Region:Global

Author(s):Shubham

Product Code:KRAD0618

Pages:80

Published On:August 2025

By Type:The market is segmented into various types of treatments, including topical treatments, oral medications, injectable/procedural options, hair transplantation, device-based therapies, nutraceuticals & supplements, and camouflage & cosmetic concealers. Among these, topical treatments and oral medications are the most widely used due to their accessibility and effectiveness.

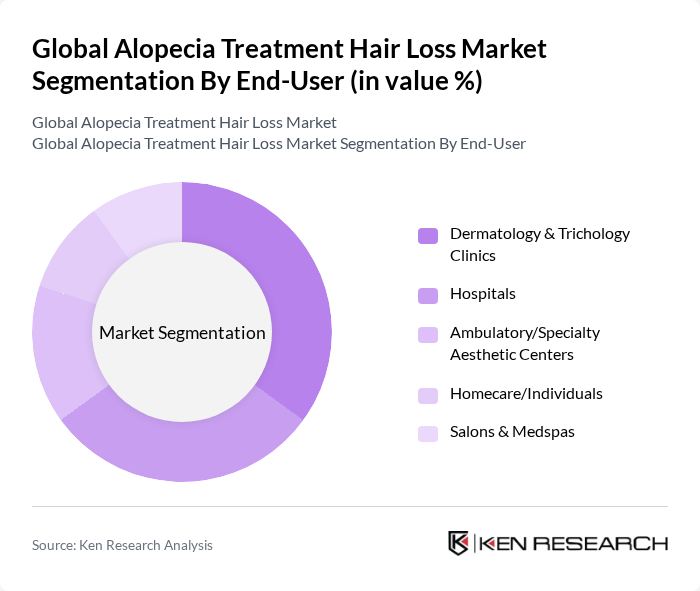

By End-User:The end-user segmentation includes dermatology & trichology clinics, hospitals, ambulatory/specialty aesthetic centers, homecare/individuals, and salons & medspas. Dermatology clinics and hospitals are the primary users due to their access to advanced treatment options and professional expertise.

The Global Alopecia Treatment Hair Loss Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eli Lilly and Company, Incyte Corporation, Johnson & Johnson (McNeil Consumer Healthcare; Rogaine), Merck & Co., Inc. (Propecia/finasteride), Sun Pharmaceutical Industries Ltd. (Taro; topical minoxidil), Cipla Ltd. (topical/oral minoxidil; finasteride), Almirall S.A. (dermatology portfolio), Concert Pharmaceuticals, Inc. (a subsidiary of Sun Pharma), Aclaris Therapeutics, Inc., Hims & Hers Health, Inc., Keeps (Thirty Madison, Inc.), Nutrafol (Unilever), Church & Dwight Co., Inc. (Toppik), Lexington International, LLC (HairMax), Bosley Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the alopecia treatment market appears promising, driven by ongoing innovations and a growing consumer base. As awareness of hair loss solutions increases, more individuals are likely to seek effective treatments. Additionally, the integration of telemedicine is expected to enhance access to consultations, making it easier for patients to explore their options. The market is poised for growth as companies continue to invest in research and development, focusing on personalized and effective treatment solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Topical Treatments (e.g., Minoxidil, Ketoconazole) Oral Medications (e.g., Finasteride, Dutasteride, JAK inhibitors) Injectable/Procedural (PRP, Mesotherapy) Hair Transplantation (FUE, FUT) Device-Based Therapies (LLLT/laser combs, LEDs) Nutraceuticals & Supplements Camouflage & Cosmetic Concealers (fibers, sprays) |

| By End-User | Dermatology & Trichology Clinics Hospitals Ambulatory/Specialty Aesthetic Centers Homecare/Individuals Salons & Medspas |

| By Distribution Channel | Hospital Pharmacies Retail/Drug Stores & Chain Pharmacies Online Pharmacies & DTC E-commerce Specialty Stores & Clinics Supermarkets/Hypermarkets |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Age Group | 24 Years 34 Years 44 Years Years and Above |

| By Gender | Male Female Others |

| By Treatment Duration | Short-term Treatments Long-term Treatments Maintenance Treatments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 90 | Dermatologists, Clinic Managers |

| Patient Experience Surveys | 140 | Alopecia Patients, Caregivers |

| Pharmaceutical Providers | 80 | Product Managers, Sales Representatives |

| Healthcare Policy Experts | 60 | Health Economists, Policy Advisors |

| Clinical Research Institutions | 70 | Clinical Researchers, Trial Coordinators |

The Global Alopecia Treatment Hair Loss Market is valued at approximately USD 10.5 billion, reflecting a significant increase due to rising diagnosed prevalence, improved access to therapies, and growing consumer awareness regarding hair loss treatments.