Region:Global

Author(s):Shubham

Product Code:KRAA1733

Pages:85

Published On:August 2025

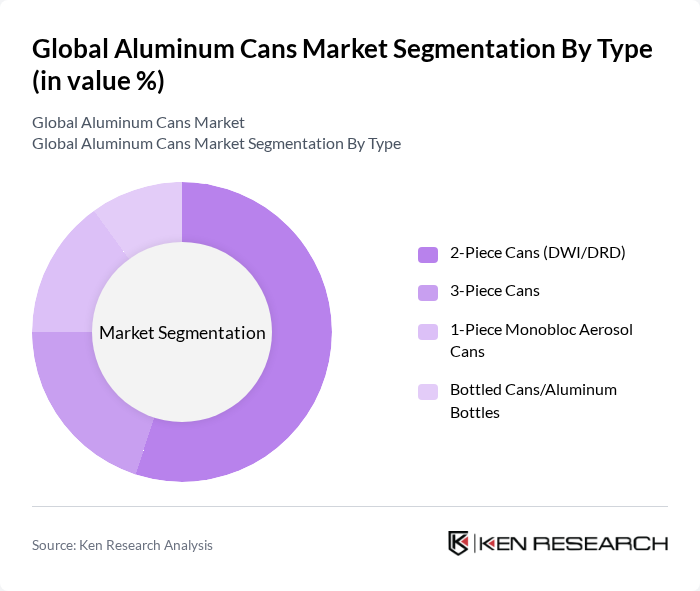

By Type:The aluminum cans market is segmented into various types, including 2-Piece Cans (DWI/DRD), 3-Piece Cans, 1-Piece Monobloc Aerosol Cans, and Bottled Cans/Aluminum Bottles. Among these, 2-Piece Cans dominate the market due to their lightweight nature and cost-effectiveness, making them a preferred choice for beverage manufacturers. The trend towards lightweight packaging is driven by consumer preferences for convenience and sustainability, leading to increased adoption of 2-Piece Cans in various applications. Industry sources consistently indicate 2-piece formats hold the majority share in beverages owing to cost efficiency, strength, and high-speed lines .

By End-User:The market is further segmented by end-user applications, including Beverages (Carbonated Soft Drinks, Beer, Energy & RTD, Water), Food (Canned Foods, Pet Food), Personal Care & Household (Aerosols), Pharmaceuticals & Nutraceuticals, and Industrial (Paints, Chemicals & Lubricants). The beverage sector is the largest end-user, driven by the rising consumption of carbonated drinks, beer, and energy/RTD beverages, as well as water moving into cans in select markets. Aluminum cans’ portability, light weight, and strong recyclability make them the preferred packaging for many beverage categories .

The Global Aluminum Cans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ball Corporation, Crown Holdings, Inc., Ardagh Metal Packaging S.A. (AMP), CANPACK S.A., Silgan Holdings Inc., Toyo Seikan Group Holdings, Ltd., CPMC Holdings Limited, Kian Joo Can Factory Berhad, Nampak Limited, CCL Container (CCL Industries Inc.), Shenzhen ORG Technology Co., Ltd. (ORG Packaging), Trivium Packaging, Massilly Group, Baosteel Packaging Co., Ltd., Envases Universales contribute to innovation, geographic expansion, and service delivery in this space.

The aluminum cans market is poised for significant growth, driven by increasing consumer demand for sustainable packaging and the expansion of the beverage industry. Innovations in recycling technologies will further enhance the market's sustainability profile, while regulatory pressures will push manufacturers towards greener practices. As e-commerce continues to rise, the demand for aluminum cans is expected to increase, providing opportunities for companies to innovate and capture new market segments, particularly in emerging economies.

| Segment | Sub-Segments |

|---|---|

| By Type | Piece Cans (DWI/DRD) Piece Cans Piece Monobloc Aerosol Cans Bottled Cans/Aluminum Bottles |

| By End-User | Beverages (Carbonated Soft Drinks, Beer, Energy & RTD, Water) Food (Canned Foods, Pet Food) Personal Care & Household (Aerosols) Pharmaceuticals & Nutraceuticals Industrial (Paints, Chemicals & Lubricants) |

| By Application | Carbonated Drinks Beer and Alcoholic Beverages Energy Drinks, RTD Tea/Coffee & Functional Beverages Water & Non-Carbonated Beverages Processed Foods & Pet Food Aerosols (Personal Care & Household) |

| By Distribution Channel | Direct to Brand Owners (B2B) Distributors/Wholesalers Contract Fillers/Beverage Co-packers Retail (Private Label/Small Brands) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Capacity | Up to 200 ml to 450 ml to 700 ml to 1000 ml More than 1000 ml |

| By Sustainability Features | Recycled Content Share (PCR %) Lightweighting (g/can) Closed-loop Collection & Return Systems BPA-NI & Next-Gen Coatings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Manufacturers | 120 | Product Managers, Supply Chain Directors |

| Aluminum Can Producers | 100 | Operations Managers, Quality Control Supervisors |

| Recycling Facilities | 80 | Recycling Managers, Environmental Compliance Officers |

| Logistics Providers | 70 | Logistics Coordinators, Distribution Managers |

| Retail Sector Insights | 90 | Category Managers, Procurement Officers |

The Global Aluminum Cans Market is valued at approximately USD 60 billion, reflecting a significant growth trend driven by the increasing demand for sustainable packaging solutions and high recycling rates associated with aluminum materials.