Region:Global

Author(s):Dev

Product Code:KRAC2635

Pages:98

Published On:October 2025

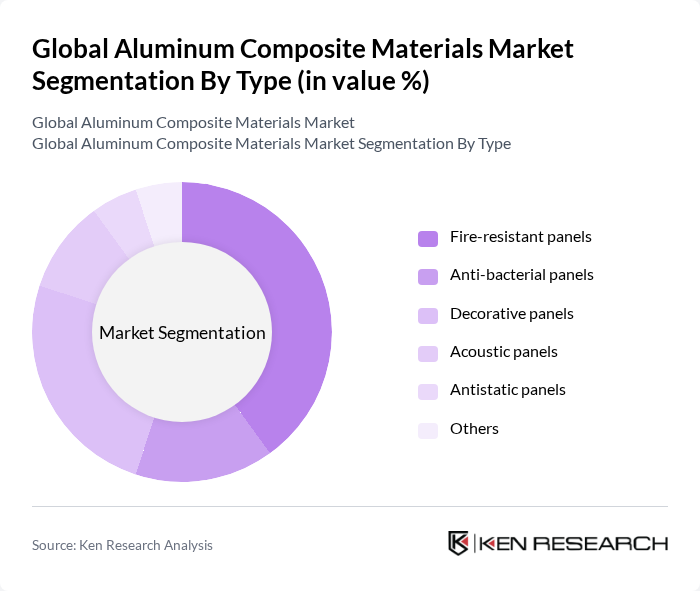

By Type:The market is segmented into various types of aluminum composite materials, each tailored for specific applications. Fire-resistant panels represent the dominant sub-segment, increasingly preferred in construction due to strict safety regulations and growing awareness of building safety. Anti-bacterial panels are gaining traction in healthcare and cleanroom environments, while decorative panels are widely adopted in commercial and retail spaces for their design flexibility. Acoustic and antistatic panels are also emerging as essential solutions in specialized industrial and institutional settings .

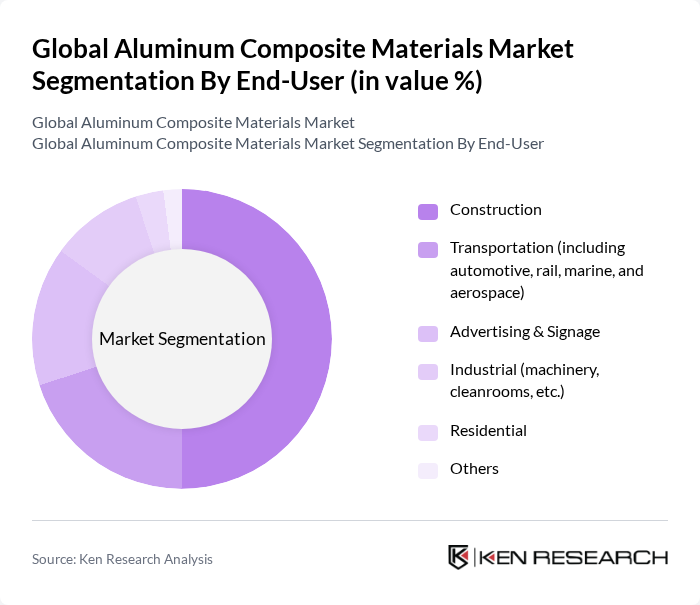

By End-User:The aluminum composite materials market serves a diverse range of end-user industries. Construction remains the largest segment, driven by demand for energy-efficient, lightweight, and fire-resistant cladding solutions. The transportation sector, including automotive, rail, marine, and aerospace, is a significant contributor due to the need for weight reduction and enhanced durability. Advertising and signage applications are expanding, propelled by the need for weather-resistant and visually appealing materials. Industrial and residential segments also contribute to market growth, with rising adoption in machinery, cleanrooms, and modern residential projects .

The Global Aluminum Composite Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3A Composites GmbH (Alucobond, Dibond), Arconic Corporation (Reynobond), Mitsubishi Chemical Corporation (ALPOLIC), Alubond U.S.A., Yaret Industrial Group Co., Ltd., Shanghai Huayuan New Composite Materials Co., Ltd., Jyi Shyang Industrial Co., Ltd., Alstrong Enterprises India Pvt. Ltd., Interplast Co. Ltd., Alstone Manufacturing Pvt. Ltd., Viva Composite Panel Pvt. Ltd., Eurobond (Euro Panel Products Ltd.), Novelis Inc., UMI (United Metal Industries Co., Ltd.), Sika AG, and KME SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aluminum composite materials market appears promising, driven by increasing sustainability initiatives and technological advancements. As industries prioritize eco-friendly solutions, the demand for aluminum composites is expected to rise, particularly in construction and automotive sectors. Additionally, the integration of smart technologies into building materials will likely enhance functionality and appeal. Companies that adapt to these trends and invest in innovative applications will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire-resistant panels Anti-bacterial panels Decorative panels Acoustic panels Antistatic panels Others |

| By End-User | Construction Transportation (including automotive, rail, marine, and aerospace) Advertising & Signage Industrial (machinery, cleanrooms, etc.) Residential Others |

| By Application | Facades & Cladding Interior walls & Partitions Signage & Display Roofing & Ceilings Vehicle Body Panels Others |

| By Distribution Channel | Direct sales (manufacturers to end-users) Distributors & Dealers Online sales Retail outlets Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Medium High |

| By Product Form | Sheets Rolls Custom shapes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 120 | Architects, Project Managers, Contractors |

| Automotive Sector Utilization | 60 | Design Engineers, Procurement Managers |

| Signage and Display Solutions | 50 | Marketing Managers, Signage Manufacturers |

| Transportation and Aerospace Applications | 40 | Product Development Engineers, Compliance Officers |

| Consumer Goods and Electronics | 45 | Product Managers, Supply Chain Analysts |

The Global Aluminum Composite Materials Market is valued at approximately USD 6.4 billion, reflecting a robust demand driven by the need for lightweight and durable materials in construction and transportation sectors.