Region:Global

Author(s):Dev

Product Code:KRAD0456

Pages:82

Published On:August 2025

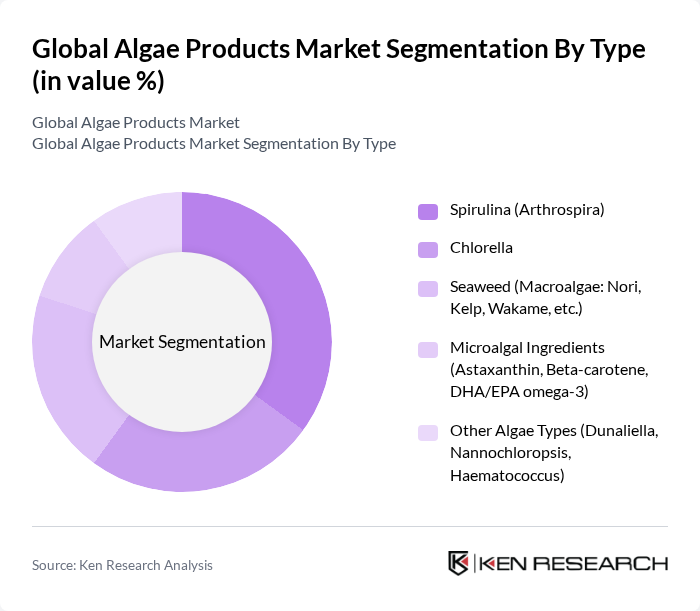

By Type:The market is segmented into various types of algae products, including Spirulina (Arthrospira), Chlorella, Seaweed (Macroalgae), Microalgal Ingredients, and Other Algae Types. Spirulina and Chlorella are widely used for protein, essential amino acids, vitamins, minerals, and antioxidant pigments (notably phycocyanin and chlorophyll), while seaweeds (nori, kelp, wakame, etc.) provide hydrocolloids and functional food uses. Microalgal ingredients such as astaxanthin, beta-carotene, and DHA/EPA omega-3 are gaining traction in nutraceuticals, dietary supplements, infant formula fortification, and specialty cosmetics due to clean-label positioning and sustainability advantages versus fish-derived inputs. ,

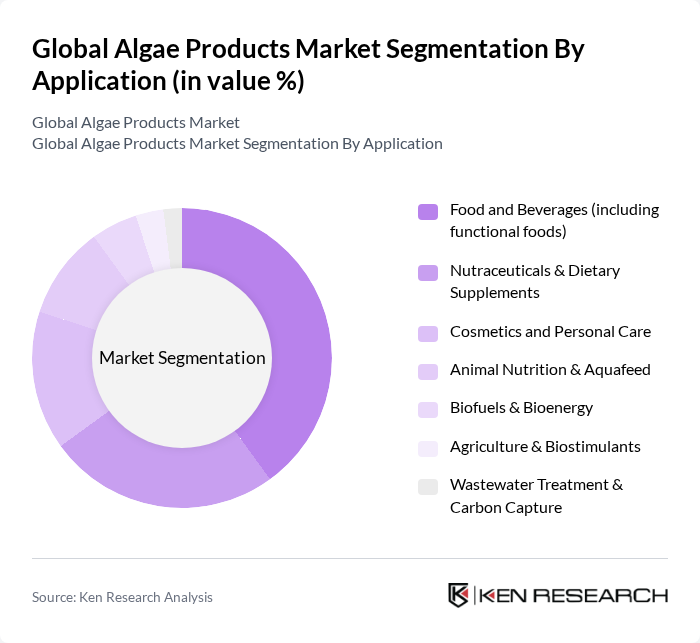

By Application:The applications of algae products span across various sectors, including Food and Beverages, Nutraceuticals & Dietary Supplements, Cosmetics and Personal Care, Animal Nutrition & Aquafeed, Biofuels & Bioenergy, Agriculture & Biostimulants, and Wastewater Treatment & Carbon Capture. The food and beverage sector remains the largest consumer, supported by growth in functional foods, plant-based proteins, natural colorants (phycocyanin, beta-carotene), and fortification with algal omega-3s; animal nutrition and aquafeed adopt algal DHA for fish-free formulation; and agriculture increasingly uses algae extracts as biostimulants for yield and stress tolerance. ,

The Global Algae Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cyanotech Corporation, DIC Corporation (incl. Earthrise Nutritionals), Corbion N.V. (algal DHA, omega-3), Cargill, Incorporated (algae-based ingredients), AstaReal AB (astaxanthin), AlgaEnergy, S.A., Algenol Biotech LLC, Algama Foods, Algae Systems LLC, Allmicroalgae – Natural Products S.A., E.I. du Pont de Nemours and Company (DuPont) – alginates/biomaterials, DSM-Firmenich (algal omega-3 via Veramaris JV), Veramaris (DSM-Firmenich & Evonik JV), Evonik Industries AG (algal omega-3), Ocean Harvest Technology plc, Aker BioMarine ASA (krill and algal omega-3 initiatives), Alva (formerly TerraVia/Solazyme assets via Corbion), Phyco-Biotech (France), Fuqing King Dnarmsa Spirulina Co., Ltd., Tianjin Norland Biotech Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the algae products market appears promising, driven by increasing consumer demand for sustainable and health-oriented products. As technological advancements continue to lower production costs and improve efficiency, the market is likely to see a surge in innovative applications across various sectors. Additionally, the growing interest in carbon sequestration technologies presents new avenues for algae utilization, potentially transforming waste management and energy production landscapes in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Spirulina (Arthrospira) Chlorella Seaweed (Macroalgae: Nori, Kelp, Wakame, etc.) Microalgal Ingredients (Astaxanthin, Beta-carotene, DHA/EPA omega-3) Other Algae Types (Dunaliella, Nannochloropsis, Haematococcus) |

| By Application | Food and Beverages (including functional foods) Nutraceuticals & Dietary Supplements Cosmetics and Personal Care Animal Nutrition & Aquafeed Biofuels & Bioenergy Agriculture & Biostimulants Wastewater Treatment & Carbon Capture |

| By End-User | Food & Beverage Manufacturers Nutraceutical & Pharmaceutical Companies Personal Care & Cosmetics Brands Aquaculture & Livestock Producers Biofuel Producers & Energy Companies Agriculture Input Providers |

| By Sales Channel | Direct B2B (contracts with manufacturers) Distributors/Wholesalers Online Retail (D2C supplements and ingredients) Specialty Retail & Health Stores |

| By Distribution Mode | B2B B2C E-commerce/Marketplace Others |

| By Price Range | Premium (e.g., astaxanthin, algal DHA) Mid-Range Budget/Commodity (e.g., bulk spirulina, seaweed) |

| By Others | Specialty Products (encapsulated omega-3, pigments) Organic & Non-GMO Algae Products Customized/Contract Manufacturing Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 150 | Product Development Managers, Quality Assurance Specialists |

| Cosmetics and Personal Care | 100 | Formulation Chemists, Brand Managers |

| Biofuels and Renewable Energy | 80 | Energy Analysts, Project Managers |

| Pharmaceuticals and Nutraceuticals | 70 | Regulatory Affairs Specialists, Research Scientists |

| Animal Feed and Agriculture | 90 | Agronomists, Feed Formulation Experts |

The Global Algae Products Market is valued at approximately USD 3.1 billion, reflecting a significant growth trend driven by the increasing demand for algae-derived ingredients in various sectors, including nutrition, cosmetics, and specialty ingredients.