Region:Global

Author(s):Shubham

Product Code:KRAA1844

Pages:88

Published On:August 2025

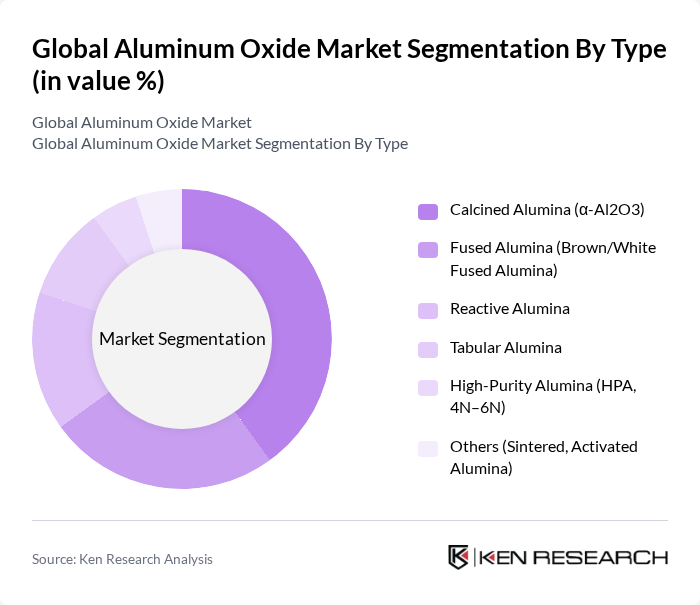

By Type:The aluminum oxide market is segmented into Calcined Alumina, Fused Alumina, Reactive Alumina, Tabular Alumina, High-Purity Alumina, and Others. Calcined Alumina is widely used across ceramics, refractories, polishing, and as feedstock for various alumina-based materials; it is not used as a feed in aluminum smelting, which relies on smelter-grade alumina refined from bauxite for electrolytic reduction. Demand for High-Purity Alumina is increasing due to applications in LEDs, semiconductors, and lithium-ion battery separators.

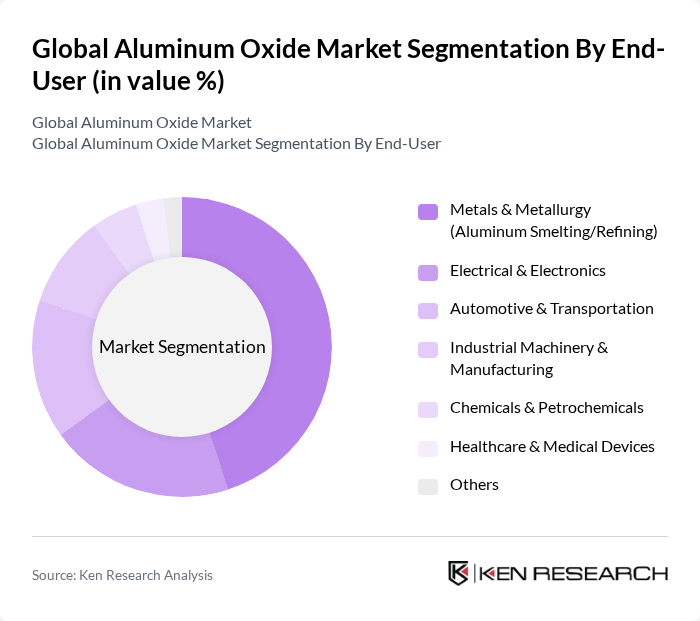

By End-User:The end-user segmentation of the aluminum oxide market includes Metals & Metallurgy, Electrical & Electronics, Automotive & Transportation, Industrial Machinery & Manufacturing, Chemicals & Petrochemicals, Healthcare & Medical Devices, and Others. The Metals & Metallurgy segment holds a leading share due to alumina’s critical role as the refined feedstock (smelter-grade alumina) for primary aluminum production, with additional non-metallurgical demand from abrasives, refractories, ceramics, catalysts, and polishing compounds.

The Global Aluminum Oxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcoa Corporation, Aluminum Corporation of China Limited (Chalco), Rio Tinto Group, Norsk Hydro ASA, United Company RUSAL, Hindalco Industries Limited (Aditya Birla Group), Emirates Global Aluminium (EGA), Sumitomo Chemical Co., Ltd., Evonik Industries AG, Huber Engineered Materials, Merck KGaA (Merck Life Science), Honeywell International Inc., CeramTec GmbH, Schunk Technical Ceramics, DADCO Alumina & Chemicals Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aluminum oxide market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt lightweight materials and high-purity aluminum oxide for specialized applications, demand is expected to rise. Additionally, the push for recycling initiatives and the development of innovative aluminum oxide products will likely create new market segments. Companies that invest in sustainable practices and advanced production technologies will be well-positioned to capitalize on these emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcined Alumina (?-Al2O3) Fused Alumina (Brown/White Fused Alumina) Reactive Alumina Tabular Alumina High-Purity Alumina (HPA, 4N–6N) Others (Sintered, Activated Alumina) |

| By End-User | Metals & Metallurgy (Aluminum Smelting/Refining) Electrical & Electronics Automotive & Transportation Industrial Machinery & Manufacturing Chemicals & Petrochemicals Healthcare & Medical Devices Others |

| By Application | Abrasives & Blasting Media Advanced Ceramics & Electrical Insulators Refractories (Bricks, Castables) Aluminum Smelting (Hall–Héroult, Fluxes) Catalysts & Adsorbents (Activated Alumina) Polishing, Lapping & CMP Slurries Coatings & Thermal Spray Others |

| By Distribution Channel | Direct (Producers to OEMs) Distributors & Traders Online/B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grades Specialty Grades High-Purity Grades |

| By Quality Grade | Standard Grade (Industrial) High Purity Grade (3N–4N) Ultra High Purity Grade (5N–6N) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Applications of Aluminum Oxide | 120 | Manufacturing Managers, Process Engineers |

| Aluminum Oxide in Electronics | 90 | Product Development Engineers, R&D Managers |

| Aluminum Oxide in Ceramics | 70 | Quality Control Analysts, Materials Scientists |

| Aluminum Oxide in Automotive Sector | 60 | Procurement Managers, Supply Chain Analysts |

| Aluminum Oxide in Aerospace Applications | 50 | Aerospace Engineers, Compliance Officers |

The Global Aluminum Oxide Market is valued at approximately USD 6.3 billion, driven by demand from various sectors including automotive, aerospace, construction, and electronics, particularly for high-purity alumina applications.