Region:Global

Author(s):Dev

Product Code:KRAA2621

Pages:86

Published On:August 2025

By Equipment Type:The equipment type segmentation includes various categories such as Snow Plow Trucks, Rotary Brooms/Sweepers, Snow Blowers, De-icing Vehicles & Equipment, Spreaders (Solid & Liquid), Multi-Task Vehicles, Tow-Behind Equipment, Loaders & Prime Movers, and Others. Each of these subsegments plays a crucial role in ensuring effective snow removal operations at airports .

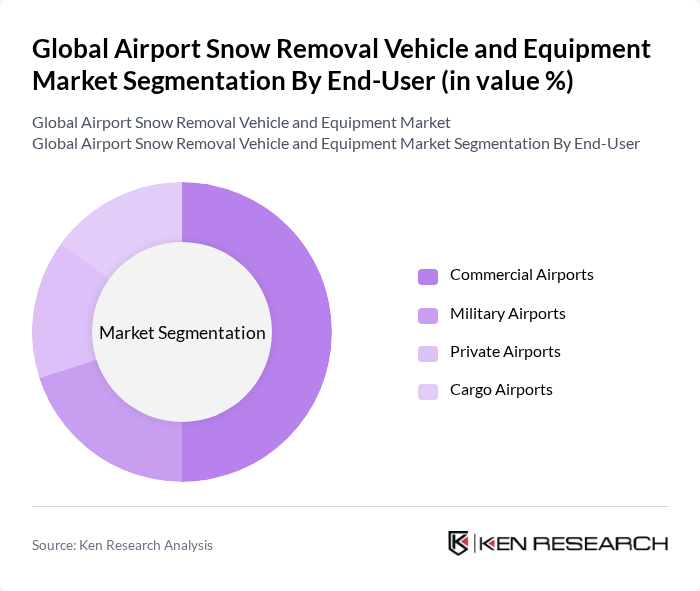

By End-User:The end-user segmentation includes Commercial Airports, Military Airports, Private Airports, and Cargo Airports. Each of these segments has unique requirements and operational challenges that influence their demand for snow removal vehicles and equipment .

The Global Airport Snow Removal Vehicle and Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oshkosh Corporation, Aebi Schmidt Holding AG, Boschung Group, Alamo Group Inc., M-B Companies, Inc., Dulevo International S.p.A., Tenco Inc., Ziegler CAT, TLD Group, Harsco Corporation, Kato Works Co., Ltd., Terex Corporation, SnowEx (a division of Douglas Dynamics), Cormac Engineering Ltd., Multihog Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the airport snow removal vehicle and equipment market is poised for growth, driven by increasing automation and a focus on sustainability. As airports adopt smart technologies, the integration of IoT and data analytics will enhance operational efficiency and safety. Additionally, the shift towards electric and hybrid vehicles will align with global sustainability goals, reducing emissions and operational costs. These trends indicate a transformative phase for the industry, emphasizing innovation and environmental responsibility in snow management practices.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Snow Plow Trucks Rotary Brooms/Sweepers Snow Blowers De-icing Vehicles & Equipment Spreaders (Solid & Liquid) Multi-Task Vehicles Tow-Behind Equipment Loaders & Prime Movers Others |

| By End-User | Commercial Airports Military Airports Private Airports Cargo Airports |

| By Application | Runway Clearing Taxiway Maintenance Apron & Parking Area Management Terminal Access Roads |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Technology | Conventional Equipment Advanced Technology Equipment (Automated, GPS-enabled, IoT-integrated) Eco-Friendly Equipment (Electric, Hybrid, Low-Emission) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Operations Management | 60 | Operations Managers, Facility Directors |

| Snow Removal Equipment Suppliers | 45 | Sales Managers, Product Development Leads |

| Maintenance Teams at Airports | 50 | Maintenance Supervisors, Equipment Operators |

| Regulatory Bodies and Safety Inspectors | 40 | Regulatory Officers, Safety Compliance Managers |

| Weather and Climate Experts | 40 | Climatologists, Meteorologists |

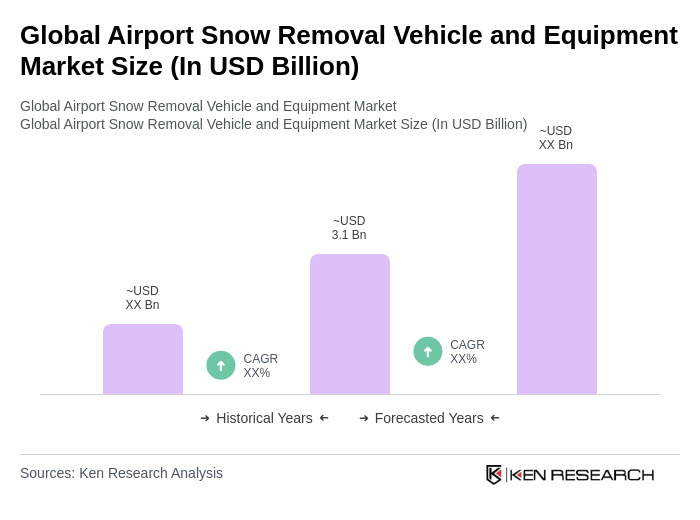

The Global Airport Snow Removal Vehicle and Equipment Market is valued at approximately USD 3.1 billion, driven by increasing air traffic and the need for efficient operations during winter months, alongside advancements in snow removal technologies.