Region:Global

Author(s):Geetanshi

Product Code:KRAA1279

Pages:88

Published On:August 2025

By Type:The market is segmented into Fire-Resistant Panels, Anti-Bacterial Panels, Decorative Panels, Acoustic Panels, Polyvinylidene Difluoride (PVDF) Coated Panels, Polyester Coated Panels, Laminating Coated Panels, Oxide Film Panels, and Others. Fire-Resistant Panels are engineered for high-temperature environments and compliance with fire safety regulations. Anti-Bacterial Panels are designed for hygienic applications, particularly in healthcare and food service settings. Decorative Panels offer aesthetic versatility for interior and exterior design. Acoustic Panels provide sound insulation for commercial and residential buildings. PVDF Coated Panels deliver superior weather resistance and color retention, making them suitable for exterior cladding. Polyester Coated Panels are preferred for cost-effective indoor applications. Laminating Coated Panels and Oxide Film Panels cater to specialized architectural and industrial needs.

The Fire-Resistant Panels segment is currently dominating the market due to increasing safety regulations and consumer awareness regarding fire hazards in buildings. These panels are engineered to withstand high temperatures and inhibit flame spread, making them a preferred choice for commercial and residential applications. The growing emphasis on safety and compliance in construction projects has led to a surge in demand for fire-resistant materials, positioning this segment as a market leader.

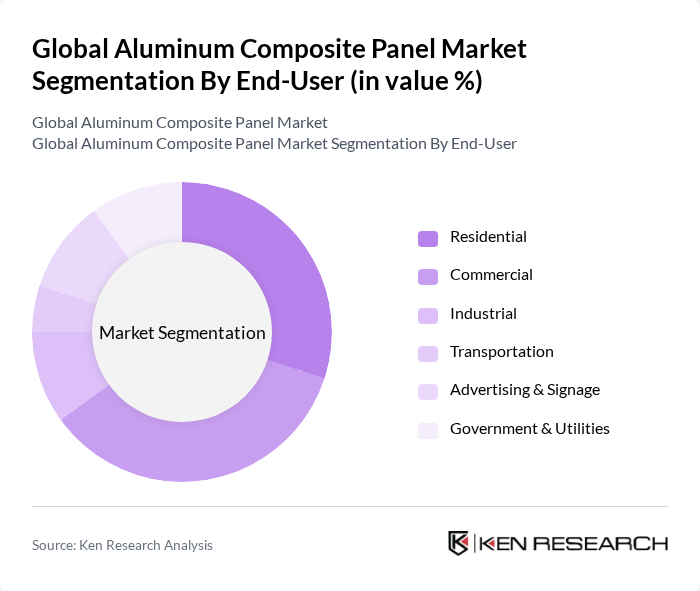

By End-User:The market is segmented by end-users: Residential, Commercial, Industrial, Transportation, Advertising & Signage, and Government & Utilities. Residential applications focus on facade cladding and interior decoration, emphasizing durability and aesthetics. Commercial end-users drive demand through office buildings, retail spaces, and hospitality projects, prioritizing modern design and fire safety. Industrial users require panels for facility cladding and insulation. Transportation applications include vehicle exteriors and interiors, leveraging lightweight and durable properties. Advertising & Signage utilizes panels for outdoor displays and branding due to weather resistance and printability. Government & Utilities employ ACPs in public infrastructure and utility buildings for longevity and compliance.

The Commercial segment leads the market, driven by the expansion of office buildings, retail centers, and hospitality projects. The demand for aesthetically pleasing, functional, and compliant building materials in commercial construction continues to propel the adoption of aluminum composite panels. Modern architectural trends and sustainability requirements further enhance the segment's growth.

The Global Aluminum Composite Panel Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3A Composites (Alucobond, Dibond), Arconic (Reynobond), Mitsubishi Chemical Corporation (Alpolic), Jyi Shyang Industrial Co., Ltd., Guangzhou Xinghe ACP Co., Ltd., Yaret Industrial Group, Alstrong Enterprises India Pvt. Ltd., Eurobond (Euro Panel Products Pvt. Ltd.), Multipanel UK Ltd., Viva Composite Panel Pvt. Ltd., Alucoil (Grupo Alibérico), Sika AG, Stacbond, A. H. Meyer Maschinenfabrik GmbH, and Aleris Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aluminum composite panel market appears promising, driven by the increasing emphasis on sustainability and innovation in building materials. As urbanization accelerates, the demand for lightweight, durable, and aesthetically pleasing materials will continue to rise. Additionally, advancements in manufacturing technologies are expected to enhance product quality and reduce costs, making ACPs more accessible. The integration of smart technologies into building materials will also create new opportunities for growth, positioning the market for significant expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire-Resistant Panels Anti-Bacterial Panels Decorative Panels Acoustic Panels Polyvinylidene Difluoride (PVDF) Coated Panels Polyester Coated Panels Laminating Coated Panels Oxide Film Panels Others |

| By End-User | Residential Commercial Industrial Transportation Advertising & Signage Government & Utilities |

| By Application | Building Facades (Exterior Cladding) Interior Partitions Signage & Displays Roofing Vehicle Bodies |

| By Distribution Channel | Direct Sales Distributors Online Retail |

| By Material Composition | Aluminum Core Polyethylene Core Mineral Core |

| By Price Range | Low Price Mid Price High Price |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Architectural Applications | 120 | Architects, Design Engineers |

| Commercial Construction Projects | 100 | Project Managers, Construction Supervisors |

| Residential Building Sector | 80 | Home Builders, Contractors |

| Industrial Applications | 60 | Facility Managers, Operations Directors |

| Retail and Signage Uses | 70 | Marketing Managers, Retail Designers |

The Global Aluminum Composite Panel Market is valued at approximately USD 7 billion, driven by the increasing demand for lightweight and durable building materials, green building initiatives, and infrastructure expansion worldwide.