Region:Global

Author(s):Geetanshi

Product Code:KRAA1286

Pages:87

Published On:August 2025

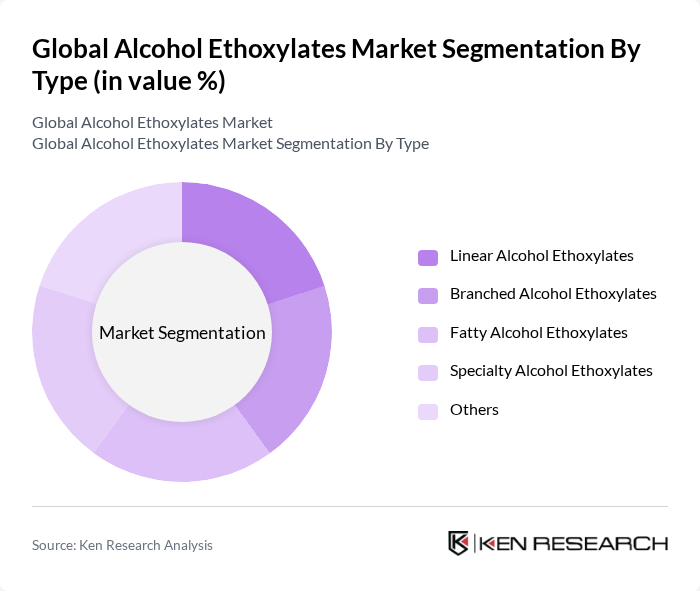

By Type:The market is segmented into various types of alcohol ethoxylates, including Linear Alcohol Ethoxylates, Branched Alcohol Ethoxylates, Fatty Alcohol Ethoxylates, Specialty Alcohol Ethoxylates, and Others. Among these, Linear Alcohol Ethoxylates are the most widely used due to their effectiveness as surfactants in cleaning and personal care products. Their compatibility with a wide range of formulations and favorable performance characteristics make them a preferred choice for manufacturers .

By Application:The applications of alcohol ethoxylates are diverse, including Household Cleaning Products, Personal Care Products, Industrial Cleaning Agents, Agricultural Chemicals, Textile Processing, Oilfield Chemicals, and Others. The Household Cleaning Products segment leads the market, driven by increasing consumer preference for effective and eco-friendly cleaning solutions. The surge in demand for household cleaning products, especially during and after the pandemic, has significantly boosted this segment .

The Global Alcohol Ethoxylates Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Huntsman Corporation, Clariant AG, Evonik Industries AG, AkzoNobel N.V., Croda International Plc, Solvay S.A., Oxiteno S.A. Indústria e Comércio, Stepan Company, KAO Corporation, Wilmar International Limited, Innospec Inc., Mitsubishi Chemical Corporation, Sasol Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the alcohol ethoxylates market appears promising, driven by a growing emphasis on sustainability and innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in research and development to create advanced formulations. Additionally, the expansion into emerging markets will provide new growth avenues, particularly in Asia-Pacific, where rising disposable incomes and urbanization are expected to boost demand for personal care and household products significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Alcohol Ethoxylates Branched Alcohol Ethoxylates Fatty Alcohol Ethoxylates Specialty Alcohol Ethoxylates Others |

| By Application | Household Cleaning Products (Detergents, Laundry Liquids) Personal Care Products (Shampoos, Cosmetics) Industrial Cleaning Agents Agricultural Chemicals (Adjuvants, Pesticide Formulations) Textile Processing Oilfield Chemicals Others |

| By End-User | Consumer Goods Manufacturers Industrial Manufacturing Agriculture Textile Industry Oil & Gas Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Liquid Powder Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Product Development Managers, Brand Managers |

| Household Cleaning Products | 80 | Procurement Managers, R&D Chemists |

| Industrial Applications | 70 | Operations Managers, Technical Sales Representatives |

| Agricultural Chemicals | 50 | Field Researchers, Regulatory Affairs Specialists |

| Textile and Leather Processing | 40 | Production Supervisors, Quality Control Managers |

The Global Alcohol Ethoxylates Market is valued at approximately USD 6.8 billion, reflecting a robust growth trajectory driven by increasing demand for surfactants across various applications, including household cleaning and personal care products.