Region:Global

Author(s):Rebecca

Product Code:KRAB0190

Pages:80

Published On:August 2025

By Type:The alkaline battery market is segmented into AA Batteries, AAA Batteries, 9V Batteries, C Batteries, D Batteries, Specialty Batteries, Button Cell Batteries, and Others. AA and AAA batteries are the most widely used, primarily due to their application in consumer electronics, toys, and household devices. Their versatility, availability, and compatibility with a broad range of products make them the preferred choice for consumers, resulting in a dominant market share for these segments .

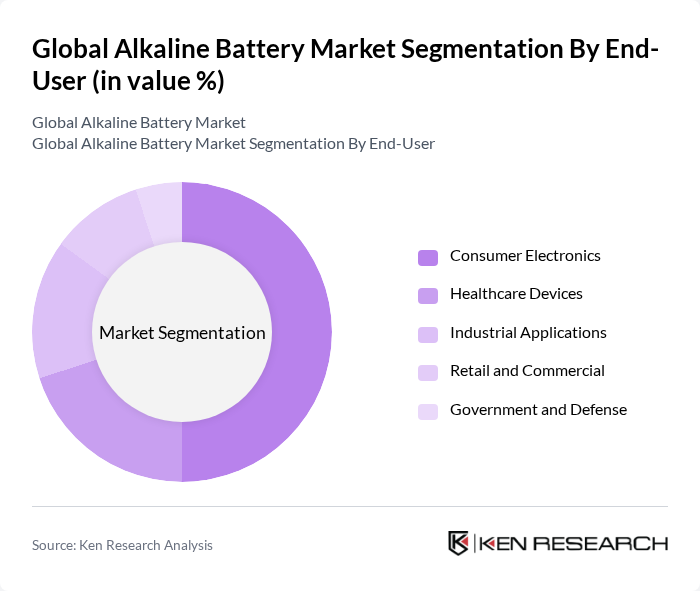

By End-User:The market is segmented by end-user into Consumer Electronics, Healthcare Devices, Industrial Applications, Retail and Commercial, and Government and Defense. The Consumer Electronics segment is the largest, driven by the increasing use of batteries in devices such as remote controls, cameras, toys, and portable electronics. Growth in this segment is supported by the rising adoption of smart devices, wearables, and IoT-enabled products, as well as the need for reliable, long-lasting power sources .

The Global Alkaline Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Energizer Holdings, Inc., Duracell Inc., Panasonic Corporation, Rayovac (Spectrum Brands Holdings, Inc.), Toshiba Corporation, Varta AG, GP Batteries International Limited, Maxell Holdings, Ltd., Camelion Batterien GmbH, Sony Corporation, EVE Energy Co., Ltd., Zhongyin (Ningbo) Battery Co., Ltd., FDK Corporation, Nanfu Battery Co., Ltd., Gold Peak Industries (Holdings) Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the alkaline battery market appears promising, driven by technological advancements and a shift towards sustainable energy solutions. As manufacturers innovate to enhance battery efficiency and reduce environmental impact, the demand for eco-friendly alkaline batteries is expected to rise. Additionally, the increasing integration of alkaline batteries in smart home devices and renewable energy systems will further bolster market growth, creating new avenues for expansion and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | AA Batteries AAA Batteries V Batteries C Batteries D Batteries Specialty Batteries Button Cell Batteries Others |

| By End-User | Consumer Electronics Healthcare Devices Industrial Applications Retail and Commercial Government and Defense |

| By Application | Remote Controls Toys and Games Flashlights Smoke Detectors Portable Electronics Clocks and Watches Cameras Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Convenience Stores Wholesale Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Market | 100 | Product Managers, Retail Buyers |

| Automotive Battery Applications | 80 | Automotive Engineers, Procurement Managers |

| Industrial Battery Usage | 60 | Operations Managers, Facility Engineers |

| Retail Distribution Channels | 90 | Supply Chain Managers, Retail Executives |

| Research & Development Insights | 40 | R&D Directors, Technical Specialists |

The Global Alkaline Battery Market is valued at approximately USD 8.9 billion, driven by the increasing demand for portable electronic devices and advancements in battery technology, including improved energy density and longer shelf life.