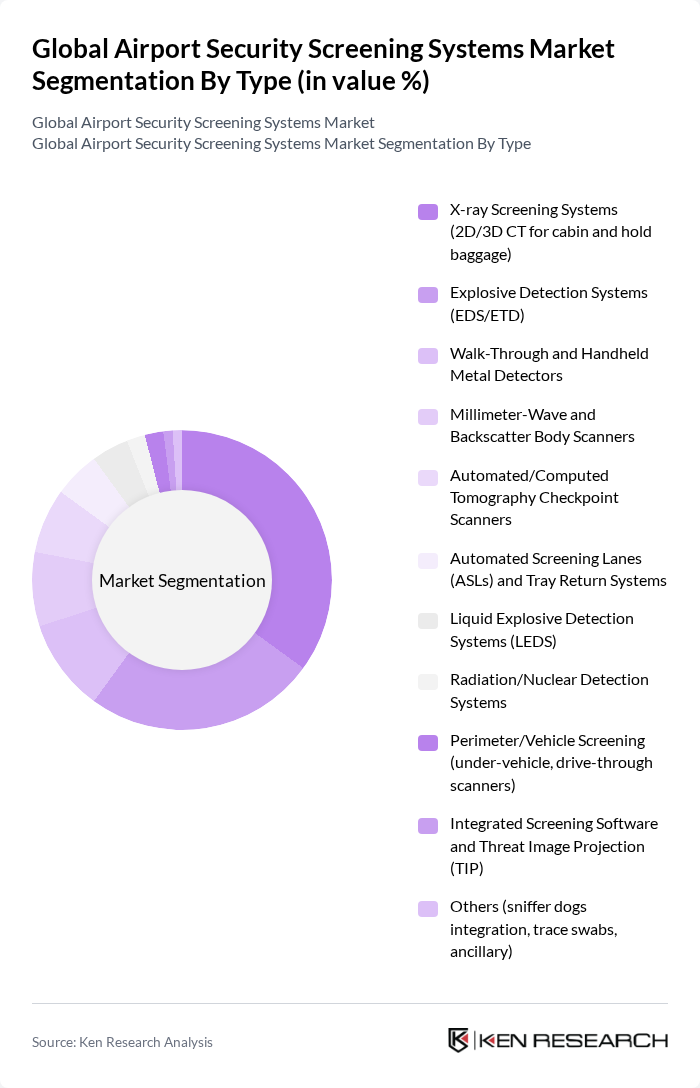

By Type:The market is segmented into various types of screening systems, each catering to specific security needs. The dominant sub-segment isX-ray Screening Systems(including 2D and CT for cabin and hold baggage), widely deployed for baggage inspection and increasingly upgraded to CT meeting ECAC EDS CB C3 performance levels.Explosive Detection Systems (EDS/ETD)remain critical for baggage and trace screening in high-security environments. The increasing adoption ofautomated systems—such as automated screening lanes, AI-enabled auto-detection, and high-throughput CT—is driven by the need for efficiency and faster processing at checkpoints while maintaining stringent detection performance .

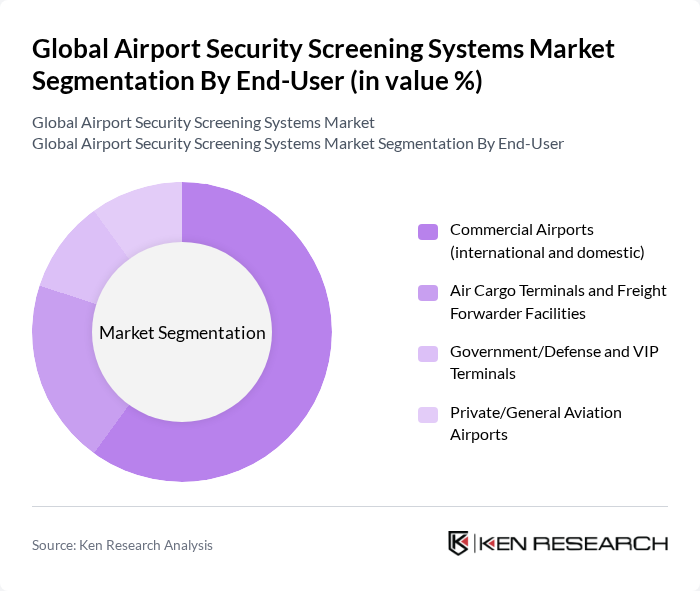

By End-User:The end-user segmentation includes various categories such as commercial airports, air cargo terminals, government/defense, and private aviation.Commercial airportsdominate due to high passenger throughput and mandatory compliance with TSA/ECAC/ICAO-aligned screening requirements.Air cargo terminalsshow rising adoption of certified EDS and ETD solutions driven by e-commerce growth and regulated air cargo security programs .

The Global Airport Security Screening Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smiths Detection, Leidos, Rapiscan Systems (OSI Systems), Analogic Corporation, Nuctech Company Limited, CEIA S.p.A., Astrophysics Inc., Leidos Security Detection & Automation, VOTI Detection, Gilardoni S.p.A., L3Harris Security & Detection Systems (legacy installed base), Evolv Technology, Adani Systems, Inc. (ADANI), Garrett Metal Detectors, Teledyne ICM (Teledyne Technologies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of airport security screening systems is poised for significant transformation, driven by technological advancements and evolving security needs. As airports increasingly adopt biometric and contactless screening technologies, operational efficiency and passenger experience will improve. Additionally, the integration of data analytics for threat detection will enhance security measures. These trends indicate a shift towards more automated and intelligent systems, ensuring that airports can effectively manage growing passenger volumes while maintaining high safety standards.

| Segment | Sub-Segments |

|---|---|

| By Type | X-ray Screening Systems (2D/3D CT for cabin and hold baggage) Explosive Detection Systems (EDS/ETD) Walk-Through and Handheld Metal Detectors Millimeter-Wave and Backscatter Body Scanners Automated/Computed Tomography Checkpoint Scanners Automated Screening Lanes (ASLs) and Tray Return Systems Liquid Explosive Detection Systems (LEDS) Radiation/Nuclear Detection Systems Perimeter/Vehicle Screening (under-vehicle, drive-through scanners) Integrated Screening Software and Threat Image Projection (TIP) Others (sniffer dogs integration, trace swabs, ancillary) |

| By End-User | Commercial Airports (international and domestic) Air Cargo Terminals and Freight Forwarder Facilities Government/Defense and VIP Terminals Private/General Aviation Airports |

| By Application | Passenger Screening Checkpoints Cabin Baggage Screening Hold/Checked Baggage Screening Air Cargo and Mail Screening Landside/Perimeter and Access Control Screening |

| By Component | Hardware (scanners, detectors, conveyors) Software/Algorithms (AI/ML, auto-detection, integration) Services (installation, MRO, calibration, training) |

| By Sales Channel | Direct Sales to Airport Authorities System Integrators and Distributors Government Procurement Frameworks/Tenders |

| By Distribution Mode | Air Transport Land Transport Sea Transport |

| By Price Range | Entry-Level Systems Mid-Range Systems Premium/High-Capacity Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Security Management | 100 | Security Managers, Operations Directors |

| Technology Providers for Screening Systems | 80 | Product Managers, Sales Directors |

| Regulatory Compliance Experts | 60 | Compliance Officers, Legal Advisors |

| Airport Operations and Logistics | 70 | Logistics Managers, Facility Managers |

| Passenger Experience and Feedback | 90 | Customer Service Managers, Passenger Experience Officers |

The Global Airport Security Screening Systems Market is valued at approximately USD 4.6 billion, reflecting a significant growth trend driven by increasing passenger traffic, security concerns, and technological advancements in screening systems.