Region:Global

Author(s):Shubham

Product Code:KRAD0776

Pages:89

Published On:August 2025

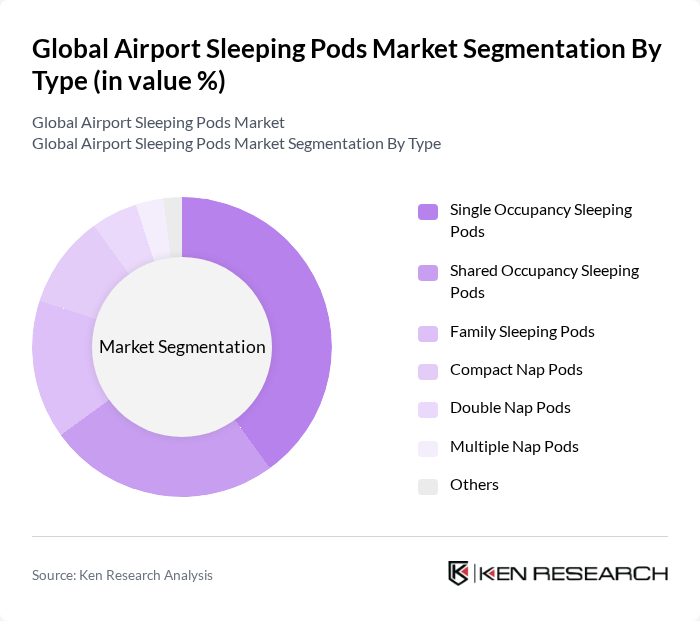

By Type:The market is segmented into Single Occupancy Sleeping Pods, Shared Occupancy Sleeping Pods, Family Sleeping Pods, Compact Nap Pods, Double Nap Pods, Multiple Nap Pods, and Others. Single Occupancy Sleeping Pods remain the most popular due to their privacy, comfort, and appeal to business travelers and solo passengers seeking a quiet space to rest. Shared Occupancy Sleeping Pods are gaining traction in budget-conscious markets, offering a more economical option for travelers. Family Sleeping Pods are increasingly in demand as airports invest in family-friendly amenities. Compact Nap Pods and Double Nap Pods are preferred for short-term rest and space optimization, while Multiple Nap Pods and other variants cater to group travelers and flexible usage scenarios.

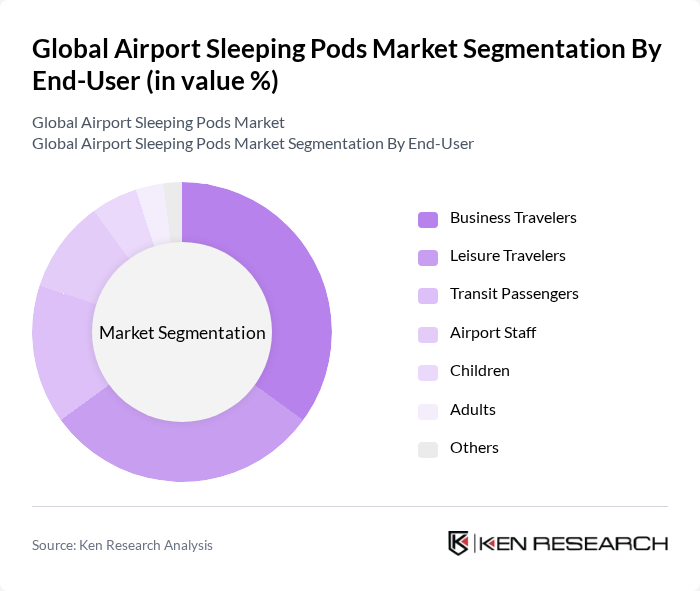

By End-User:The end-user segmentation includes Business Travelers, Leisure Travelers, Transit Passengers, Airport Staff, Children, Adults, and Others. Business Travelers continue to dominate the market, driven by their need for quick rest during layovers and tight schedules. Leisure Travelers are significant users, seeking comfort and convenience during travel. The adoption of sleeping pods by airport staff is rising, particularly for long shifts and overnight duties. The increasing number of families traveling with children is driving demand for family-oriented sleeping solutions, while adults and children benefit from dedicated pods designed for their specific needs.

The Global Airport Sleeping Pods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sleepbox, Minute Suites, YOTEL, SnoozeCube, GoSleep, Podtime, ZzzleepandGo, Restworks, Dream and Fly, Napcabs GmbH, 9hours (Nine Hours), AirPod Smart Sleeping Pods, JetQuay, Sleep 'n Fly, Rest & Fly contribute to innovation, geographic expansion, and service delivery in this space.

The future of the airport sleeping pods market appears promising, driven by increasing passenger traffic and a growing emphasis on traveler comfort. As airports continue to modernize and expand, the integration of innovative sleeping solutions will likely become a standard offering. Additionally, the trend towards sustainability and smart technology will shape the design and functionality of sleeping pods, enhancing their appeal to environmentally conscious travelers and tech-savvy consumers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Occupancy Sleeping Pods Shared Occupancy Sleeping Pods Family Sleeping Pods Compact Nap Pods Double Nap Pods Multiple Nap Pods Others |

| By End-User | Business Travelers Leisure Travelers Transit Passengers Airport Staff Children Adults Others |

| By Location | International Airports Domestic Airports Regional Airports Others |

| By Service Model | Pay-per-use Subscription-based Membership Programs Others |

| By Amenities Offered | Basic Amenities (bed, lighting, ventilation) Premium Amenities (private bathroom, entertainment system) Tech-enabled Amenities (Wi-Fi, smart controls, charging ports) Eco-friendly Features (energy-efficient lighting, sustainable materials) Others |

| By Duration of Stay | Less than 2 hours 6 hours Overnight Stays Others |

| By Pricing Tier | Budget Tier Mid-range Tier Premium Tier Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Management Insights | 60 | Airport Directors, Operations Managers |

| Traveler Preferences Survey | 120 | Frequent Flyers, Business Travelers |

| Service Provider Feedback | 50 | Concessionaires, Facility Managers |

| Market Trend Analysis | 40 | Travel Industry Analysts, Market Researchers |

| Consumer Behavior Study | 90 | Leisure Travelers, Airport Users |

The Global Airport Sleeping Pods Market is valued at approximately USD 83 million, driven by increasing air traveler numbers, longer layover times, and a growing demand for comfort and convenience during airport stays.